- United States

- /

- Semiconductors

- /

- NasdaqGS:UCTT

Will Ultra Clean Holdings (UCTT) Leverage New Leadership to Redefine Its Competitive Edge in Semiconductors?

Reviewed by Simply Wall St

- Ultra Clean Holdings recently announced the appointment of James Xiao as Chief Executive Officer effective September 2, 2025, and Chris Cook as Chief Business Officer, marking significant additions to its executive team.

- The backgrounds of both leaders, with experience across advanced semiconductor, solar, and electronic systems, position the company for a potential shift in operational focus and customer engagement strategies.

- We'll consider how the CEO appointment could influence Ultra Clean Holdings' long-term growth outlook and operational priorities within the semiconductor sector.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ultra Clean Holdings Investment Narrative Recap

Ultra Clean Holdings' long-term thesis centers on capturing growth in advanced semiconductor manufacturing by delivering specialized process subsystems and services. The recent appointments of James Xiao as CEO (effective September 2025) and Chris Cook as Chief Business Officer signal a refreshed leadership team, but in the near term, do not fundamentally change the key catalyst: the expected revenue uplift from new product ramps and facility qualifications. The primary risk remains persistent demand weakness in the capital equipment cycle, putting downward pressure on utilization and earnings visibility.

Among recent company announcements, the Q2 2025 earnings update is highly relevant. The results showed continued unprofitability, with a net loss of US$162 million despite flat year-over-year revenue and cautious guidance for the next quarter, underscoring the challenges of operating far below prior capacity expectations and highlighting the importance of upcoming operational improvements and leadership transitions to restore growth momentum.

However, investors should be aware that against this backdrop of management change, the ongoing risk of revenue exposure to a concentrated customer base remains particularly relevant...

Read the full narrative on Ultra Clean Holdings (it's free!)

Ultra Clean Holdings' narrative projects $2.7 billion revenue and $64.6 million earnings by 2028. This requires 7.8% yearly revenue growth and a $217.6 million earnings increase from -$153.0 million.

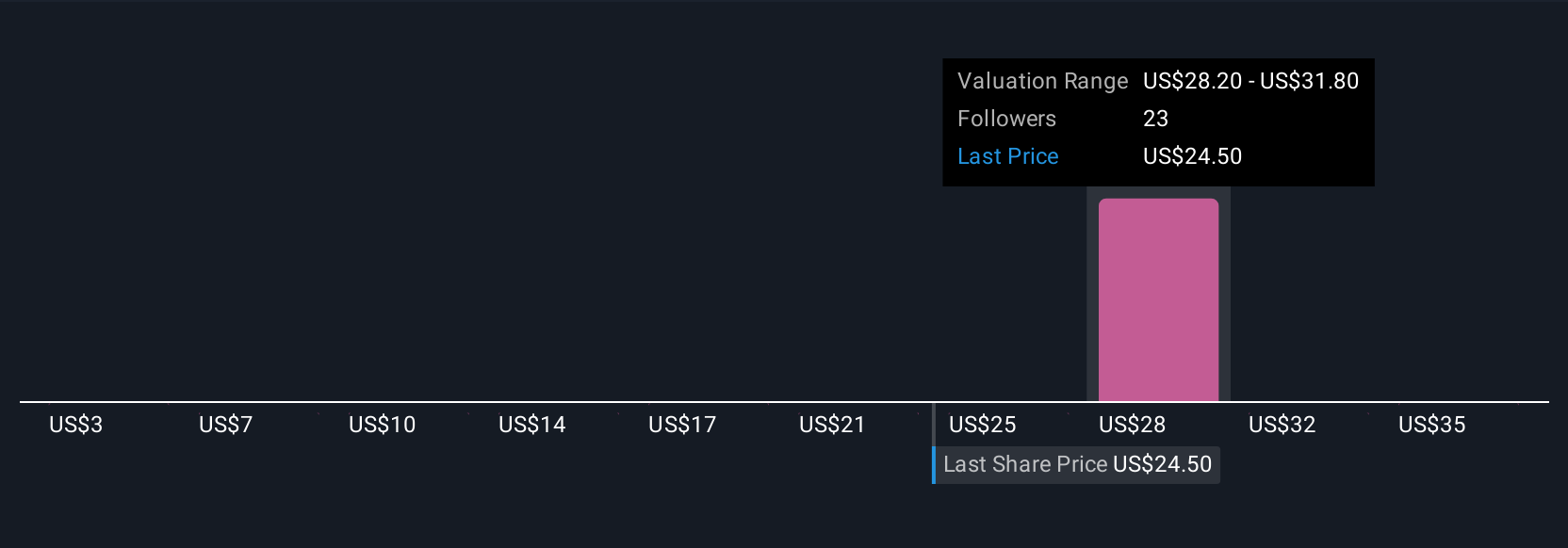

Uncover how Ultra Clean Holdings' forecasts yield a $31.25 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Five community members on Simply Wall St have issued fair value estimates for Ultra Clean Holdings, ranging from as low as US$3 to as high as US$39 per share. While these span nearly the entire current trading range, ongoing industry demand uncertainty and exposure to major customers remain key themes for future performance, so consider how your outlook compares to these diverse views.

Explore 5 other fair value estimates on Ultra Clean Holdings - why the stock might be worth less than half the current price!

Build Your Own Ultra Clean Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ultra Clean Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ultra Clean Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ultra Clean Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UCTT

Ultra Clean Holdings

Develops and supplies critical subsystems, components and parts, and ultra-high purity cleaning and analytical services for the semiconductor industry in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026