- United States

- /

- Software

- /

- NasdaqGS:ADBE

Adobe (NasdaqGS:ADBE) Drops 15% Despite Robust Q1 2025 Earnings Announcement

Reviewed by Simply Wall St

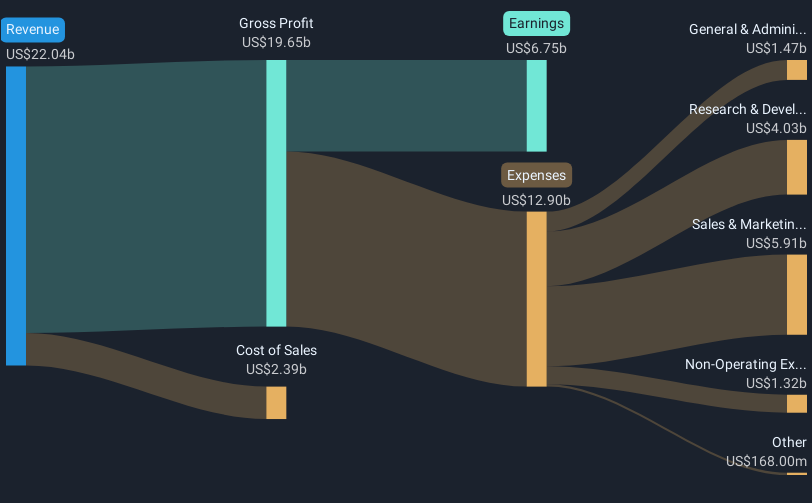

Adobe (NasdaqGS:ADBE) recently announced robust earnings for Q1 2025, with a notable rise in both revenue and net income. Despite this financial upswing, the company's share price fell 15.05% over the last week. This decline coincides with broader market volatility, which saw a 4.1% drop in the market overall. Even as the tech sector, led by Nvidia and other giants, experienced gains towards the week's end, Adobe did not capture investor confidence. The company had also updated its Q2 guidance, indicating stable future growth yet possibly overshadowed by general market uncertainty associated with economic policies and inflation expectations. Adobe's partnerships and product innovations, such as the collaboration with EsteeL Lauderdale and the launch of Firefly, though enhancing its digital offerings, did not offset the week's overall market corrections and investor wariness, reflecting a challenging trading environment for the stock.

Explore historical data to track Adobe's performance over time in our past results report.

Over the past five years, Adobe's total shareholder return, encompassing both share price appreciation and dividends, was 22.87%. During this period, the company's performance was marked by robust financial achievements, including earnings announcements such as the Q3 2020 results reporting total revenue of US$3.23 billion, marking a year-on-year increase. Adobe also undertook a significant share repurchase program, initiated in December 2020, with up to US$15 billion allocated to buy back common stock through fiscal 2024. This move was aimed at returning value to shareholders and reducing dilution.

Enhanced client partnerships also contributed to Adobe's market presence, with collaborations like the November 2020 integration with Adjust, targeting improved customer journey tracking and analytics. Additionally, the strategic partnership with IBM and Red Hat in mid-2020 focused on accelerating digital transformation across industries. Despite these efforts, Adobe underperformed the broader U.S. Software industry over the past year and the US Market in the same timeframe. Nonetheless, the company remains well-positioned with its innovations and industry collaborations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives