- United States

- /

- Software

- /

- NasdaqGS:API

Does Agora (NASDAQ:API) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Agora, Inc. (NASDAQ:API) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Agora

What Is Agora's Net Debt?

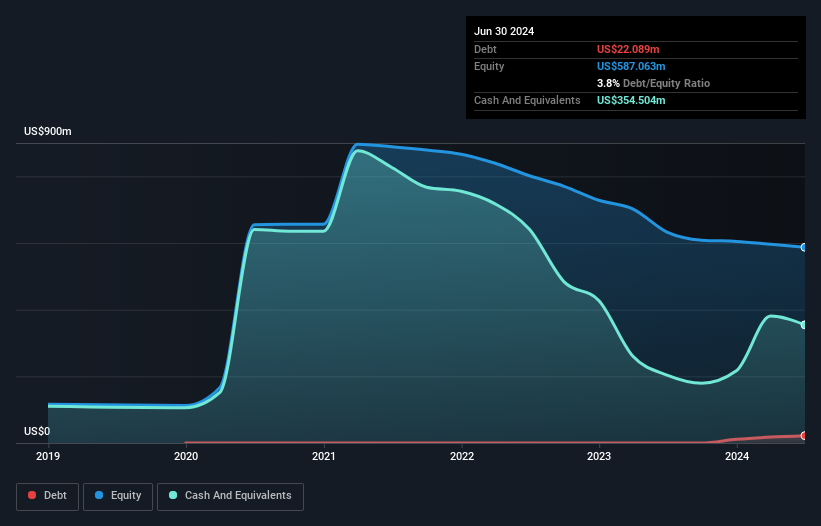

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Agora had US$22.1m of debt, an increase on none, over one year. But on the other hand it also has US$354.5m in cash, leading to a US$332.4m net cash position.

How Strong Is Agora's Balance Sheet?

The latest balance sheet data shows that Agora had liabilities of US$50.0m due within a year, and liabilities of US$42.2m falling due after that. Offsetting these obligations, it had cash of US$354.5m as well as receivables valued at US$38.5m due within 12 months. So it actually has US$300.8m more liquid assets than total liabilities.

This luscious liquidity implies that Agora's balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Succinctly put, Agora boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Agora can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Agora made a loss at the EBIT level, and saw its revenue drop to US$138m, which is a fall of 8.8%. We would much prefer see growth.

So How Risky Is Agora?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Agora lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$34m and booked a US$44m accounting loss. But the saving grace is the US$332.4m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Agora has 1 warning sign we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:API

Agora

Through its subsidiaries, engages in the operation of a real-time engagement platform-as-a-service in the United States, the People’s Republic of China, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

AGAG still in exploration, in bull market, such company will be the last to participate. It's high risk but can results in 20-30 baggers potential. The best play with current bull are with producers or near-producer miners, you can get 5-10 baggers with much lower risk. See my analysis on santacruz silver, andean silver.