- United States

- /

- Software

- /

- NasdaqGS:ADSK

Autodesk (ADSK): Assessing Valuation as AI Partnerships and Analyst Upgrades Boost Growth Expectations

Reviewed by Kshitija Bhandaru

Autodesk (ADSK) is drawing investor focus after a new client partnership expanded its use of artificial intelligence solutions in construction technology. The integration follows an upgrade by HSBC, highlighting Autodesk's position in a growing digital market.

See our latest analysis for Autodesk.

Autodesk’s push into AI-driven construction solutions has kept momentum building, with shares gaining notice over the past year. Its 1-year total shareholder return is 17.6%, handily outperforming many peers. After solid partnership news and fresh upgrades, investors remain focused on longer-term growth drivers in digital design and infrastructure.

If you’re tracking sector leaders embracing AI and innovation, now’s a great opportunity to discover companies at the intersection of technology and growth with our See the full list for free.

Given this momentum and several analyst upgrades, investors are now left to consider whether Autodesk shares remain undervalued in light of these bullish developments, or if today’s price already reflects next year’s growth potential.

Most Popular Narrative: 11.2% Undervalued

Compared to its latest closing price of $318.90, the consensus narrative prices Autodesk at $358.96, suggesting the stock has room to run. The narrative draws on bold shifts in Autodesk's recurring revenue and product ecosystem to support this viewpoint.

Continued innovation and integration of AI-driven tools (such as generative design and AutoConstrain), along with industry-specific foundation models, are boosting customer productivity and differentiating Autodesk's offerings. This supports premium pricing while driving margin expansion and long-term earnings growth.

Want to know the secret behind this high target? Hint: The story centers on steeper profit margins and revenue assumptions rarely seen in the industry. Find out what financial projections are helping boost Autodesk’s valuation. Click through to uncover the numbers behind the narrative.

Result: Fair Value of $358.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from open-source platforms and shifts in customer buying habits could quickly dampen Autodesk's growth outlook if these trends accelerate.

Find out about the key risks to this Autodesk narrative.

Another View: What Do Market Ratios Suggest?

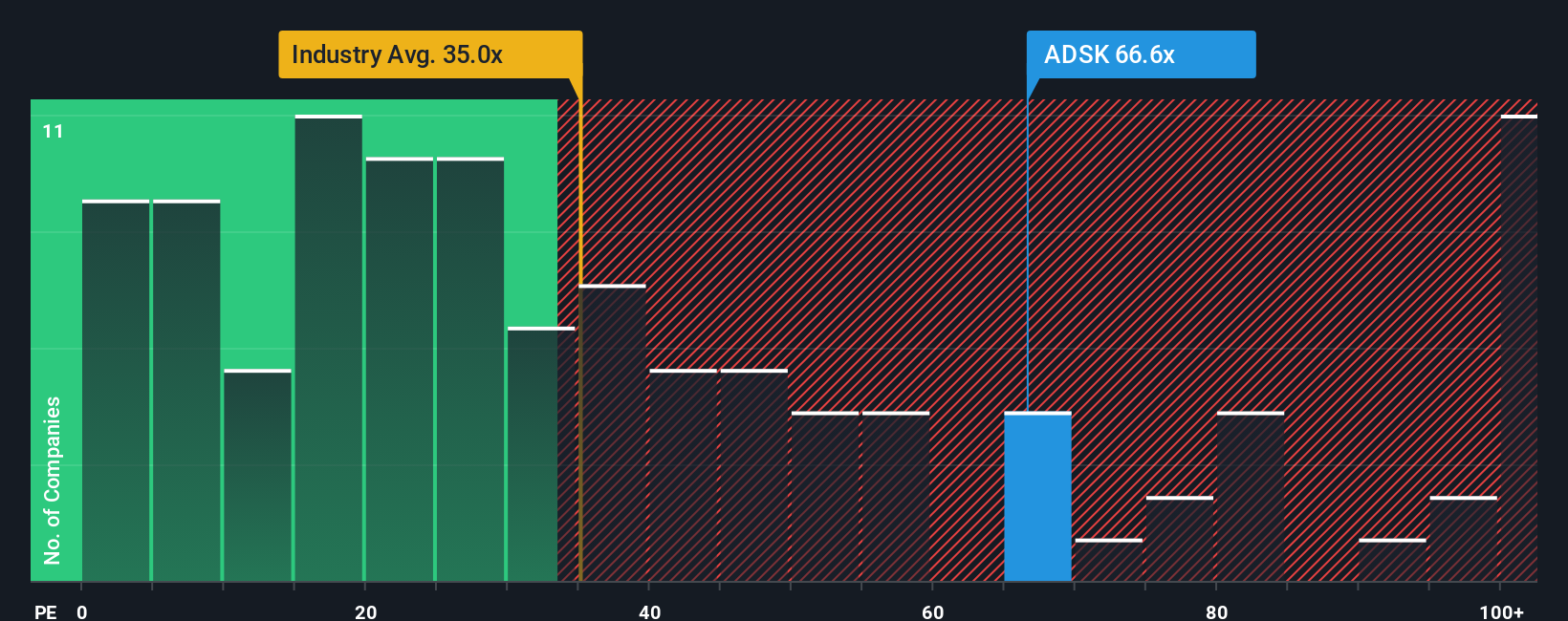

Looking through the lens of the price-to-earnings ratio, Autodesk trades at 65.1x, which is much higher than the US Software industry average of 35.7x and notably above its own fair ratio of 42.2x. While it is cheaper than some peers, this premium could signal valuation risk if expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Autodesk Narrative

If you want to challenge these conclusions or prefer a hands-on approach, you can dig into the data yourself and put together a personal narrative in just a few minutes. Do it your way

A great starting point for your Autodesk research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Tapping into fresh opportunities is key to staying ahead. Smart investors keep hunting for advantage. Don’t miss out on the potential of these booming market trends for your next pick.

- Snap up unique value by starting with these 896 undervalued stocks based on cash flows that stand out based on future cash flows and solid fundamentals.

- Catch powerful income opportunities by reviewing these 19 dividend stocks with yields > 3% that have consistently strong yields above 3%.

- Ride disruptive innovation as you check out these 24 AI penny stocks reshaping industries with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives