- United States

- /

- Software

- /

- NasdaqGS:ALTR

Did You Miss Altair Engineering's (NASDAQ:ALTR) 28% Share Price Gain?

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. For example, the Altair Engineering Inc. (NASDAQ:ALTR) share price is up 28% in the last year, clearly besting than the market return of around -0.6% (not including dividends). That's a solid performance by our standards! We'll need to follow Altair Engineering for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for Altair Engineering

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Altair Engineering went from making a loss to reporting a profit, in the last year. When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 19% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

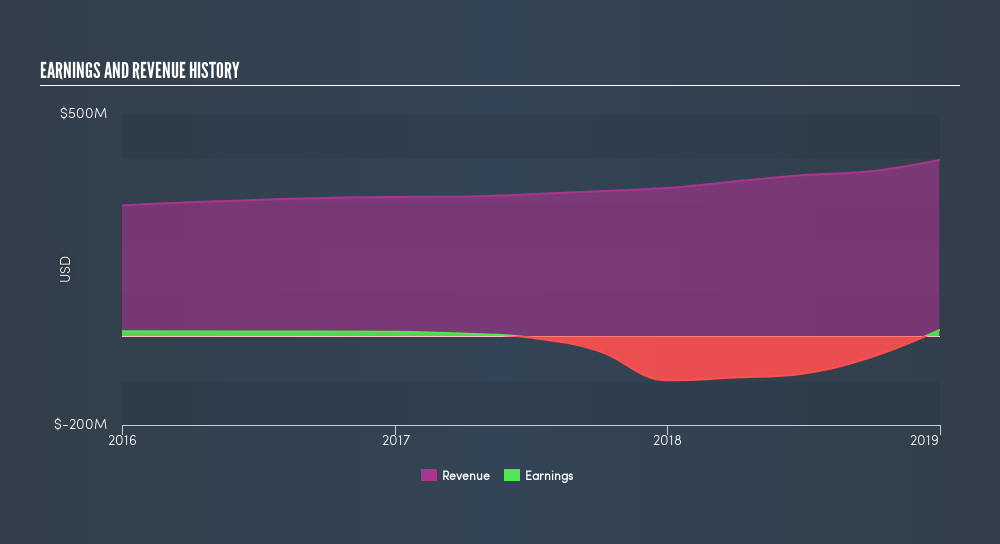

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Altair Engineering stock, you should check out this freereport showing analyst profit forecasts.

A Different Perspective

Altair Engineering boasts a total shareholder return of 28% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 28% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. If you would like to research Altair Engineering in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:ALTR

Altair Engineering

Provides software and cloud solutions in the areas of simulation, high-performance computing, data analytics, and artificial intelligence in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives