- United States

- /

- Semiconductors

- /

- NYSE:SQNS

Sequans Communications (NYSE:SQNS) Valuation Spotlight as 1-for-10 Stock Split Approaches

Reviewed by Simply Wall St

Most Popular Narrative: 74.5% Overvalued

The most widely followed narrative sees Sequans Communications as significantly overvalued, based on projected growth and risk factors.

"Product revenue from the IoT business is expected to ramp significantly through the second half of 2025 and into 2026, as a large pipeline of design wins (approximately $250 million) transitions to mass production. This dynamic aligns with robust adoption of connected devices across industries, and is set to drive meaningful revenue growth. Sequans' launch of new RF transceiver products targeting high-value markets such as defense, drones, and automotive, combined with strong early design win momentum, supports long-term expansion into diversified verticals with premium gross margins and higher earnings potential."

What is the real math fueling this towering fair value? The headline numbers count on a revenue surge and profit margins rarely seen in this corner of tech. Powerful growth forecasts and audacious assumptions about future technology domination support the current narrative. Want to discover which financial drivers set this projection apart? The full story waits in the complete narrative.

Result: Fair Value of $5.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the company's aggressive pivot to Bitcoin and ongoing shareholder dilution may quickly shake confidence if expected IP licensing revenues or profit growth do not meet expectations.

Find out about the key risks to this Sequans Communications narrative.Another View: Checking Against Peers

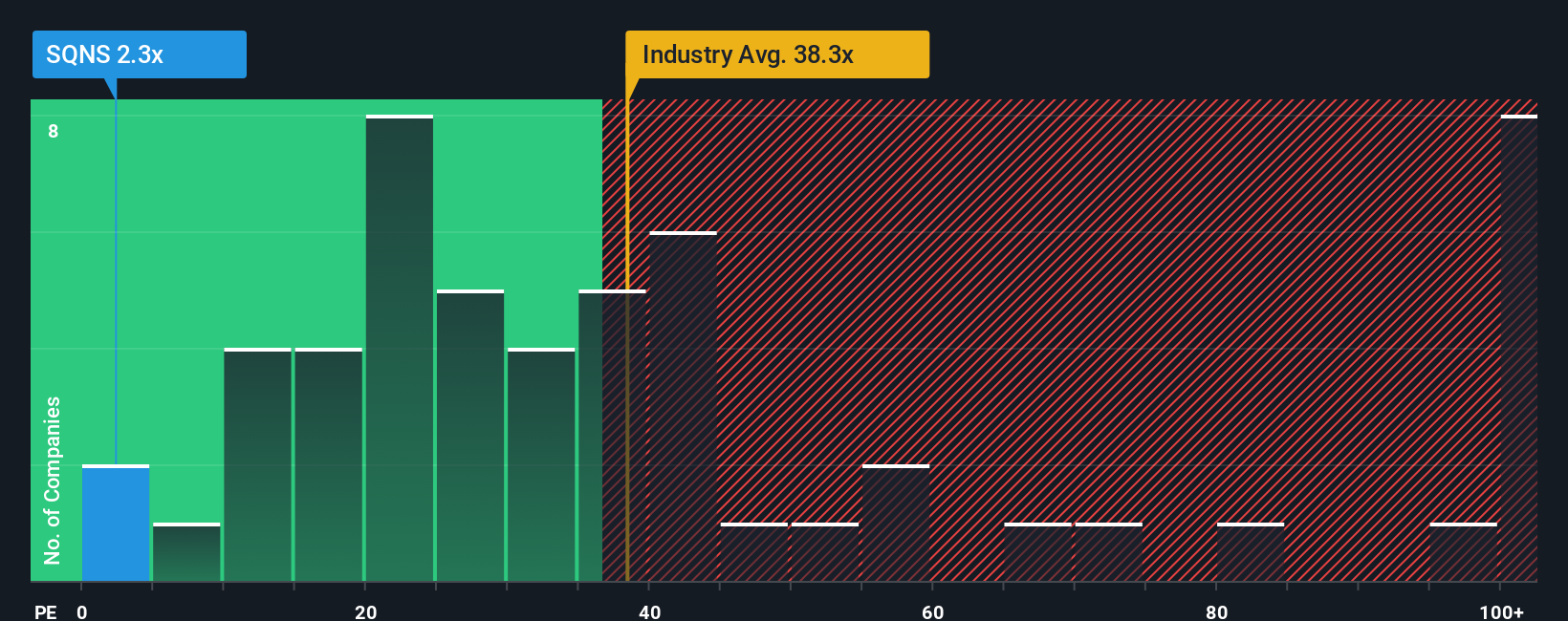

While some see Sequans Communications as overvalued, comparing its valuation to other companies in the semiconductor industry tells a slightly different story. Is this benchmarked approach highlighting overlooked value, or does it signal hidden risks?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Sequans Communications to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Sequans Communications Narrative

If you have a different perspective or want to test your own ideas, you can easily build a custom narrative from the latest data in just a few minutes. Do it your way

A great starting point for your Sequans Communications research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to power up your portfolio with standout opportunities you might have overlooked in the rush. Use the Simply Wall Street Screener to unlock new ideas tailored to your style. You could spot a hidden gem before others do and stay ahead of the crowd.

- Maximize your income and stability by checking out dividend stocks offering yields above 3% through our dividend stocks with yields > 3% selection.

- Uncover companies shaping the future of healthcare with breakthroughs in artificial intelligence using our healthcare AI stocks.

- Catch undervalued stocks poised for a turnaround by using the special list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQNS

Sequans Communications

Engages in the fabless designing, developing, and supplying of cellular semiconductor solutions for massive and broadband internet of things markets.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)