- United States

- /

- Software

- /

- NasdaqGS:ALKT

Assessing Alkami Technology (ALKT) Valuation After Its Digital Banking Conversion Toolkit Launch

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 34.2% Undervalued

According to the most widely followed narrative, Alkami Technology is trading at a significant discount to its estimated fair value, with current analyst expectations indicating the stock is undervalued by over 34%. This viewpoint is anchored in strong anticipated growth across digital banking transformation and recurring revenues.

Growing expectations for advanced, fraud-resistant, omnichannel digital banking experiences are prompting more financial institutions to adopt Alkami's API-driven, cloud-native architecture. This platform can support secure growth and higher operating leverage. Over time, this trend should improve gross and operating margin profiles.

Want to know the numbers powering this bold valuation? The narrative relies on bullish forecasts for rapid revenue expansion, a shift to sustainable profitability, and a future profit multiple that raises eyebrows. Curious which optimistic projections analysts are betting on? Find out what drives this premium by exploring the main assumptions behind Alkami’s fair value.

Result: Fair Value of $38.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Alkami’s strong reliance on regional banks and rapid fintech competition could quickly undermine its momentum if industry dynamics shift unfavorably.

Find out about the key risks to this Alkami Technology narrative.Another View: Market Multiple Reality Check

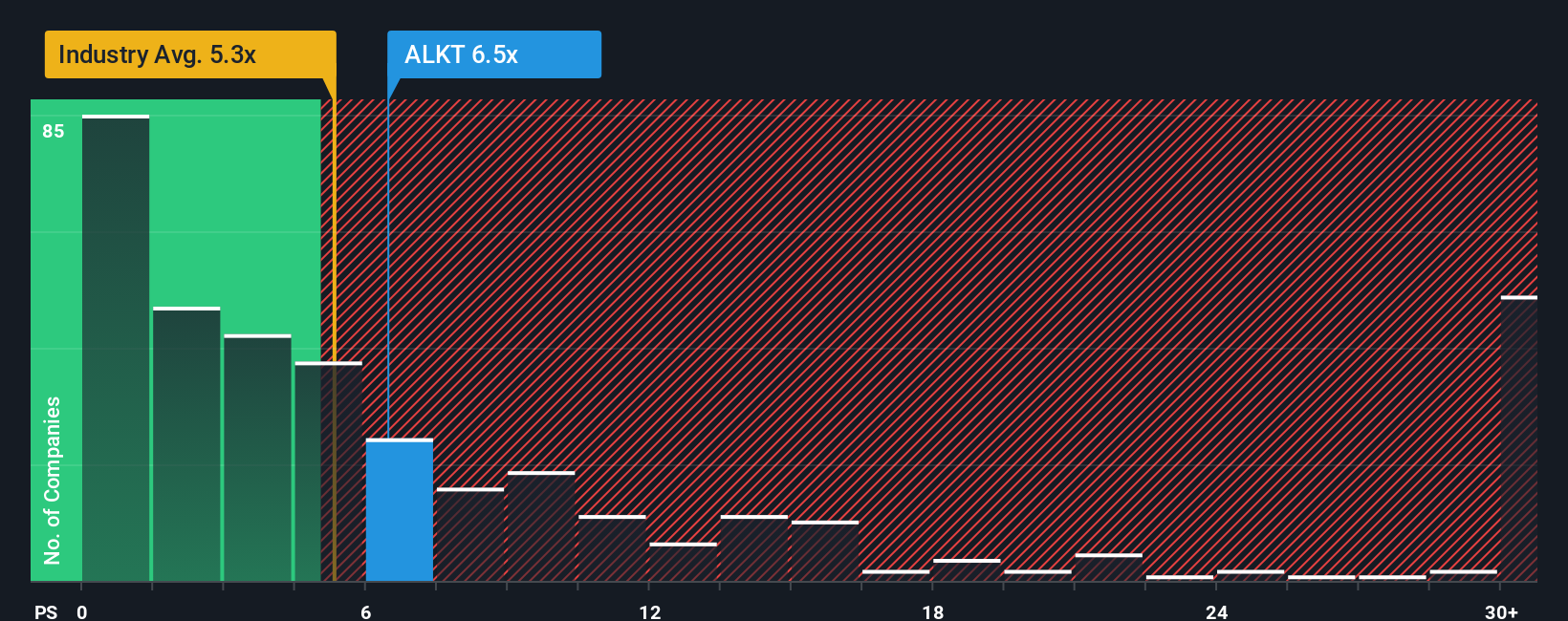

Taking a step back from fair value forecasts, the market multiple approach tells a different story. On this measure, Alkami appears more expensive than many software peers, even if growth is strong. Is this a warning or simply a premium for future potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alkami Technology Narrative

If you see things differently or want to dig into the details on your own, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Alkami Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Give yourself an edge by checking out other winning strategies beyond Alkami Technology. These curated choices could point you toward your next standout opportunity. Don’t let them pass you by.

- Unlock hidden bargains in overlooked sectors with our undervalued stocks based on cash flows, finding quality stocks trading below their intrinsic value before the crowd catches on.

- Tap into the future of medicine and innovation by searching for breakthrough advances with our healthcare AI stocks, where AI is reshaping healthcare outcomes and industry potential.

- Accelerate your portfolio’s growth by finding high-upside opportunities among the innovators powering tomorrow with our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives