- United States

- /

- Software

- /

- NasdaqGS:ALLT

Allot (ALLT): Assessing Valuation After Renewed Analyst Optimism and Earnings Upgrades

Reviewed by Simply Wall St

Renewed analyst optimism around Allot (ALLT), highlighted by its Zacks Rank of #1 Strong Buy and a sharply upgraded earnings outlook over the past 3 months, has pushed the stock sharply ahead of its tech peers.

See our latest analysis for Allot.

The optimism seems to be feeding directly into the tape, with Allot’s share price at $9.86 after a robust year to date share price return of around 59 percent and a standout 1 year total shareholder return of roughly 87 percent. This suggests momentum is still very much building rather than fading.

If Allot’s run has you rethinking your tech exposure, this could be a good moment to explore other high growth opportunities in high growth tech and AI stocks.

With shares still trading at a roughly 21 percent discount to estimated intrinsic value and more than 35 percent below the average analyst target, is Allot a genuine bargain, or is the market already pricing in much of its future growth?

Most Popular Narrative: 26.3% Undervalued

With Allot last closing at $9.86 versus a most popular narrative fair value of $13.38, the valuation story hinges on aggressive profit and growth assumptions.

Shift to a higher margin, recurring revenue product mix (SECaaS and software expansion deals now comprising a larger share of revenue) is directly driving gross margin improvement (now in the 71 to 73% range), with the expectation this will persist as more software based contracts are landed and legacy hardware and services shrink in mix. Persistent global data traffic growth, spurred by increasing connectivity, 5G/IoT adoption, and cloud migration, is fueling service provider investment in advanced traffic management and security analytics, directly benefiting Allot's differentiated, inline network visibility and control solutions; this supports a strong pipeline of future large deals and underpins expectations for multi year revenue and operating profit growth.

Curious how a maturing security business can still command a premium style valuation? The narrative leans on compounding revenue, fatter margins, and a rich future multiple. Want to see which forward looking profit and growth paths justify that gap to fair value, and how they stack up against today’s earnings base? Dive in and unpack the full playbook behind this price target.

Result: Fair Value of $13.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view could falter if key telecom partners slow rollouts or if long sales cycles delay converting major pipeline deals into recurring revenue.

Find out about the key risks to this Allot narrative.

Another Angle on Valuation

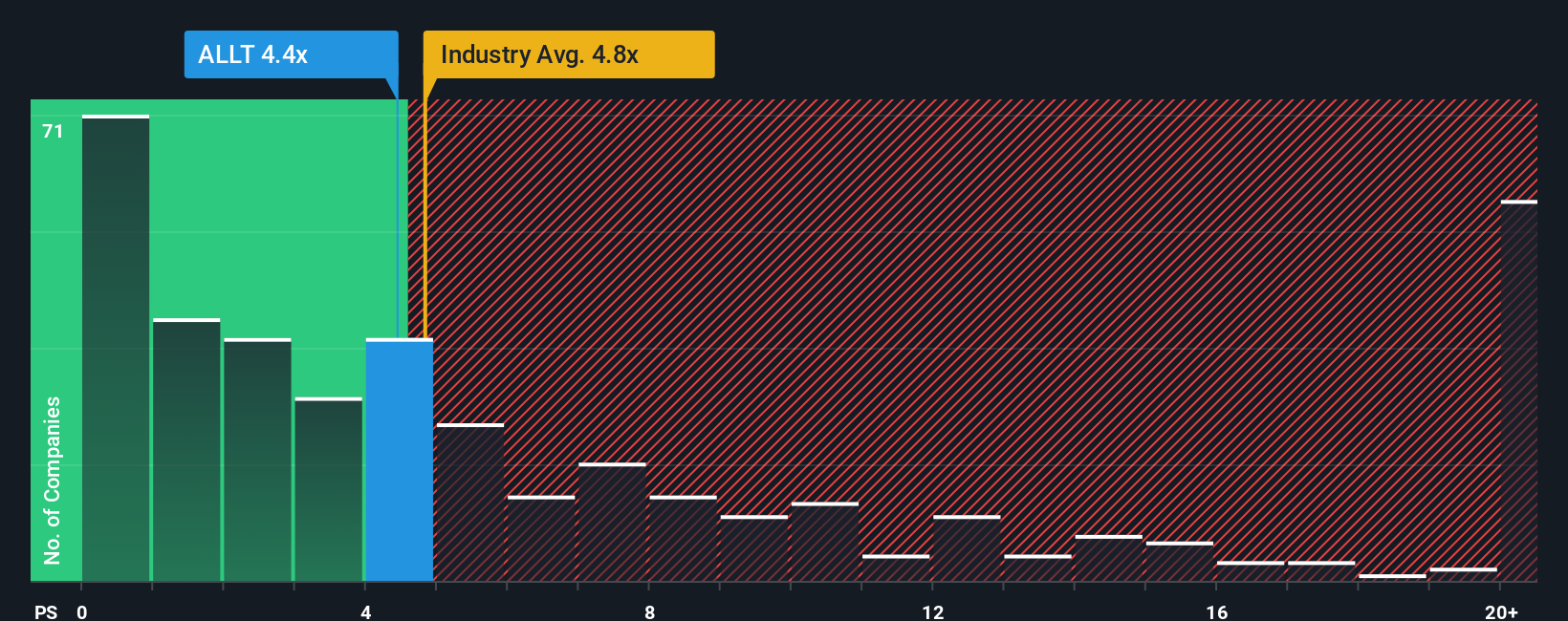

While the narrative points to upside, our ratio based view is more cautious. Allot trades on a price to sales of 4.8x, well above its 2.8x fair ratio and peer average of 2.3x, even if roughly in line with the US software sector at 4.9x. That premium hints at less margin for error if growth stumbles, so are investors really being paid for the risk they are taking?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allot Narrative

If you would rather challenge these conclusions or lean on your own research, you can build a custom Allot storyline in minutes: Do it your way.

A great starting point for your Allot research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next move in Allot’s story, you might consider putting your capital to work across other opportunities on Simply Wall St’s Screener so you can stay on top of compelling setups.

- Explore potential multi baggers by scanning these 3613 penny stocks with strong financials that already show robust balance sheets and solid fundamentals.

- Focus on structural trends in healthcare by targeting these 30 healthcare AI stocks that are involved in improving patient outcomes, diagnostics, and medical workflows.

- Look for potentially attractive entry points with these 908 undervalued stocks based on cash flows that our models flag as trading below their cash flow based fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALLT

Allot

Develops, sells, and markets network intelligence and security solutions in Israel, Europe, Asia, Oceania, the Americas, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)