- United States

- /

- Software

- /

- NasdaqGS:ACIW

Can You Imagine How ACI Worldwide's Shareholders Feel About The 73% Share Price Increase?

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

One simplest way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks, you could make more than that. For example, ACI Worldwide, Inc. (NASDAQ:ACIW) shareholders have seen the share price rise 73% over three years, well in excess of the market return (54%). However, more recent returns haven't been as impressive as that, with the stock returning just 31% in the last year.

View our latest analysis for ACI Worldwide

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years of share price growth, ACI Worldwide actually saw its earnings per share (EPS) drop 41% per year. Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Given this situation, it makes sense to look at other metrics too.

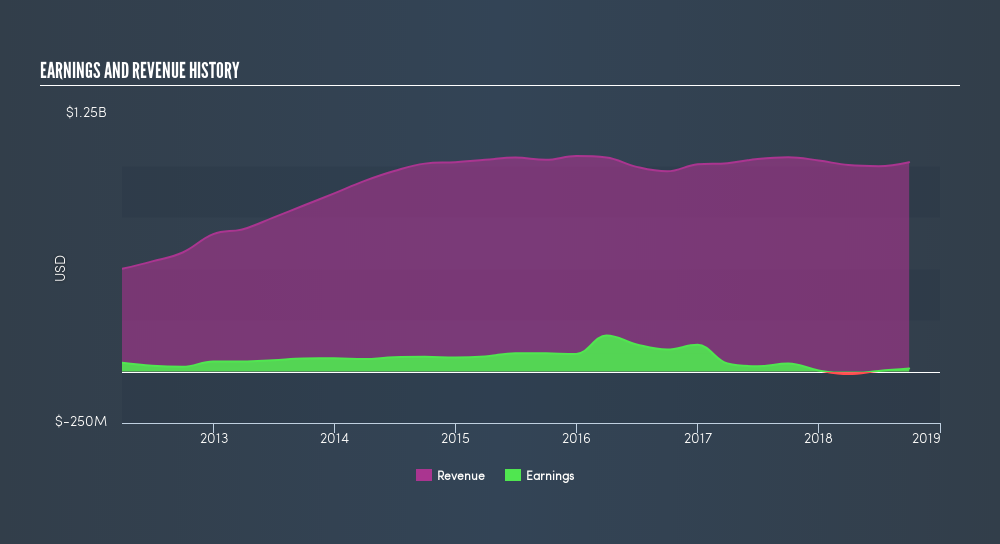

You can only imagine how long term shareholders feel about the declining revenue trend (slipping at 0.5% per year). The only thing that's clear is there is low correlation between ACI Worldwide's share price and its historic fundamental data. Further research may be required!

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

It's good to see that ACI Worldwide has rewarded shareholders with a total shareholder return of 31% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 9.4% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before spending more time on ACI Worldwide it might be wise to click here to see if insiders have been buying or selling shares.

We will like ACI Worldwide better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:ACIW

ACI Worldwide

Develops, markets, installs, and supports software products and services for facilitating electronic payments in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives