- United States

- /

- Semiconductors

- /

- NYSE:TSM

Here’s why Taiwan Semiconductor Manufacturing’s (NYSE:TSM) Massive Capital Expenditure is Promising

Shares of Taiwan Semiconductor Manufacturing ( NYSE:TSM ) have remained under pressure despite the company reporting an excellent set of results 10 days ago. Despite the weak sentiment, TSM has some attributes that make it stand out in the tech sector.

TSMC’s stock price remains under pressure despite solid quarterly results

TSMC’s first-quarter results beat expectations on the top and bottom line. Revenue increased by 35.5% year-over-year while EPS were up 46% from a year earlier. Margins were also significantly higher across the board. In addition, the company raised its guidance for the second quarter and said margins are expected to improve further.

There was a lot to like about these results, but the stock price has remained under pressure along with the rest of the market, and the semiconductor industry in particular. Semiconductor stocks are down 16.8% in the last month and the weakest industry in the technology sector .

For long-term investors, volatility can create great opportunities, and TSM has some attributes which may make it an attractive tech sector holding when sentiment improves.

TSM vs Other large Semiconductor stocks

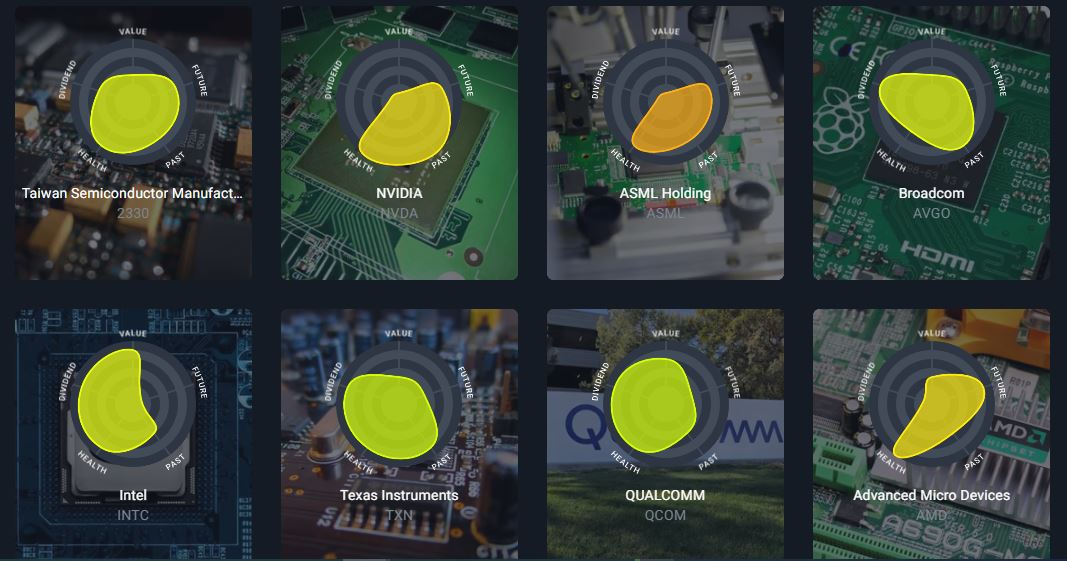

We used the Simply Wall St stock screener to have a quick look at the largest semiconductor stocks. (The ‘snowflake’ graphics help us to visually compare stocks according to valuation, future growth forecasts, past performance, financial health, and dividends. Companies with strong fundamentals have larger, greener snowflakes. A green snowflake doesn’t imply a company is a buy, but it does suggest that based on publicly available data the stock looks promising and is worth further analysis. )

TSMC, along with Texas Instruments ( NASDAQ: TXN ) stand out here with the largest snowflakes. In fact, TSM scores very well in four out of five categories, apart from value — although the valuation is improving every day that the sector remains under pressure.

TSM’s Capex and Return on Capital Employed

While there are lots of companies that design semiconductor chips, there are very few that actually manufacture, or fabricate, them. TSM is the leader in this space with around 55% market share. To maintain this lead, the company reinvests a significant percentage of its profits - that’s why you’ll notice that TSM’s cash flows are lower than its earnings.

In 2021, TSM’s Capex (capital expenditure) was ~$30 billion, and the company plans to spend between $40 and $44 bln on Capex in 2022. While this level of investment is not without its risks, it's also the right strategy for two reasons.

Firstly, the high Capex helps the company maintain its position as the leading manufacturer of chips. And secondly, it helps TSM compound its earnings. For a company to increase in value over the long term it needs to generate high rates of return on capital employed, and have opportunities to reinvest cash flows at those high rates of return.

We like to look at a company’s return on capital employed (ROCE) to get an idea of its earning potential over the long term. The formula for ROCE is as follows:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

TSMC’s ROCE is currently about 24%, up from 20% three years ago. This is an impressive number and it's also encouraging to see that TSM has opportunities to reinvest its profits. For investors, the high Capex rate also suggests that the company believes the current demand for its products will persist.

The risks

Like any company, TSMC does face some risks:

Competition: TSMC is facing increased competition from Samsung, Intel, and other chip fabricators. Intel in particular is trying to make up lost ground with its own $20 bln Capex plan .

Delays in 2nm process: TSMC plans to produce 2nm chips in 2025, but there are some indications that this timeline has been delayed. If other manufacturers can produce these chips earlier, TSMC may lose out on new orders.

Dividend: TSMC pays a 2% dividend, however, the payout ratio is high and not well covered by cash flows.

Summary

TSMC is a leader in the semiconductor industry, with impressive margins. The company’s high Capex levels may help it maintain its leadership position and give it the opportunity to compound earnings. If the share price continues to fall it will soon have strong scores across all five of the factors, we use to evaluate stocks (valuation, future growth forecasts, past performance, financial health, and dividends.)

To learn more, have a look at our full TSMC analysis. You can also check out the stock screener to compare the attributes of other semiconductor stocks.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives