- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Could Teradyne's (TER) New AI Testing Platform Reshape Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- In early October 2025, Teradyne announced multiple major product launches, including the ETS-800 D20 for power semiconductor testing, the Titan HP platform tailored for AI and cloud infrastructure, and the UltraPHY224G for UltraFLEXplus to meet demand in silicon photonics and high-speed data centers.

- These advancements highlight Teradyne's commitment to staying ahead of innovation cycles in semiconductor testing, addressing complex requirements across AI, cloud, and emerging data market segments.

- We'll examine how the launch of the Titan HP platform for AI and cloud infrastructure could impact Teradyne's future growth outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Teradyne Investment Narrative Recap

The thesis for holding Teradyne centers on the belief that long-term demand in AI, chip manufacturing automation, and silicon photonics will fuel sustained growth, despite cyclical pressures. While the company's recent product launches reinforce its innovation credentials, near-term risks like tariffs and unpredictable trade policy remain the key variables for earnings and revenue volatility, and these news events do not materially change that calculus right now.

Among the new announcements, the Titan HP platform stands out in context of potential catalysts, as it directly targets AI and cloud infrastructure, sectors expected to drive future semiconductor test demand and possibly offset cyclical soft spots elsewhere in Teradyne's business.

However, with ongoing uncertainty in tariff policy presenting a persistent hurdle, investors should be aware that even positive catalysts…

Read the full narrative on Teradyne (it's free!)

Teradyne's outlook anticipates $4.1 billion in revenue and $952.0 million in earnings by 2028. This assumes a 13.2% annual revenue growth rate and a $482.8 million increase in earnings from the current $469.2 million.

Uncover how Teradyne's forecasts yield a $124.69 fair value, a 10% downside to its current price.

Exploring Other Perspectives

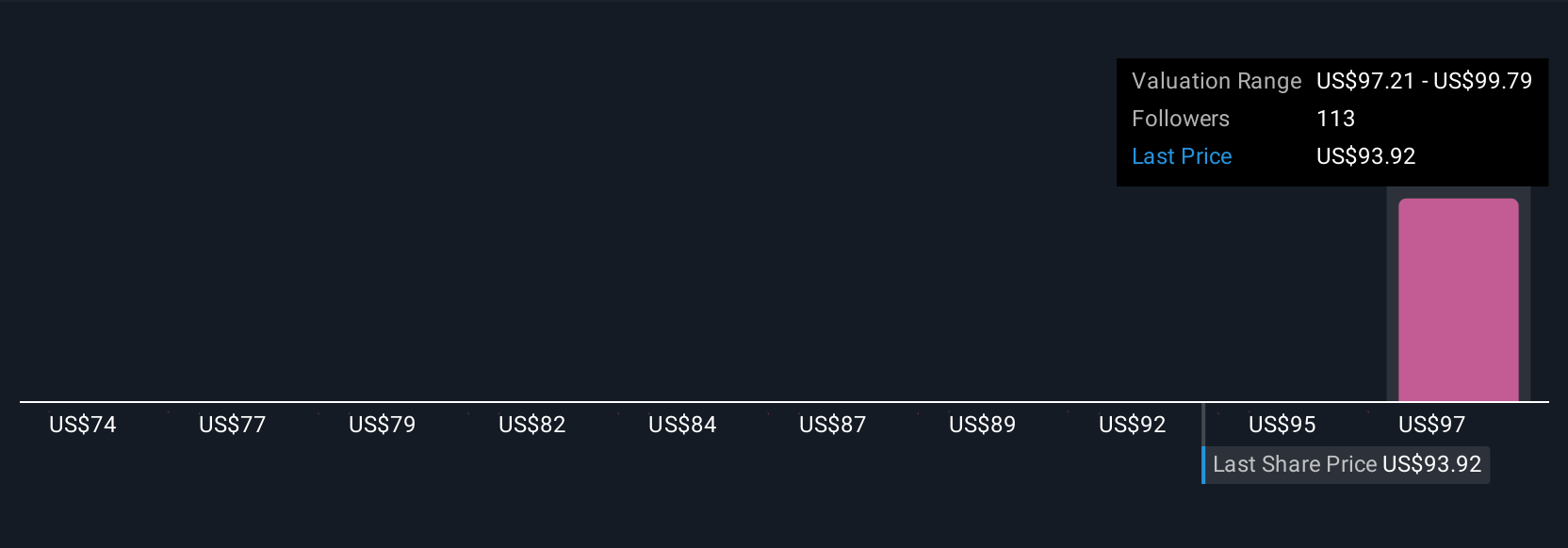

Seven Simply Wall St Community members see fair value ranging from US$74 to US$127 per share. As opinions vary, some investors focus on robust growth catalysts, while others remain cautious about profit margin pressures and external risks.

Explore 7 other fair value estimates on Teradyne - why the stock might be worth 47% less than the current price!

Build Your Own Teradyne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradyne research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Teradyne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradyne's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives