- United States

- /

- Software

- /

- NasdaqGS:ADBE

Adobe (ADBE): Evaluating Valuation After Recent Earnings Drive Market Reaction

Reviewed by Simply Wall St

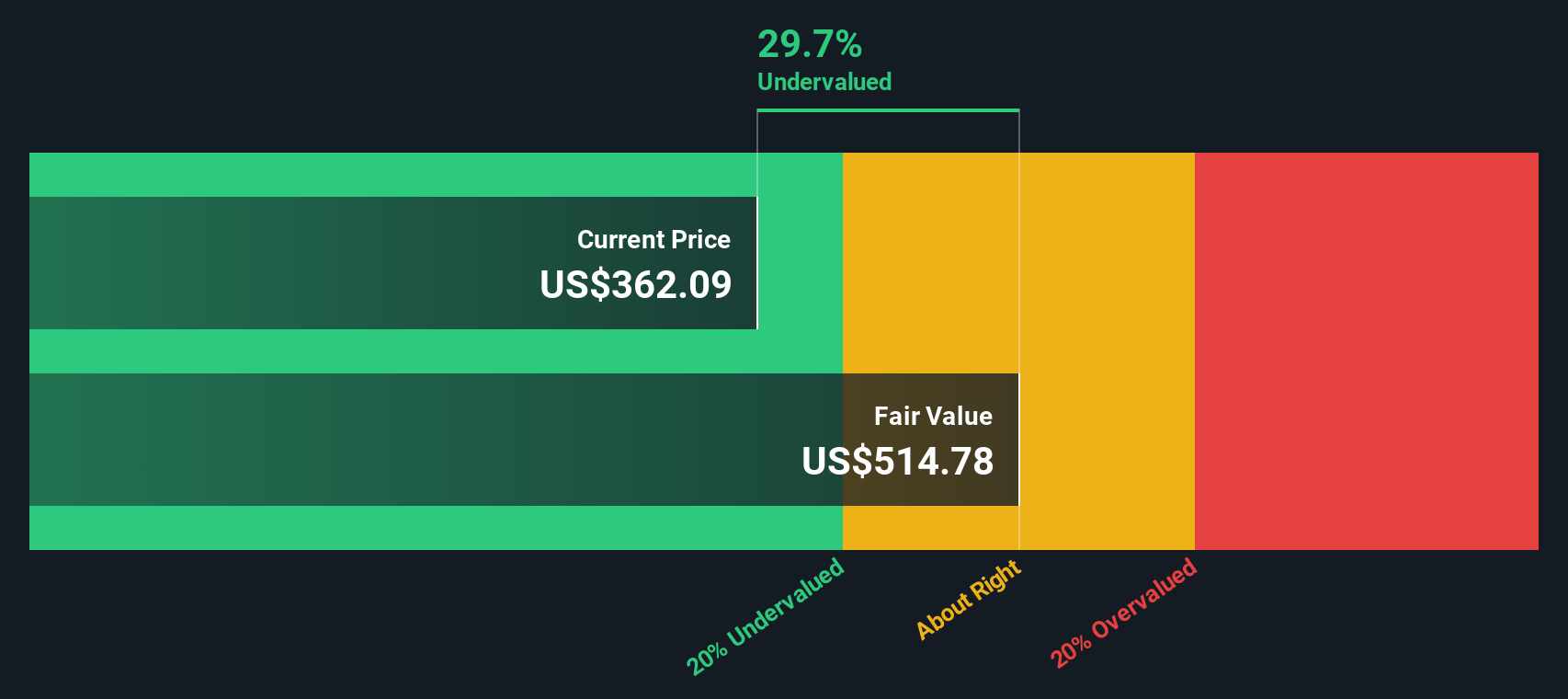

Adobe (ADBE) shares have been in the spotlight after the company’s recent earnings sparked plenty of conversation among investors weighing their next move. The numbers showed steady growth, but the market’s response, which sent the stock down sharply, raises questions on whether investors are shifting their view on Adobe’s future prospects. For anyone holding Adobe or considering picking up shares, this event naturally brings the question of value and growth into sharper focus.

Looking at the bigger picture, Adobe’s stock has faced pressure this year, falling nearly 38% over the past twelve months. This comes despite solid annual revenue and net income growth figures hovering around 8%. Momentum has faded, as the stock has lagged behind peers and shown a notably weaker trend compared to its multi-year returns. Still, the underlying business remains both profitable and established, signaling that the market may be wrestling with Adobe’s long-term growth story.

With the stock trading well below its past highs, it is worth asking whether Adobe is undervalued at these levels or if the market has already factored in the slower growth ahead.

Most Popular Narrative: 11.4% Overvalued

According to the narrative by Goran_Damchevski, Adobe’s current share price is projected as overvalued compared to its calculated fair value, which considers diminishing growth, increased competition from AI-driven design tools, and market saturation. This perspective takes into account industry shifts, margin compression, and the impact of potential acquisitions or regulatory obstacles on future earnings.

Adobe’s previously rock-solid moat may begin to break down as browser-based startups continue to emerge. Adobe is now playing defense against new browser-based competitors such as Canva, Figma, and smaller clones that could take market share. Given the nature of software and the rapid advancements in creative media software capabilities, I believe Adobe's existing moat of switching costs and brand power may not carry the same influence as in the past, and users may no longer feel obligated to use Adobe as the "industry standard."

Curious which financial forecasts and margin changes drive this valuation perspective? Industry data suggests a pivotal moment for Adobe. Community insights point to shifting industry standards and challenging earnings expectations. Want to see how forward-looking metrics and strong competition are shaping this story? Dive deeper for the full rationale and learn what could redefine Adobe’s valuation landscape.

Result: Fair Value of $317.27 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if Adobe successfully acquires Figma or benefits from weaker competitors in a downturn, these catalysts could quickly challenge the current view that the stock is overvalued.

Find out about the key risks to this Adobe narrative.Another View: Our DCF Model Sees Opportunity

While the first valuation suggests Adobe is overvalued due to industry headwinds, our DCF model tells another story and points to value at current levels. Why the difference? It comes down to how you weigh long-term growth compared to near-term challenges. Which vision for Adobe’s future resonates more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Adobe for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Adobe Narrative

If you have a different perspective or want your own take, you can easily build a narrative around the data yourself in just a few minutes. do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Adobe.

Looking for more investment ideas?

Opportunities are always unfolding, and waiting means you could miss out on stocks poised for bold moves. Let the Simply Wall Street Screener guide you to fresh, high-potential picks tailored to your interests. Here are some exciting ways to broaden your watchlist now:

- Spot companies shaping the AI landscape by tapping into AI penny stocks. These innovators are driving advancements that could reshape industries.

- Unlock the potential of steady income and resilience with dividend stocks with yields > 3% to find businesses offering yields above 3%, perfect for bolstering your portfolio.

- Fuel your portfolio’s growth with undervalued stocks based on cash flows, pinpointing stocks trading below their intrinsic cash flow value and ready for a re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives