- United States

- /

- Oil and Gas

- /

- NasdaqCM:SLNG

Stabilis Solutions And 2 Other Noteworthy Penny Stocks

Reviewed by Simply Wall St

As the U.S. markets close higher with a rebound in tech and crypto-related stocks, investors are keenly observing opportunities across various sectors. Penny stocks, despite being an older term, continue to hold relevance for those seeking growth potential in smaller or newer companies. These stocks can offer significant returns when backed by strong financial health, making them an intriguing option for investors looking to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Here Group (HERE) | $3.08 | $249.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Dingdong (Cayman) (DDL) | $1.79 | $368.6M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.87 | $676.31M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.28 | $551.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.26 | $1.36B | ✅ 5 ⚠️ 1 View Analysis > |

| FinVolution Group (FINV) | $4.93 | $1.3B | ✅ 3 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.87 | $245.4M | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (CINT) | $4.54 | $586.77M | ✅ 5 ⚠️ 0 View Analysis > |

| BAB (BABB) | $0.825 | $5.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.00 | $90.62M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 352 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Stabilis Solutions (SLNG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stabilis Solutions, Inc. is an energy transition company that offers turnkey clean energy solutions using liquefied natural gas (LNG) for production, storage, transportation, and fueling across North America, with a market cap of $91.31 million.

Operations: The company generates revenue primarily from its Liquefied Natural Gas (LNG) segment, which accounts for $72.27 million.

Market Cap: $91.31M

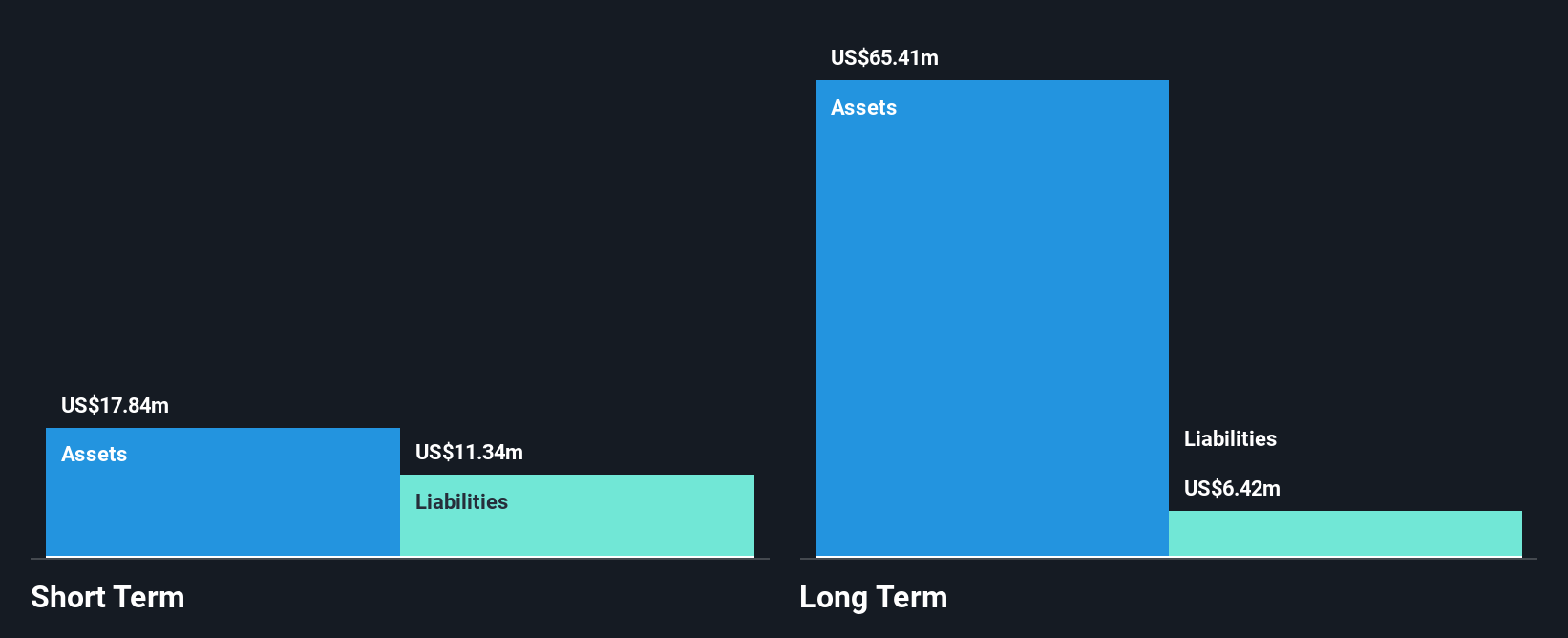

Stabilis Solutions, Inc., with a market cap of US$91.31 million, primarily generates revenue from its LNG segment, reporting sales of US$20.33 million in Q3 2025, up from US$17.63 million a year ago. Despite improving earnings over five years and reducing debt levels slightly, the company faces challenges with declining profit margins and negative earnings growth over the past year (-74.1%). Management's inexperience could be a concern for investors seeking stability in this sector. Although short-term assets cover liabilities well, forecasted declines in earnings may warrant caution for potential investors interested in penny stocks.

- Unlock comprehensive insights into our analysis of Stabilis Solutions stock in this financial health report.

- Learn about Stabilis Solutions' future growth trajectory here.

OraSure Technologies (OSUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OraSure Technologies, Inc. is a company that develops, manufactures, markets, sells, and distributes diagnostic and specimen collection devices globally with a market cap of $179.33 million.

Operations: The company's revenue is derived from its Diagnostics and Molecular Solutions segment, which generated $125.70 million.

Market Cap: $179.33M

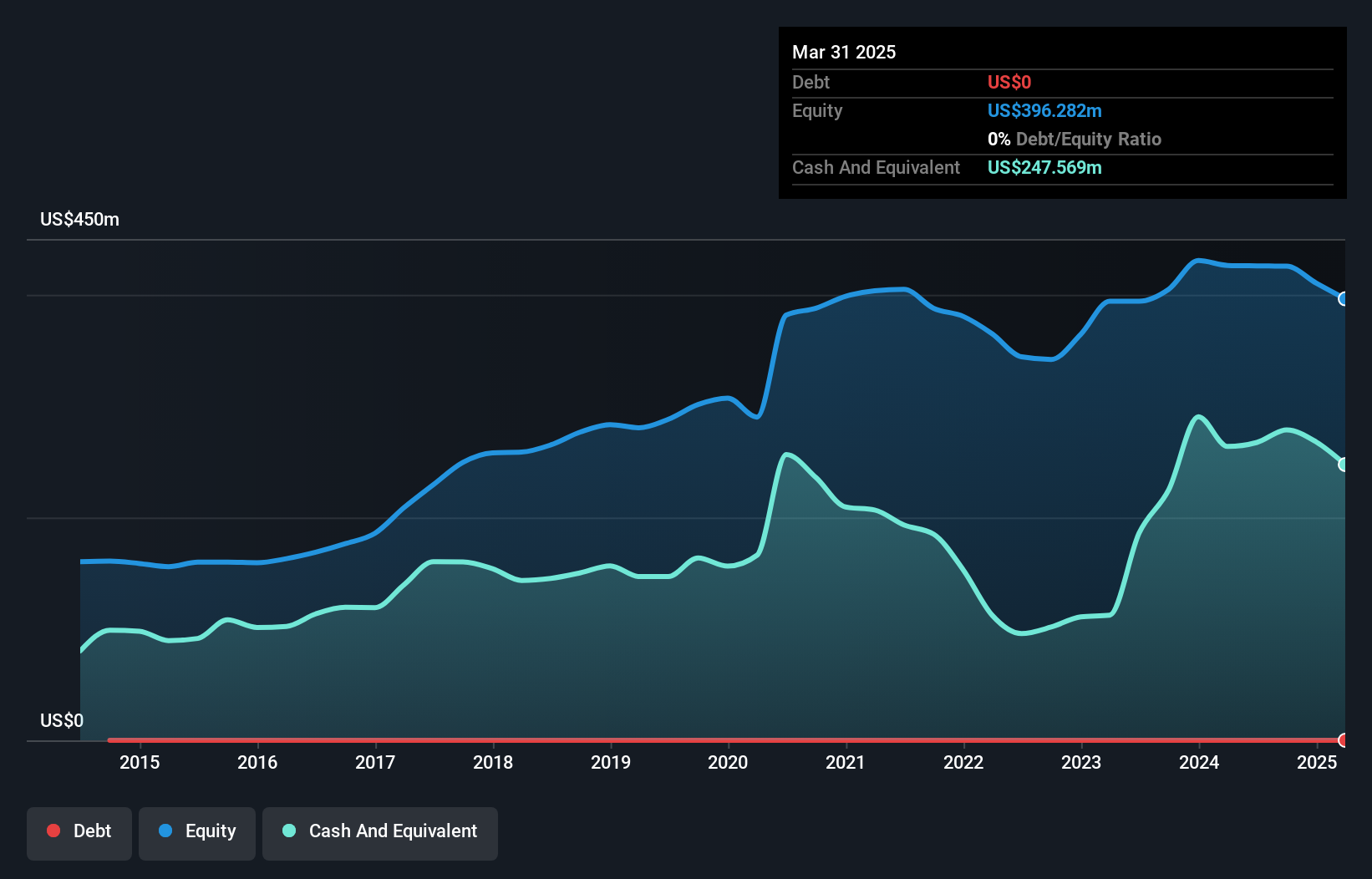

OraSure Technologies, Inc., with a market cap of US$179.33 million, is debt-free and has demonstrated financial prudence by maintaining short-term assets of US$283 million that comfortably cover its liabilities. Despite reporting a net loss of US$13.71 million in Q3 2025, the company continues to focus on strategic growth through board refreshment and operational excellence initiatives. Recent leadership changes aim to bolster expertise in diagnostics and sample management solutions, while share buybacks reflect confidence in future prospects. However, declining revenues from US$39.92 million to US$27.09 million year-on-year highlight ongoing challenges for this penny stock investment consideration.

- Click here to discover the nuances of OraSure Technologies with our detailed analytical financial health report.

- Assess OraSure Technologies' future earnings estimates with our detailed growth reports.

Magnachip Semiconductor (MX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Magnachip Semiconductor Corporation designs, manufactures, and supplies analog and mixed-signal semiconductor solutions for various applications including communications, IoT, consumer electronics, computing, industrial sectors, and automotive industries with a market cap of approximately $101.11 million.

Operations: The company's revenue primarily comes from its Power Solutions Business, specifically the Power Analog Solutions segment, which generated $167.12 million.

Market Cap: $101.11M

Magnachip Semiconductor, with a market cap of US$101.11 million, faces challenges as it remains unprofitable with increasing losses over five years. Despite this, the company is strategically expanding its Power Solutions Business and has cash reserves exceeding debts. Recent agreements with Hyundai Mobis to develop IGBT technology highlight potential growth in the EV sector. However, Q3 2025 results show a revenue decline to US$45.95 million and increased net loss of US$13.09 million compared to last year, reflecting ongoing financial hurdles amidst efforts to enhance technological competitiveness in high-power semiconductor markets.

- Jump into the full analysis health report here for a deeper understanding of Magnachip Semiconductor.

- Evaluate Magnachip Semiconductor's prospects by accessing our earnings growth report.

Where To Now?

- Unlock more gems! Our US Penny Stocks screener has unearthed 349 more companies for you to explore.Click here to unveil our expertly curated list of 352 US Penny Stocks.

- Looking For Alternative Opportunities? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNG

Stabilis Solutions

An energy transition company, provides turnkey clean energy production, storage, transportation, and fueling solutions primarily using liquefied natural gas (LNG) to various end markets in North America.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026