- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (NasdaqGS:TXN) Reflects Resilience With 10% Price Jump Following Shelf Registration Filing

Reviewed by Simply Wall St

Texas Instruments (NasdaqGS:TXN) saw its stock price increase by 10% last week, coinciding with the company's filing of a Shelf Registration. This development allows the tech giant to issue various securities, enhancing its flexibility for future financing and investment opportunities. While Texas Instruments experienced a notable increase, broader market trends were mixed. The Dow showed slight gains, whereas the S&P 500 and Nasdaq Composite faced declines amid a challenging rebound from a previous sell-off. These mixed results reflect varying performances within the tech sector, where Texas Instruments stood out against declines among other tech shares such as Palantir and Super Micro Computer. As the market grappled with shifting investor sentiment and data on home sales and consumer confidence, the flexibility provided by the Shelf Registration potentially presented Texas Instruments as a resilient option in an otherwise turbulent environment.

Get an in-depth perspective on Texas Instruments's performance by reading our analysis here.

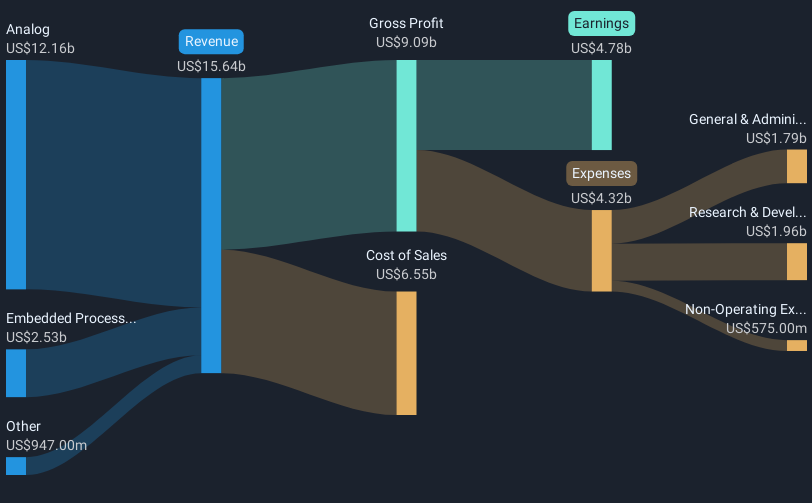

Texas Instruments' shares have delivered a total return of 95.17% over the last five years, an impressive performance driven by strategic capital management and innovative products. The company consistently increased its dividends, with recent hikes bringing the quarterly cash dividend to US$1.36 per share. Texas Instruments also executed significant share repurchases, purchasing 44.58 million shares for US$6.75 billion since 2018, showcasing its commitment to returning capital to shareholders.

Additionally, product innovation has played a critical role. The launch of new integrated automotive chips and collaborations, like the one with LeddarTech, have positioned the company at the forefront of advancements in ADAS technologies. Regulatory support, including a US$1.6 billion award through the U.S. CHIPS and Science Act, further solidified its position within the semiconductor industry. Despite a recent 26.3% decline in earnings over the past year, the company's strong track record underscores its resilience in navigating market challenges.

- Learn how Texas Instruments' intrinsic value compares to its market price with our detailed valuation report.

- Assess the potential risks impacting Texas Instruments' growth trajectory—explore our risk evaluation report.

- Are you invested in Texas Instruments already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives