- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (NasdaqGS:TXN) Sees 10% Stock Rise Following Earnings Report Despite Lower Sales

Reviewed by Simply Wall St

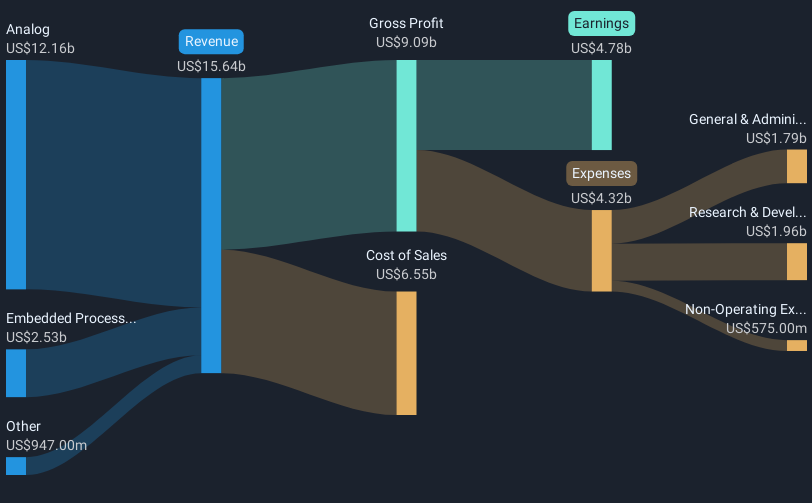

Texas Instruments (NasdaqGS:TXN) saw a 10% increase in its stock price last week, a notable rise amid a broader market decline. The catalyst for this gain could be the company's latest earnings announcement, despite reporting a decrease in both sales and net income year-over-year. The stock's positive trajectory might also be influenced by its updated share repurchase program, where significant buybacks were recently executed. Concurrently, the company's shelf registration filing adds flexibility for future capital allocation strategies, potentially enticing investors. Meanwhile, the broader market, including sectors like those involving Tesla and Nvidia, experienced a downturn, with the Nasdaq Composite index falling by 2%. This divergence suggests robust investor confidence in TXN, contrasting with the pervasive market slump. As Texas Instruments navigates its current financial landscape, its strategic financial moves continue to support its competitive stance in the tech sector.

See the full analysis report here for a deeper understanding of Texas Instruments.

Over the past five years, Texas Instruments (NasdaqGS:TXN) delivered a total shareholder return of 103.43%, combining stock price appreciation and dividends. This substantial return reflects the company's consistent efforts in enhancing shareholder value, such as through share buybacks. One significant initiative was the completion of a buyback program initiated in 2018, which saw a tranche ending in December 2024 with the repurchase of 2.75 million shares for US$543.34 million. Additionally, its robust dividend policy, including a raise in late 2024 to US$1.36 per share, underscores its commitment to returning capital to shareholders despite challenging market conditions.

Market-sensitive developments have also played a role. In December 2024, Texas Instruments secured a US$1.6 billion funding agreement under the U.S. CHIPS Act, supporting new wafer fabs in Texas and Utah. This investment highlights a forward-looking stance in expanding production capabilities, which is complemented by the introduction of new automotive chips in January 2025. These advancements support long-term growth prospects and reinforce investor confidence in the company's trajectory.

- Analyze Texas Instruments' fair value against its market price in our detailed valuation report—access it here.

- Discover the key vulnerabilities in Texas Instruments' business with our detailed risk assessment.

- Shareholder in Texas Instruments? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives