- United States

- /

- Software

- /

- NasdaqGS:ADSK

Autodesk (NASDAQ:ADSK) is Making Stable Profits, and Even More Cash Flows

Autodesk, Inc. (NASDAQ:ADSK) shareholders have seen the share price descend 13% over the month. But over five years, returns have been remarkably great. In that time, the share price has soared some 321% higher! What we are going to analyze is whether the business can improve itself sustainably, thus justifying a higher price. We are going to review the fundamentals and see what can they tell us on the company's valuation.

View our latest analysis for Autodesk

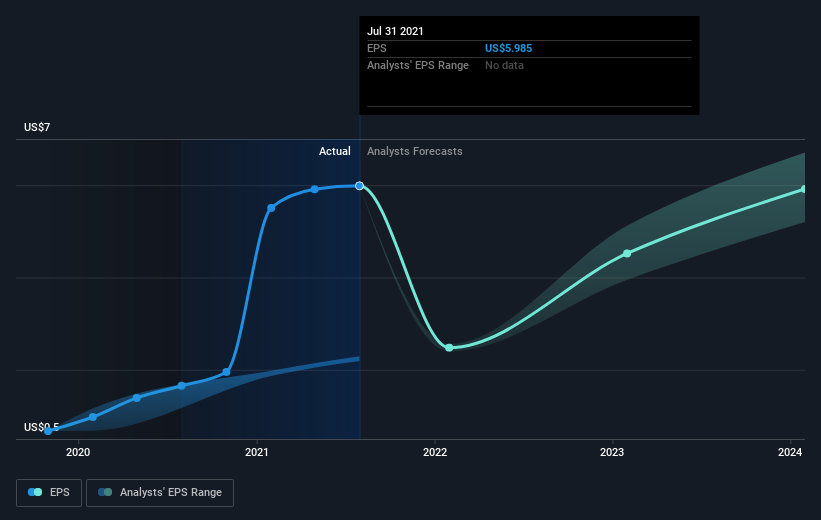

One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Autodesk moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. In the case of Autodesk, it seems to have a large rebound since March 2020 and a trend that persists.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

What we can see is a large bump in EPS since 2021. This is more an exception to the rule and comes from a tax benefit that the company received at the end of 2021. Investors should be aware that this will not last and expect net income to normalize in the near future.

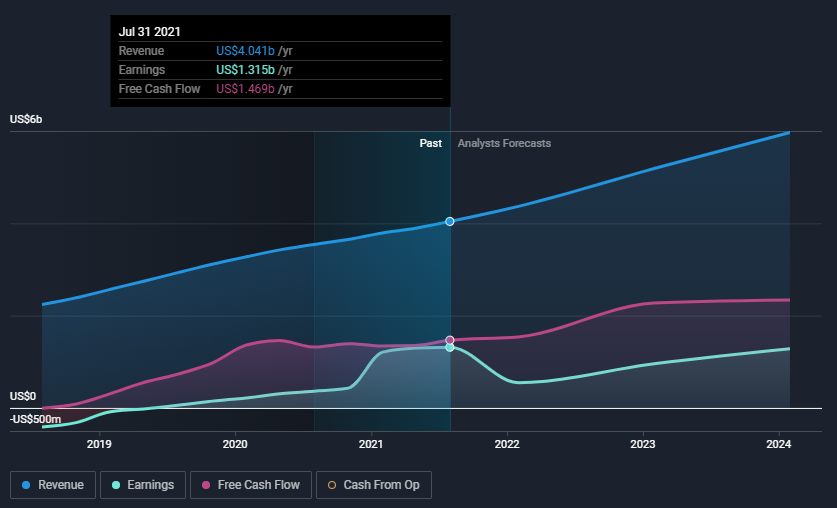

Otherwise, the trends look quite optimistic, and the company is making stable profit. Even better, as we will see in the next graphic, besides just statutory profits, the company is bringing positive free cash flows.

This shows us that the company is highly successful at converting income into cash flows, which is sometimes a leading indicator of growing net income in the future. This is also known as an accrual ratio, and for Autodesk it stands at -0.14.

It is of course excellent to see how Autodesk has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Autodesk stock, you should check out this FREE detailed report on its balance sheet.

By using analysts' estimates, we see that the company is expected to continue with a stable revenue growth rate of 16%, which is slightly above the industry average of 14.3%. This stability opens up additional routes to value maximization, such as acquisitions and cost optimization.

Conversely, the company announced that it will actively begin seeking acquisitions on the 1st of September. The type of acquisitions they would like to find are value accretive, which simply means that the combined businesses should drive growth for Autodesk (as opposed to cost-cutting acquisitions).

Key Takeaways

Autodesk's shareholders are up 25% for the year. But that was short of the market average. On the bright side, the longer term returns (running at about 33% a year, over half a decade) look better.

The company has a stable future ahead, and its ability to convert income into free cash flows only adds to their quality.

While we cannot predict the future price movements, it helps to know the intrinsic value of the company, as it can give investors a good baseline upon which we can tailor our expectations - Click Here to view our intrinsic valuation for Autodesk. Remember that our model is a rough estimate, and there are other ways to come up with an intrinsic value.

Autodesk has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion