- United States

- /

- Media

- /

- NYSE:MNTN

3 Top Growth Stocks Insiders Are Investing In

Reviewed by Simply Wall St

As the U.S. market navigates a busy earnings season, with major indices experiencing slight declines amid ongoing government shutdown concerns, investors are closely watching for opportunities in growth stocks with strong insider ownership. In such a volatile environment, companies where insiders hold significant stakes can signal confidence in their future prospects and align management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.1% | 52.6% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Celsius Holdings (CELH) | 10.8% | 31.8% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| AppLovin (APP) | 27.5% | 25.4% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Here's a peek at a few of the choices from the screener.

Agora (API)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service globally, including in the United States and China, with a market cap of approximately $321.17 million.

Operations: The company's revenue segment includes $133.55 million from Internet Telephone services.

Insider Ownership: 24.8%

Agora is poised for growth with forecasts indicating profitability within three years, surpassing average market expectations. Recent advancements in AI, including integration with OpenAI's Realtime API, enhance its competitive edge in conversational AI. Despite no recent insider buying or selling activity, significant share buybacks have been completed. Revenue growth projections slightly outpace the US market at 10.5% annually. Leadership changes and strategic product developments further position Agora as a key player in real-time engagement technology.

- Dive into the specifics of Agora here with our thorough growth forecast report.

- The analysis detailed in our Agora valuation report hints at an inflated share price compared to its estimated value.

MNTN (MNTN)

Simply Wall St Growth Rating: ★★★★★☆

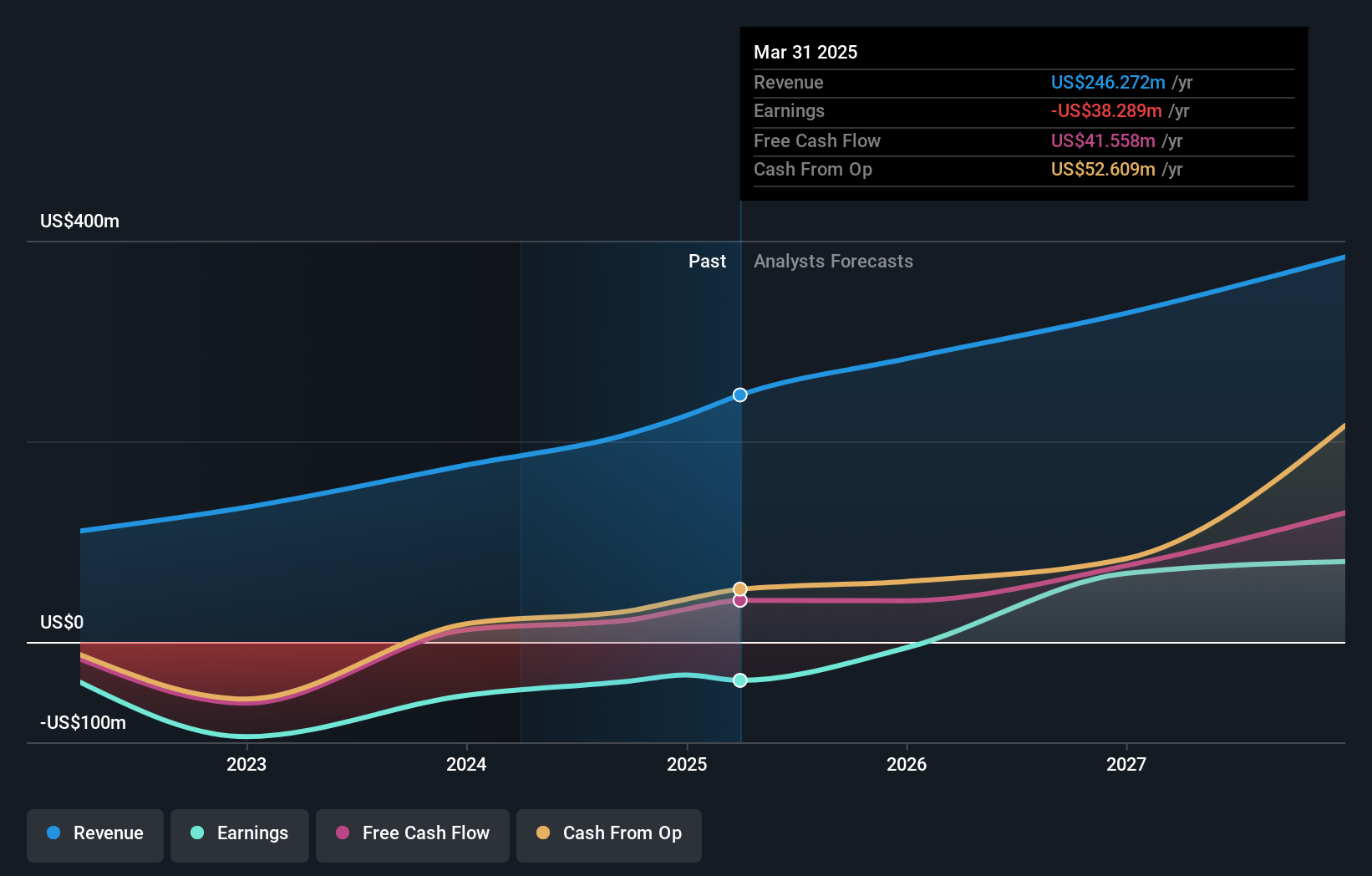

Overview: MNTN, Inc. operates a technology platform focused on performance marketing for Connected TV and has a market cap of approximately $1.10 billion.

Operations: The company generates revenue of $259.91 million from its Internet Software & Services segment.

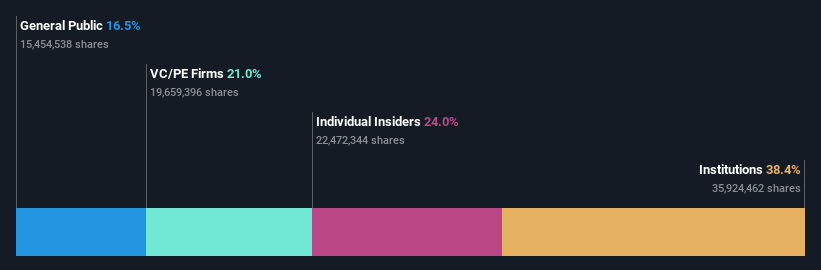

Insider Ownership: 13.3%

MNTN's robust growth outlook is supported by high insider ownership and strategic partnerships, such as with Haus and PubMatic, enhancing its Connected TV (CTV) advertising capabilities. Despite a slower revenue growth forecast of 18% annually compared to some peers, MNTN's anticipated profitability within three years and strong earnings growth projections bolster its market position. Recent legal challenges present risks; however, leadership changes aim to strengthen data partnerships and innovation in the CTV space.

- Click here and access our complete growth analysis report to understand the dynamics of MNTN.

- Insights from our recent valuation report point to the potential undervaluation of MNTN shares in the market.

Tuya (TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

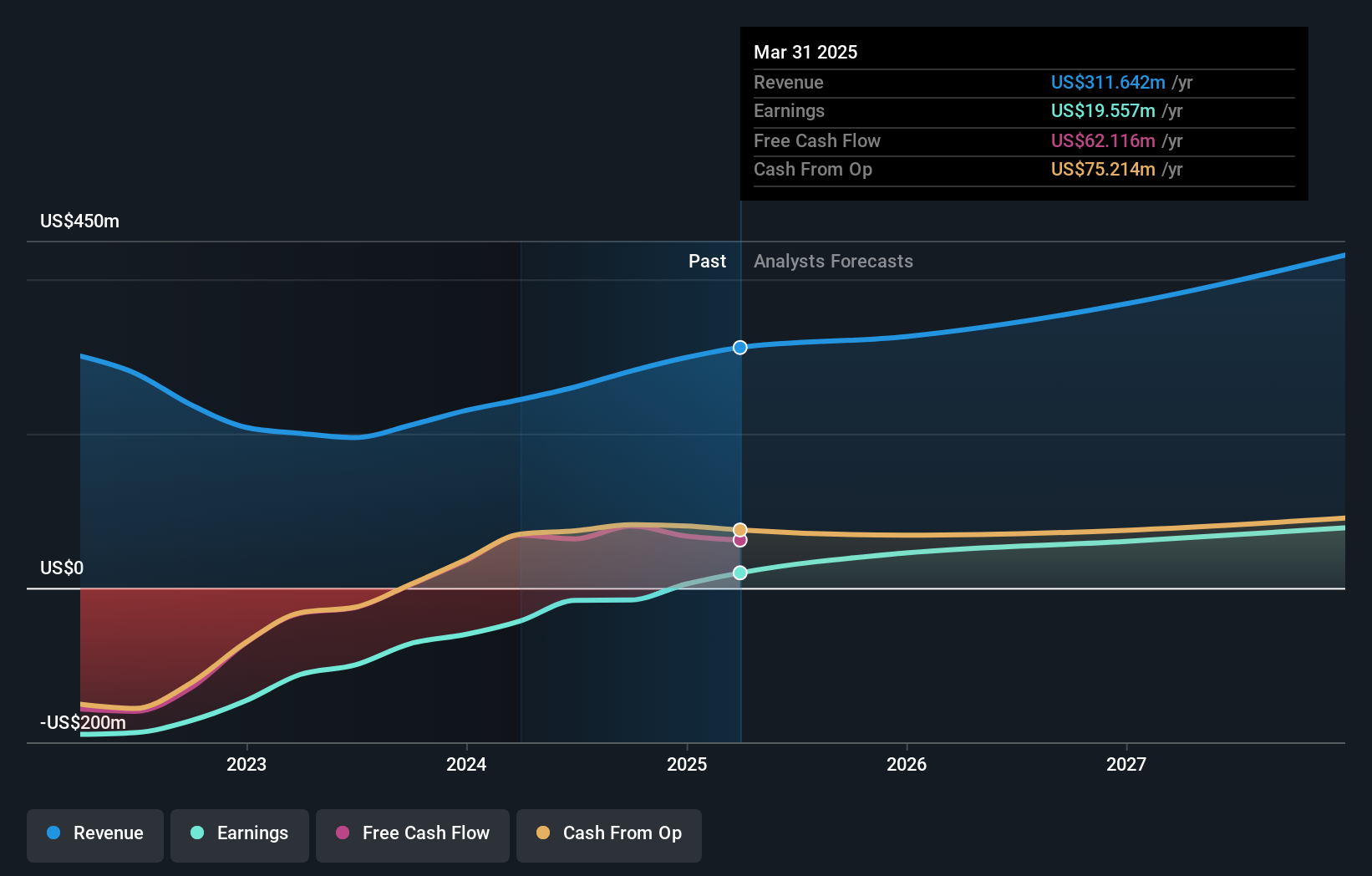

Overview: Tuya Inc. operates as an AI cloud platform service provider in the People’s Republic of China, with a market capitalization of approximately $1.45 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, which generated $318.49 million.

Insider Ownership: 25.6%

Tuya's growth potential is underpinned by high insider ownership and a forecasted earnings growth of 22.4% annually, outpacing the US market average. Despite a slower revenue growth rate of 10.8% per year, recent financial reports show improved profitability, with net income increasing to US$23.6 million for the first half of 2025 compared to a loss previously. The company's strategic moves include filing for an ESOP-related offering worth US$5.38 million, indicating ongoing employee investment initiatives.

- Unlock comprehensive insights into our analysis of Tuya stock in this growth report.

- Our expertly prepared valuation report Tuya implies its share price may be too high.

Make It Happen

- Explore the 201 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNTN

MNTN

Operates a technology platform that brings performance marketing to Connected TV.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)