- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Insiders at Affirm Holdings (NASDAQ:AFRM) are Holding onto their Shares After 130% Rally

Affirm Holdings, Inc’s . (NASDAQ:AFRM) shareholders have had a wild ride since the company held its IPO in January. The stock began trading at $91, and reached $146.90 within a month, before collapsing to below $50 by May. Since then there have been several positive developments which have seen the price back above $100, and once again targeting February’s high.

The major news has been a partnership with Amazon (NASDAQ: AMZN) whereby Affirm will provide finance to Amazon’s customers. This announcement resulted in an immediate 43% jump in the share price.

Earlier this month the company released fourth quarter results, and reported year-on-year revenue growth of 71%. This was substantially higher than the year-on-year growth in the previous two quarters. Profits were lower than expected, but the market chose to focus on the revenue growth.

The ‘buy now, pay later’ credit model has also received a vote of confidence from some major players in the financial industry. In July, Square (NYSE:SQ) entered the BNPL market by acquiring Afterpay for $26 billion. Since then, Mastercard (NYSE: MA) and Visa (NYSE:V) have both launched BNPL products too.

Check out our latest analysis for Affirm Holdings

Affirm’s Insider Shareholders

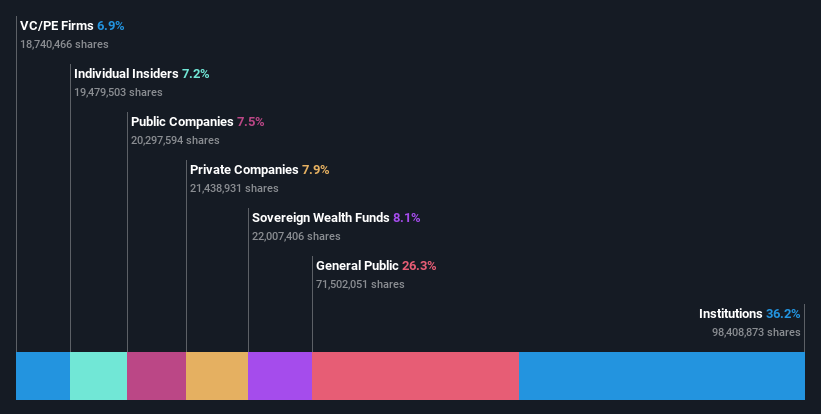

Affirm Holdings has a diverse group of insiders, including the company’s founders, management team, and early investors. The funds and companies that invested in affirm before its IPO might not be true ‘insiders’, but they will usually be closer to the company than other public market investors. When we include companies and funds that invested while the company was still private, insiders own around 25% of Affirm.

Having a management team with ‘skin in the game’ is always reassuring as it can help to align the interests of shareholders and the leadership team. However, when a company goes public there is always a risk that insiders and early investors will sell shares and depress the stock price. For this reason IPOs usually have a lock-up period to prevent too many shares coming to the market soon after the IPO.

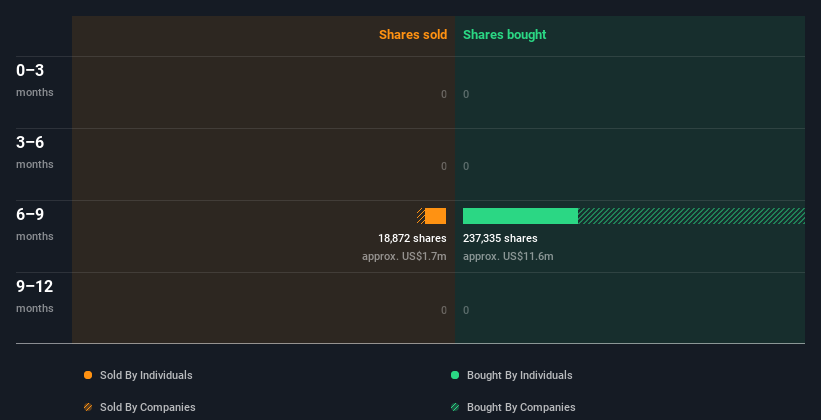

The lock-up period, for Affirm, expired on 12th July. However, in March, a partial release was enacted which allowed certain insiders to sell up to 10% of their holding. This early release made up to 15.6 million shares available for sale.

The good news is that very few of these shares were sold during the early release period, and no shares have been sold since the remainder of the lock-up period expired. It’s particularly notable to see that the VC and private equity firms have held onto their shares. Typically private investors will exit as soon as they believe further upside is limited.

Affirm is still some way from profitability, and valuing such a business is always a bit of a guessing game. But in Affirm’s case, the fact that insiders are holding onto their shares now that the price is well above the IPO level, is encouraging. On the face of it, this suggests they still see potential gains ahead.

Institutional shareholders now own 36% of the company which is also encouraging. Ideally we would like to see this increase more in the future.

Next Steps:

We see the fact that insiders are holding onto their shares as a vote of confidence in the share price, which has now risen 137% since the May low. It’s always worth keeping an eye on what insiders are doing - you can track insider transactions here.

We've also identified 2 warning signs with Affirm Holdings , and understanding them should be part of your investment process.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives