- United States

- /

- Software

- /

- NasdaqGS:ADBE

Digging Into Adobe (ADBE) Valuation as Investors Weigh Recent Share Price Swings

Reviewed by Simply Wall St

If you’ve been keeping an eye on Adobe (ADBE), its recent share price swings might have you wondering what’s really lying beneath the surface. There hasn’t been a headline-grabbing event propelling the stock this week, but that hasn’t stopped investors from wondering if these moves are a signal of something bigger on the horizon. Sometimes, it’s these quieter moments that prompt us to dig deeper and ask whether the market is telling us the whole story or just shifting gears.

Over the past year, Adobe’s share price hasn’t moved much in the bulls’ favor, showing declines both short- and long-term. Despite solid annual growth in revenue and net income, Adobe’s stock is down nearly 39% over the past year and about 21% since the start of the year. That kind of performance can reset expectations and spark conversations about what’s next, especially as no recent news points to a change in momentum.

Which brings us to the core question: does the current price reflect an undervalued tech leader, or is the market simply baking in growth well ahead of schedule?

Most Popular Narrative: 10% Overvalued

According to Goran_Damchevski’s narrative, Adobe is currently overvalued compared to its fair value estimate, factoring in a discount rate of 6.9% and modest long-term growth expectations.

Adobe is now playing defense against new browser based startups such as Canva, Figma and smaller clones that may take market share. Given the nature of software, and the rapid advancements in creative media software capabilities, I believe Adobe's existing moat of switching costs and brand power will not hold the same weight they used to, and users will not need to use Adobe as the “industry standard”.

Curious how much pressure Adobe’s “industry standard” status is really under? Behind this bold narrative, crucial projections about growth and margin changes could shake up what investors should expect next. See which surprising assumptions drive the numbers behind this headline valuation.

Result: Fair Value of $317.27 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors such as a successful Figma acquisition or a downturn that shakes out weaker competitors could quickly reshape the outlook for Adobe’s market position.

Find out about the key risks to this Adobe narrative.Another View: What About Cash Flows?

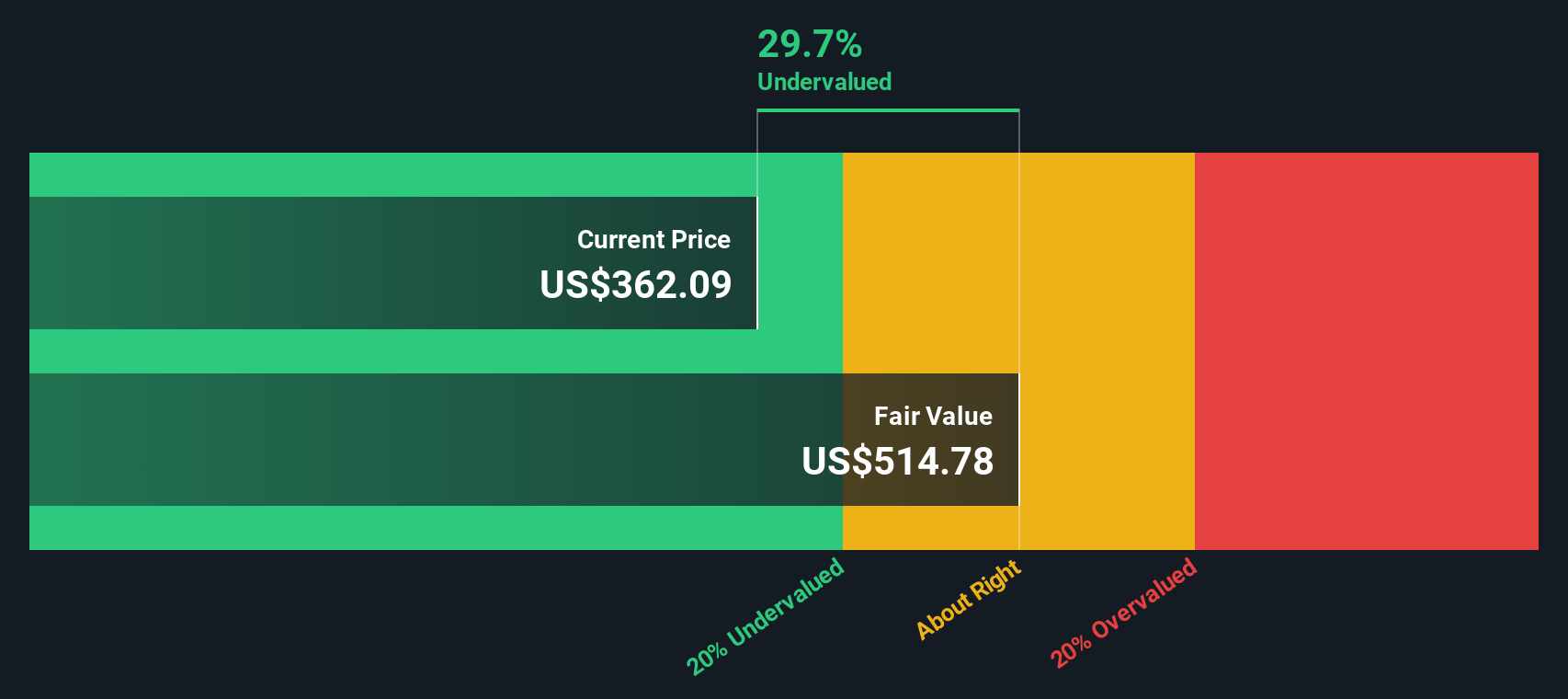

While one approach points to Adobe being overvalued, our SWS DCF model takes a very different view and suggests the company could actually be undervalued. Can two respected methods really tell such different stories?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Adobe to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Adobe Narrative

If you see things differently or prefer hands-on analysis, it’s easy to dive into the data and build your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Adobe.

Looking for More Smart Investment Opportunities?

Your next winning move could be just a screen away. Don’t sit on the sidelines while others are finding their edge. Check out these handpicked ideas that are shaking up the market right now:

- Accelerate your search for tech disruptors by tracking the rise of early-stage companies with penny stocks with strong financials.

- Grow your portfolio with steady income streams and take advantage of companies offering dividend stocks with yields > 3%.

- Get ahead of Wall Street by targeting the market’s most attractively priced stocks using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)