- United States

- /

- IT

- /

- NasdaqGS:APLD

Applied Digital (APLD) Is Up 9.6% After Securing CoreWeave Deals and US$50M Debt Raise

Reviewed by Simply Wall St

- Earlier this month, Applied Digital announced additional data center lease agreements with CoreWeave and completed a US$50 million debt financing with Macquarie Equipment Capital Inc. to support these expansion plans.

- This development marks a continued pivot towards AI-focused infrastructure, underscored by new multi-billion dollar, long-term contracts fueling predictable revenue streams.

- We'll examine how Applied Digital's expanded CoreWeave partnership and new financing arrangements shape its evolving investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Applied Digital Investment Narrative Recap

To be a shareholder in Applied Digital, you need to believe in the long-term growth of AI-powered infrastructure and the stability brought by multi-billion dollar leasing contracts with hyperscalers like CoreWeave. The recent US$50 million debt financing with Macquarie Equipment Capital is primarily supportive of these expansion plans; it does not alter the biggest short-term catalyst, ramping up utilization at new data centers, nor does it materially reduce the most significant risk of customer concentration.

Among recent announcements, the expanded CoreWeave lease agreement is most relevant, raising total contracted capacity to 400MW and securing roughly US$11 billion in anticipated lease revenue. This substantially strengthens the predictable revenue pipeline but reinforces reliance on a limited number of large customers, a focal point for both immediate growth and ongoing risk.

Importantly, if CoreWeave or any key client reduces its commitments, investors should carefully consider the implications for cash flows...

Read the full narrative on Applied Digital (it's free!)

Applied Digital's narrative projects $755.7 million revenue and $102.2 million earnings by 2028. This requires 73.7% yearly revenue growth and a $263.2 million earnings increase from -$161.0 million.

Uncover how Applied Digital's forecasts yield a $20.00 fair value, in line with its current price.

Exploring Other Perspectives

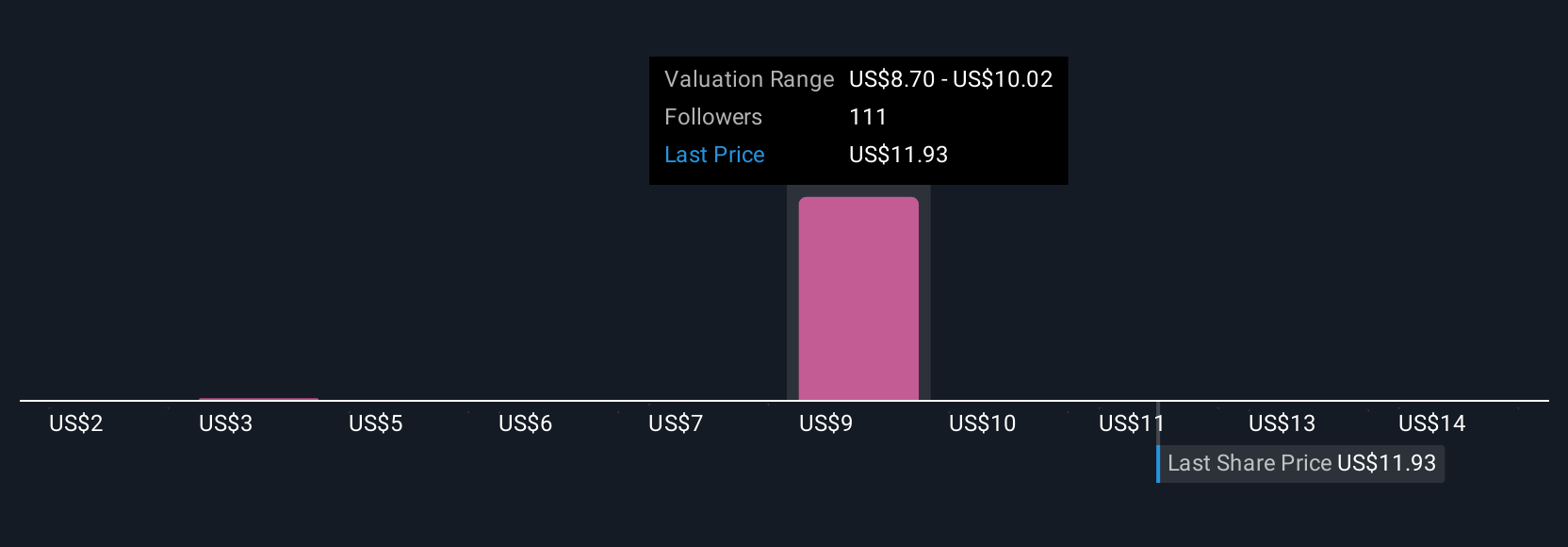

Simply Wall St Community members provided 29 fair value estimates for Applied Digital stock ranging from US$2.11 to US$24 per share. While most see strong growth potential from long-term AI infrastructure contracts, opinions vary widely on revenue reliability given customer concentration risk, consider reviewing a range of assessments to form your own view.

Explore 29 other fair value estimates on Applied Digital - why the stock might be worth as much as 17% more than the current price!

Build Your Own Applied Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Digital research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Applied Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Digital's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)