- United States

- /

- Software

- /

- NasdaqCM:AMPL

A Fresh Look at Amplitude (AMPL) Valuation After Spike in Volatility and Shifting Analyst Sentiment

Reviewed by Kshitija Bhandaru

Amplitude (AMPL) has seen a sharp rise in implied volatility within its options market, which points to expectations for sizable stock moves ahead. This comes at a time when investor sentiment has soured and growth questions remain.

See our latest analysis for Amplitude.

Amplitude’s share price has lost momentum lately, dropping over 10% in the past month and down more than 21% for the most recent quarter, as last week’s slide continued a rough patch. Still, despite the recent selloff, the one-year total shareholder return stands at a positive 15%, reflecting resilience after earlier weakness and continued belief in the company’s long-term potential from parts of the market.

If you’re interested in finding other fast movers and hidden growth opportunities, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

The big question for investors now is whether Amplitude’s recent slide and discounted price reflect a temporary setback that could be followed by a rebound, or if the market is already considering the company’s long-term growth challenges and risks.

Most Popular Narrative: 36.6% Undervalued

Despite Amplitude’s recent decline to $9.94 at last close, the narrative’s consensus fair value ($15.67) suggests the market may be missing renewed momentum beneath the surface. This significant gap between expectations and price comes as growth, artificial intelligence, and digital transformation shifts influence analysts’ positive outlook.

The continued investment and leadership in AI-driven analytics, supported by multiple strategic talent acquisitions and rapid product innovation (such as AI agents, Guides, Surveys), position Amplitude to capitalize on the growing enterprise need for automated, actionable insights. This creates opportunities to increase ACV and command premium pricing, ultimately supporting margin expansion and stronger earnings.

Wondering how bold bets on future technology stack up to the numbers? This narrative’s winning formula depends on relentless product evolution, ambitious revenue targets, and expectations for major shifts in enterprise buying. See the numbers and forecasts that fuel this price gap.

Result: Fair Value of $15.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks linger, including uncertainties around monetizing AI tools and Amplitude’s reliance on high-value enterprise customers. These factors could impact growth stability ahead.

Find out about the key risks to this Amplitude narrative.

Another View: What Do Traditional Multiples Say?

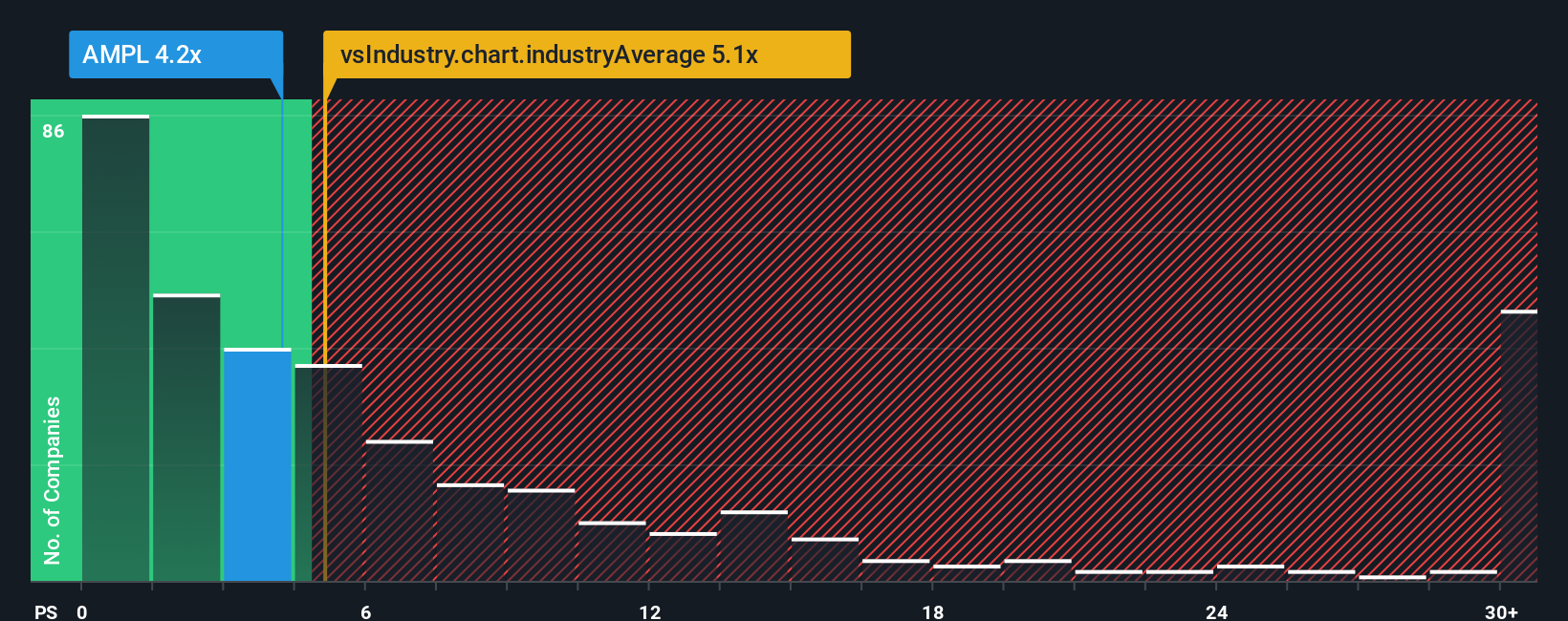

Looking at Amplitude through the lens of its price-to-sales ratio, the story is less clear-cut. It trades at 4.2 times sales, which is higher than peers at 3.4 times, but right in line with its fair ratio of 4.2 times and still below the industry average of 5 times. This balanced position may mean limited upside, but also suggests the market sees potential. Could this neutral pricing be a sign that investors remain cautious about future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amplitude Narrative

If this story does not align with your perspective, or you would rather rely on your own analysis, you can craft a fresh outlook yourself in just a couple of minutes, your way with Do it your way.

A great starting point for your Amplitude research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Push your portfolio further by checking out unique opportunities other investors might overlook. If you want an edge, tap into proven stock ideas that stand out right now.

- Tap into future-defining tech by researching these 24 AI penny stocks where artificial intelligence is transforming entire industries and creating new growth leaders.

- Unlock income and stability by browsing these 19 dividend stocks with yields > 3% with yields above 3%. This can help strengthen your returns in any market.

- Ride the next crypto wave by analyzing these 79 cryptocurrency and blockchain stocks at the intersection of innovation, security, and disruptive digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AMPL

Amplitude

Provides a digital analytics platform that analyzes customer behavior in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives