- United States

- /

- Software

- /

- NasdaqGS:ADBE

Is There Now an Opportunity in Adobe After Steep 31% Slide?

Reviewed by Simply Wall St

Trying to figure out whether Adobe is a buy, sell, or just something to watch? You are definitely not alone. With a last close at $361.78, it is fair to say that Adobe has experienced a rollercoaster of price swings recently. Over the past week, shares have climbed 2.6%, but it has been a much bumpier ride when you zoom out. The stock is flat for the last month, down 18.0% year to date, and has posted a steep 31.0% drop over the past year. If you are wondering about longer trends, Adobe has seen its value grow 30.3% over three years, though slipping 26.1% across five.

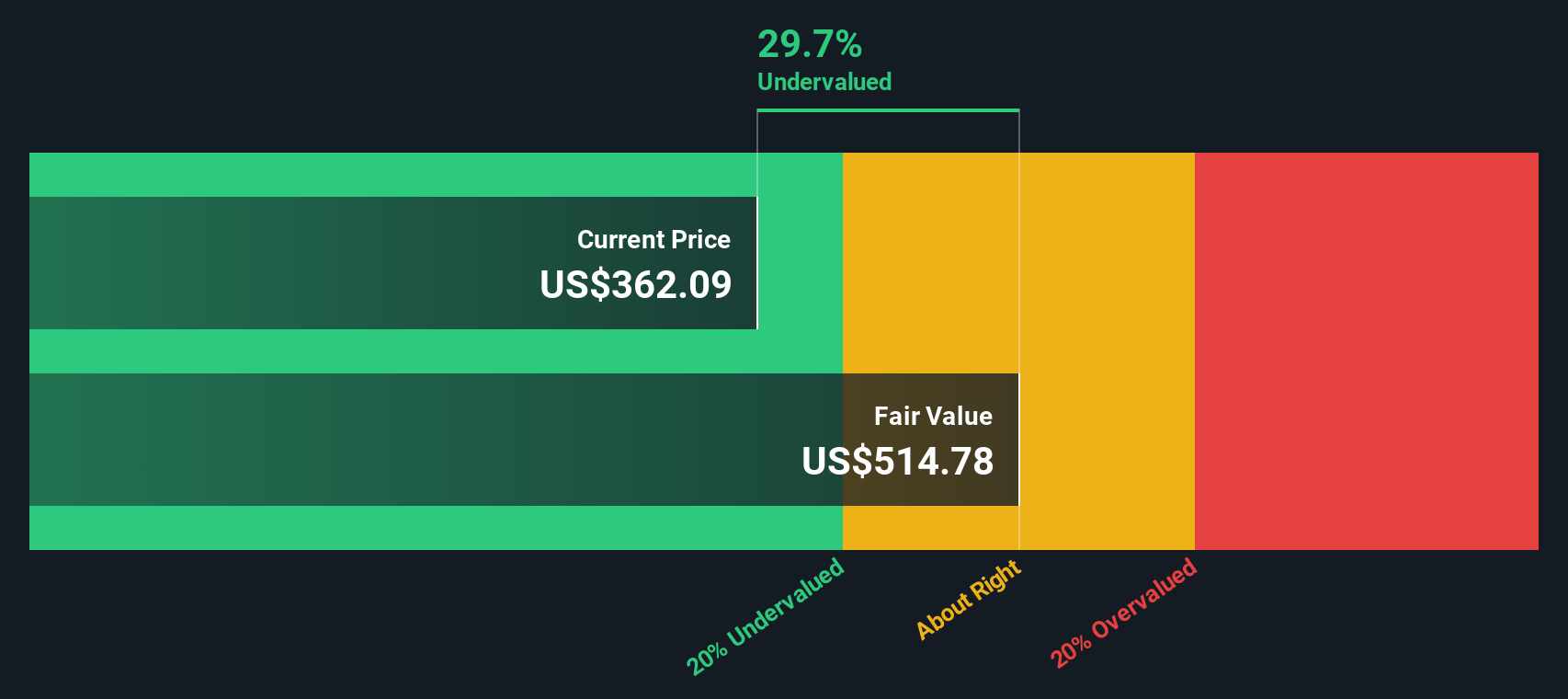

The tough reality is this is a company at the intersection of growth potential and changing risk perception. Market developments in software and tech have been rapidly shifting expectations, fueling both hope for innovation and a recalibration of what investors are willing to pay for that promise. Through all of this, Adobe’s value score, driven by fundamental valuation checks, stands at 5 out of a possible 6, suggesting the stock is considered undervalued by most measures.

So, is the market leaving a real opportunity on the table, or are there reasons to remain cautious? To figure that out, let’s break down the main ways analysts make sense of a company’s value. We will walk through those traditional yardsticks, and then, at the end, look at a smarter path to understanding what Adobe is truly worth.

Why Adobe is lagging behind its peersApproach 1: Adobe Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model is one of the most widely used methods for valuing a company. In essence, it forecasts Adobe’s expected future cash flows and then discounts them back to today’s dollars to estimate what those future earnings are worth now.

Adobe currently generates Free Cash Flow of $9.5 billion annually. Analysts have projected that by 2029, this figure could climb to around $12.5 billion, with numbers expected to continue increasing through the next decade. After five years, these projections are typically extrapolated based on reasonable growth assumptions, giving a broader perspective of Adobe’s earnings power into the future. All these cash flow figures are presented in US dollars.

After tallying up these discounted future cash flows, the DCF model calculates an intrinsic value of $507.70 per share for Adobe. That is about 28.7% higher than its most recent closing price of $361.78. This sizeable gap implies that, according to this analysis, the market is pricing Adobe well below its fundamental value.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Adobe.

Approach 2: Adobe Price vs Earnings

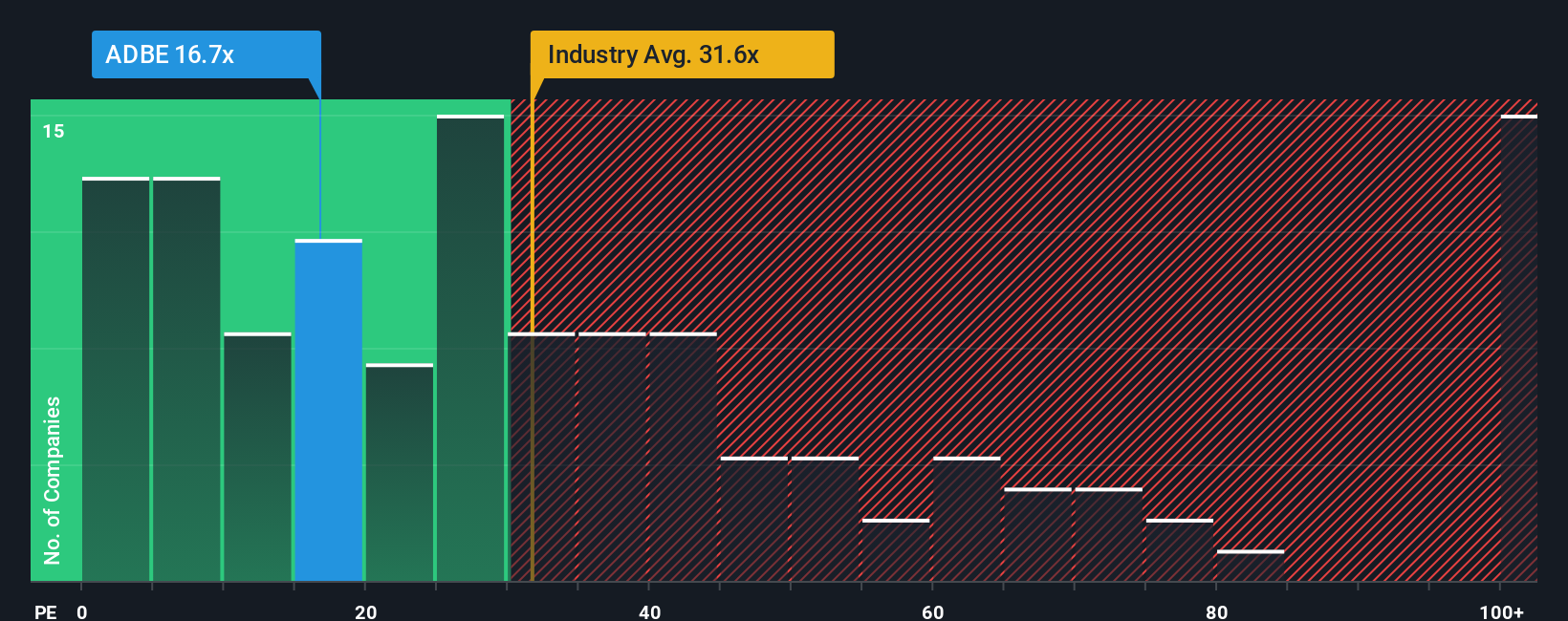

For profitable companies like Adobe, the Price-to-Earnings (PE) ratio is a classic and practical valuation tool since it directly reflects what investors are willing to pay for each dollar of current profit. A lower PE ratio can signal that a stock is undervalued if its growth prospects remain strong, while a higher PE often reflects optimistic growth expectations or low perceived risk.

Market sentiment and risk appetite play an important role in what constitutes a “normal” or “fair” PE. Growth-focused industries, such as software, often command higher ratios. Adobe’s current PE sits at 22.1x, well below the Software industry average of 36.2x and the average for its close peers at 65.5x. This suggests investors are currently applying a discount to Adobe compared to broader industry enthusiasm.

However, Simply Wall St’s proprietary “Fair Ratio” offers more nuance. This metric calculates the PE you would reasonably expect based on Adobe’s own earnings growth, its industry, profit margin, market cap, and risk profile. It is a smarter benchmark than industry or peer averages because it factors in company-specific drivers beyond generic labels.

Adobe’s Fair Ratio is 39.6x, significantly higher than its actual PE of 22.1x. This wide gap signals that, based on fundamentals and risk, Adobe may be trading at a compelling discount to its intrinsic earnings power.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Adobe Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative takes the numbers and connects them to a clear story. It lets you share your perspective about where a company is headed by building forecasts for future revenue, earnings, and margins, ultimately leading to your own Fair Value for the stock.

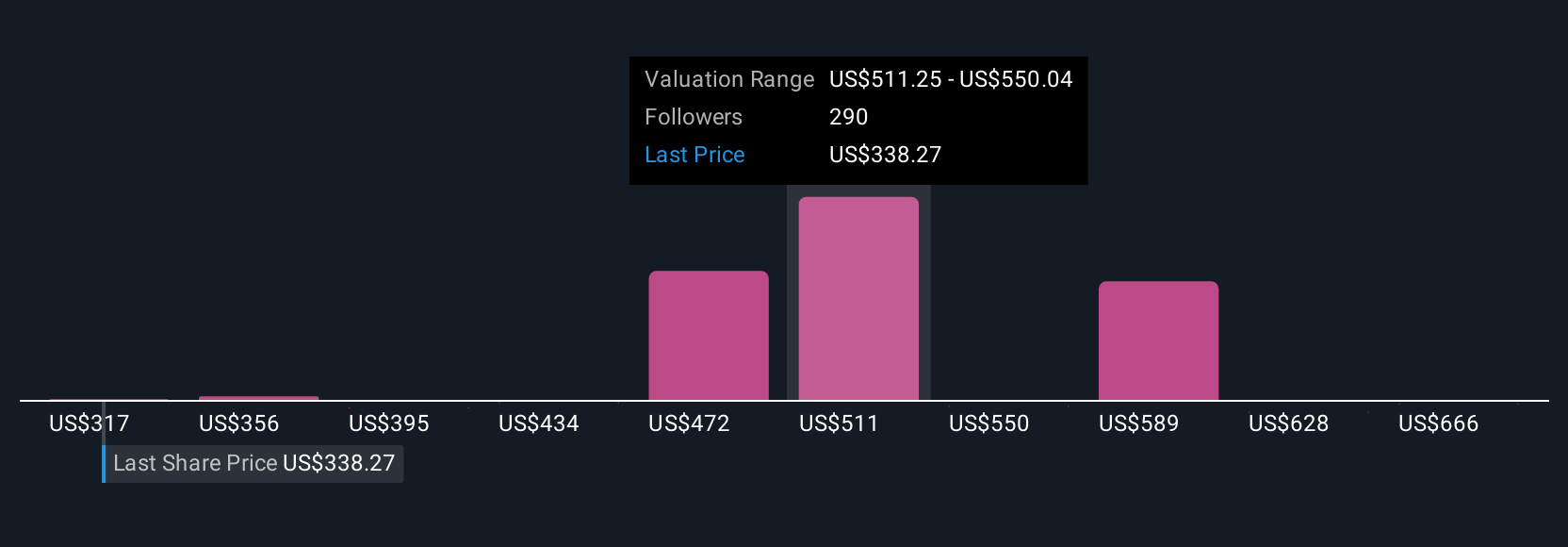

This approach goes beyond standard models by anchoring your investment decisions in real-world context. The Narrative ties a company's unique strengths, risks, and catalysts to the numbers driving its valuation. Narratives are easy to create and update, and are available directly on Simply Wall St's Community page, where millions of investors can compare perspectives and projections.

With Narratives, you can decide when to buy or sell by directly comparing your Fair Value with the live share price. Updates happen automatically as new news or earnings are reported, giving you a dynamic view that stays relevant. For example, some investors currently see Adobe's fair value as high as $605, while others see it closer to $380, reflecting very different stories and assumptions about its future growth and competitive pressures.

Do you think there's more to the story for Adobe? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives