- United States

- /

- Semiconductors

- /

- NasdaqGS:TSEM

Assessing Tower Semiconductor After 140% Surge and Strong Specialty Chip Demand in 2025

Reviewed by Bailey Pemberton

- Wondering if Tower Semiconductor is still a buy after its huge run, or if the easy money has already been made? You are not the only one trying to figure out whether the current price reflects its real value.

- The stock has surged recently, up 6.9% over the last week, 26.4% over the last month, and an eye catching 140.5% year to date, with a massive 391.7% gain over the past five years reshaping expectations and risk perceptions.

- These moves have been helped by continuing optimism around specialty chip demand and Tower's role as a key foundry partner in analog and mixed signal semiconductors, which investors see as structurally important niches. Strategic collaboration announcements and industry wide enthusiasm for capacity expansion have also reinforced the idea that Tower could be a long term beneficiary of secular chip demand, helping to justify, or at least explain, the strong price action.

- Despite all that momentum, Tower currently scores just 0/6 on our valuation checks. This means none of our standard metrics flag it as clearly undervalued yet. Next, we will walk through those valuation methods in detail and then, at the end of the article, look at a more nuanced way to think about what the market might really be pricing in.

Tower Semiconductor scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tower Semiconductor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth by projecting its future cash flows and discounting them back to today in dollar terms. For Tower Semiconductor, the model used is a 2 Stage Free Cash Flow to Equity approach.

Right now, Tower is burning cash, with last twelve month free cash flow of about $25.1 million outflow. Analysts expect this to increase, with free cash flow projected to reach around $164.7 million by 2027, and Simply Wall St extrapolates this further to roughly $1.43 billion in 2035, based on slowing but still strong growth assumptions.

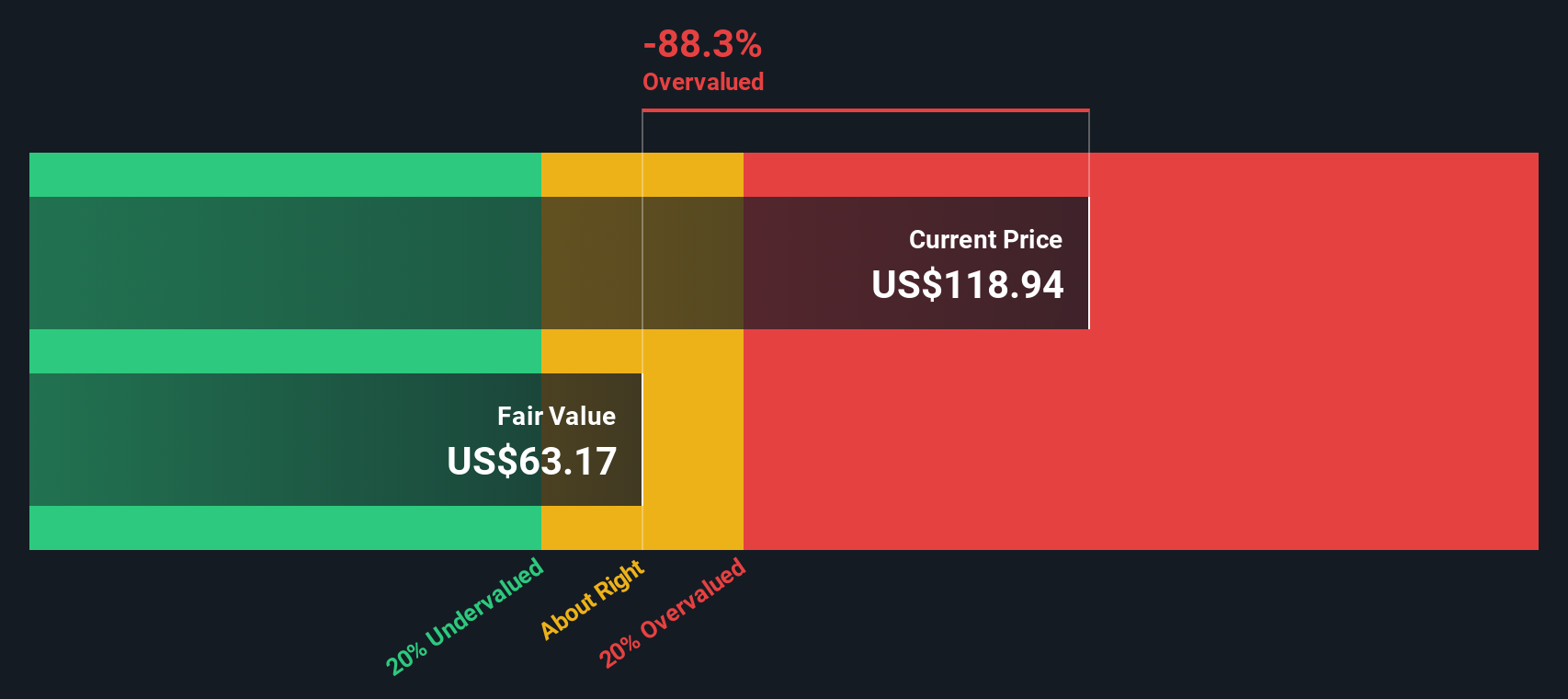

After discounting this ten-year stream of cash flows back to today, the DCF model suggests an intrinsic value of about $63.32 per share. Compared with the current share price, this implies the stock is roughly 95.8% overvalued, meaning the market price already incorporates very optimistic cash flow growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tower Semiconductor may be overvalued by 95.8%. Discover 899 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tower Semiconductor Price vs Earnings

For profitable companies, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current profit. It captures both what the business is earning today and what the market expects those earnings to do in the future.

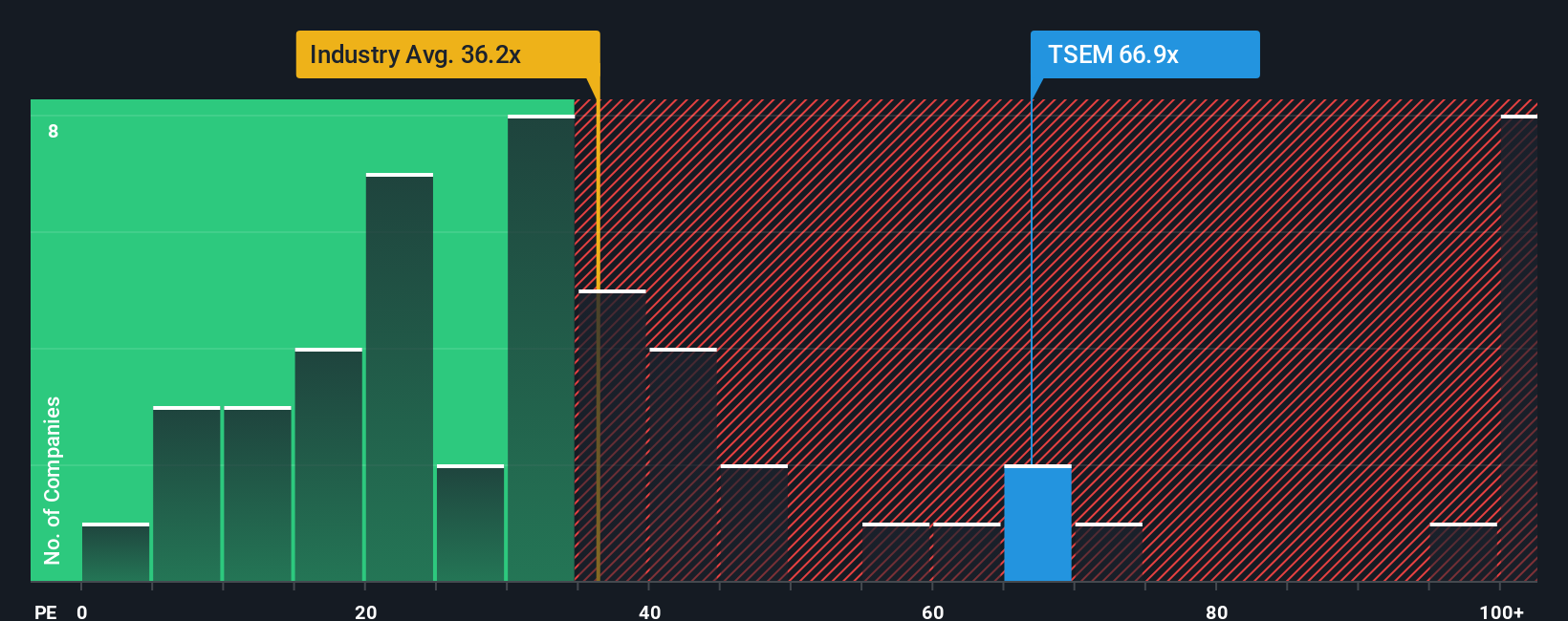

In general, faster growing, less risky companies can justify a higher PE, while slower growing or riskier companies tend to trade on lower multiples. With that in mind, Tower Semiconductor currently trades on a PE of about 71.2x, which is well above the broader Semiconductor industry average of roughly 37.9x and also higher than the peer group average of around 44.5x.

Simply Wall St also calculates a proprietary “Fair Ratio” for Tower of 46.0x. This metric goes a step beyond simple peer or industry comparisons by explicitly factoring in Tower’s earnings growth outlook, profit margins, risk profile, industry and market capitalization. Because it is tailored to the company, it should give a more nuanced sense of what a reasonable multiple might be. Comparing the current 71.2x PE with the 46.0x Fair Ratio suggests the shares are trading at a substantial premium.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tower Semiconductor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you describe your view of Tower Semiconductor’s future (its revenue growth, margins, and risks) and automatically links that story to a detailed financial forecast, a fair value, and a clear buy or sell signal by comparing that fair value with today’s share price. All of this then updates dynamically when new information such as earnings or news arrives. For example, one investor might build a bullish Narrative around accelerating RF Infrastructure and Silicon Photonics adoption that justifies a higher fair value of about $135 per share, while another more cautious investor could focus on execution, capex, and customer concentration risks to arrive at a lower fair value closer to $59 per share, with both views coexisting on the platform and giving you a transparent range of perspectives to benchmark your own decisions against.

Do you think there's more to the story for Tower Semiconductor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tower Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSEM

Tower Semiconductor

An independent semiconductor foundry, provides technology, development, and process platforms for integrated circuits in the United States, Japan, rest of Asia, and Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)