- United States

- /

- Semiconductors

- /

- NYSE:TSM

Assessing TSMC (NYSE:TSM) Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Taiwan Semiconductor Manufacturing.

After a strong several months, Taiwan Semiconductor Manufacturing’s momentum is unmistakable, with a 1-year total shareholder return approaching 49% and a remarkable 3-year figure above 350%. This surge reflects rising confidence in the company’s growth prospects and its dominant role supplying advanced chips, even as the share price recently pulled back slightly from new highs.

If you’re interested in finding more semiconductor sector leaders, now is the perfect time to explore the latest tech and AI movers with our See the full list for free.

But after such impressive gains, the key question remains: Is Taiwan Semiconductor Manufacturing’s current share price reflecting all its potential, or could now be an overlooked window for investors to act before the next leg up?

Price-to-Earnings of 25.8x: Is it justified?

At a price-to-earnings (P/E) ratio of 25.8x, Taiwan Semiconductor Manufacturing is trading at a notable discount to both its industry peers and the broader sector. The last close price of $280.66 suggests investors are not paying a steep premium relative to TSM’s recent performance.

The P/E ratio measures how much investors are willing to pay for each dollar of company earnings. For highly profitable and fast-growing semiconductor businesses like TSM, this multiple can provide a snapshot of market expectations around future profitability and growth sustainability.

Not only is TSM’s P/E lower than the US semiconductor industry average of 35.3x, it is also below the estimated fair P/E ratio of 43.1x. This level is one the market could trend toward if growth continues to outpace peers. This positioning indicates the market is currently undervaluing TSM’s earnings relative to its underlying fundamentals and industry benchmarks.

In fact, the company’s P/E is not just lower than the industry average but also well below the peer average of 61.8x. This further highlights its relative value. If earnings projections remain robust, the stock’s valuation gap may narrow over time as the market prices in its superior growth.

Explore the SWS fair ratio for Taiwan Semiconductor Manufacturing

Result: Price-to-Earnings of 25.8x (UNDERVALUED)

However, slower revenue growth or an unexpected drop in net income could challenge TSM’s current momentum and place pressure on its valuation in the future.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.

Another View: What Does the SWS DCF Model Show?

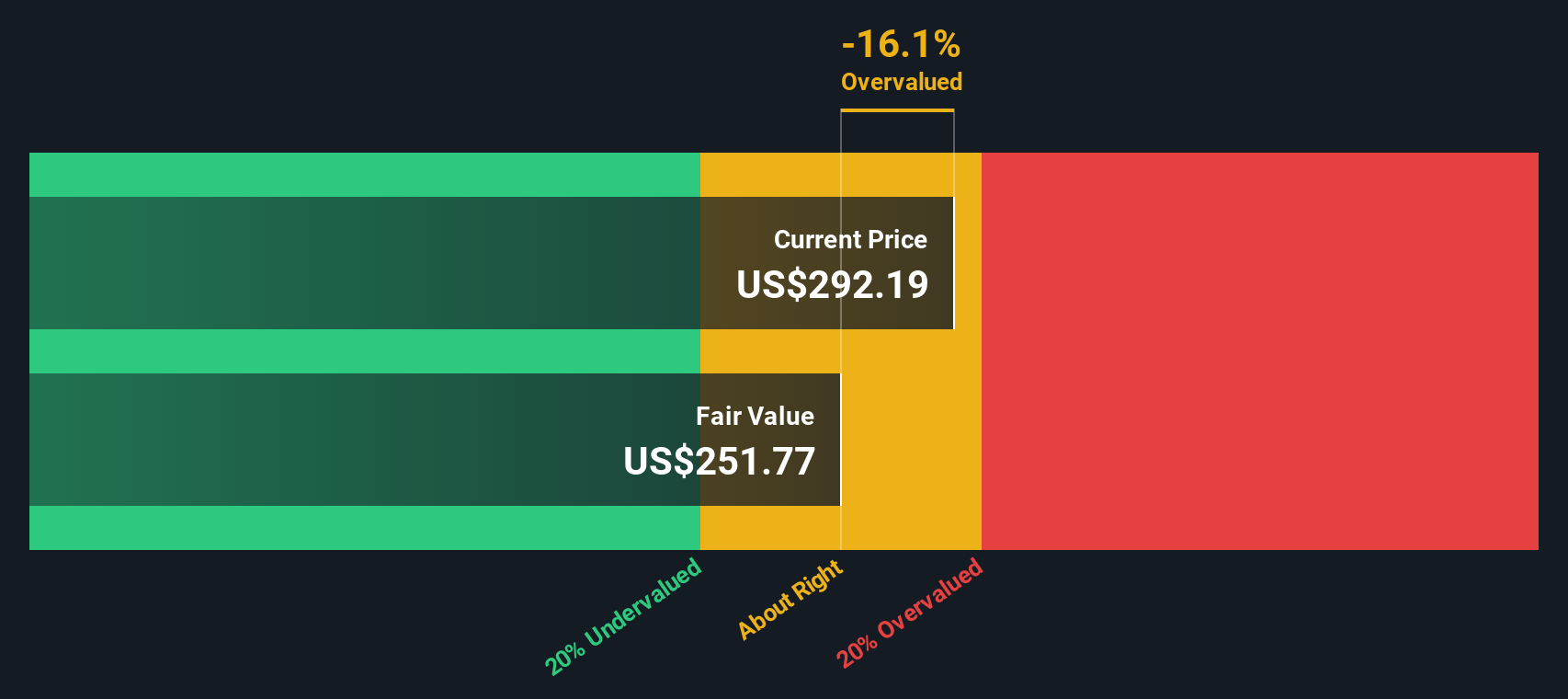

Looking at Taiwan Semiconductor Manufacturing through the SWS DCF model, a different picture emerges. Based on current estimates, the stock’s price of $280.66 is actually trading slightly above our calculated fair value of $275.61. This suggests that while multiples point to value, cash flow projections imply investors may be paying a bit of a premium. Which lens gives a truer sense of opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taiwan Semiconductor Manufacturing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taiwan Semiconductor Manufacturing Narrative

If you see things differently, or want to analyze the numbers in your own way, you can build your own perspective quickly. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Taiwan Semiconductor Manufacturing.

Looking for more investment ideas?

If you want to get ahead of the crowd, don’t overlook other actionable opportunities waiting on Simply Wall St. These focused investment angles could help you find the next big winner before everyone else.

- Catch the momentum of companies shaking up artificial intelligence by checking out these 24 AI penny stocks, which are setting the pace for innovation.

- Target attractive income streams and see which businesses offer yields above 3% through these 19 dividend stocks with yields > 3%, now delivering strong payouts.

- Capitalize on unique upside by finding these 26 quantum computing stocks, which are poised to lead the next tech transformation and disrupt entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives