Last Update 27 Nov 25

Fair value Increased 6.99%TER: AI Semiconductor Test Complexity And Robotics Expansion Will Drive Upside Through 2027

Analysts have raised their price target for Teradyne from $172.63 to $184.69, citing accelerating demand in AI-enabled semiconductor testing, greater manufacturing complexity, and a more positive outlook in industrial automation and robotics segments.

Analyst Commentary

Recent analyst updates reflect a revealing mix of optimism about Teradyne's prospects within the AI-driven semiconductor industry, as well as measured caution regarding potential headwinds and expectations.

Bullish Takeaways- Bullish analysts have significantly increased their price targets following Teradyne's third-quarter results, with targets rising to as high as $205. This is driven by the inflection of AI-enabled semiconductor test demand and upside potential in the coming years.

- AI-related growth catalysts, such as greater testing complexity for next-generation compute and memory chips and renewed smartphone demand linked to the adoption of advanced products, are fueling expectations for accelerated revenue and earnings growth through at least 2027.

- Activity in the robotics and industrial automation segment is strengthening. This is supported by increased order momentum from major technology companies and broader warehouse automation initiatives.

- Several firm upgrades cite Teradyne's ability to gain meaningful traction with leading chipmakers. This reflects heightened industry confidence in management's execution and the likelihood of upward revisions to future earnings estimates.

- Bearish analysts remain cautious that current market optimism may be ahead of actual execution. They flag that expectations for industry-wide capital expenditure and equipment spending in 2026 could be overly high.

- While seeing near-term improvements in memory and AI compute investment, some believe the pace of orders and sales visibility may be constrained by cyclical factors or macro uncertainties impacting semiconductor fab investments.

- Certain price target hikes have been driven more by multiple expansion than by a fundamental upside in core estimates. This reflects lingering questions about the durability of demand beyond the current AI cycle.

What's in the News

- Teradyne has completed the repurchase of 10,780,000 shares, representing 6.81%, for $1,124.44 million as part of its buyback program announced in January 2023 (Buyback Tranche Update).

- Michelle Turner has been appointed as Chief Financial Officer effective November 3, 2025. She will succeed Sanjay Mehta, who will continue as an executive advisor until his retirement in 2026 (Executive Changes, CFO).

- The company has issued earnings guidance for Q4 2025, expecting revenue between $920 million and $1,000 million and GAAP net income of $1.12 to $1.39 per diluted share (Corporate Guidance, New/Confirmed).

- Teradyne launched the ETS-800 D20, a new test system designed for both high-volume and high-mix or low-volume power semiconductor device testing (Product-Related Announcements).

- Teradyne introduced the Titan HP SLT platform to support AI and cloud infrastructure markets and expanded its UltraPHY product line with the release of the UltraPHY 224G for next-generation semiconductor interface testing (Product-Related Announcements).

Valuation Changes

- Fair Value: Increased from $172.63 to $184.69, reflecting a modest upward revision in the company's projected worth.

- Discount Rate: Increased slightly from 10.39% to 10.45%, indicating a marginal increase in the risk factors incorporated in the discounting process.

- Revenue Growth: Projected to rise from 16.80% to 16.94%, showing a small improvement in anticipated top-line expansion.

- Net Profit Margin: Decreased slightly from 24.30% to 24.07%, suggesting a minor dip in expected profitability levels.

- Future P/E: Increased from 29.15x to 32.10x, indicating that the market anticipates higher future earnings multiples.

Key Takeaways

- Strategic focus on AI, robotics, and semiconductor automation aims to drive significant future revenue and net margin improvement.

- Quantifi Photonics acquisition and share buyback plan reflect confidence in earnings growth and market position strengthening.

- Geopolitical and economic factors including tariffs are causing uncertainty, potentially impacting Teradyne's revenue, margins, and financial performance across multiple segments.

Catalysts

About Teradyne- Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

- Teradyne expects significant future growth potential from AI accelerators, robotics, and semiconductor automation, which are being driven by long-term industry themes such as AI, verticalization, and electrification. These areas are likely to boost future revenue.

- The acquisition of Quantifi Photonics is anticipated to strengthen Teradyne’s position in silicon photonics testing, potentially enhancing revenue growth in semiconductor testing markets.

- Teradyne’s strategic initiatives in robotics and its recent structural reorganization aim to lower the operating breakeven, thus potentially improving net margins in the future as market conditions improve.

- The significant share buyback plan, up to $1 billion through the end of 2026, indicates confidence in future earnings and free cash flow generation, which could drive EPS growth.

- New opportunities in production board test for AI compute and new mobile testing enhancements demonstrate potential for diversification and revenue growth, particularly as demand recovers for more advanced and complex technologies.

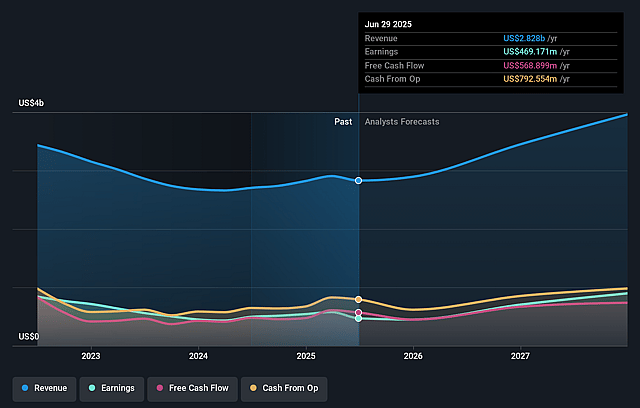

Teradyne Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Teradyne's revenue will grow by 13.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.6% today to 23.2% in 3 years time.

- Analysts expect earnings to reach $952.0 million (and earnings per share of $6.28) by about September 2028, up from $469.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $684.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, down from 39.0x today. This future PE is lower than the current PE for the US Semiconductor industry at 33.5x.

- Analysts expect the number of shares outstanding to decline by 2.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.98%, as per the Simply Wall St company report.

Teradyne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tariffs and trade policies are creating uncertainty among Teradyne's customers in the mobile, automotive, and industrial segments, potentially reducing demand and impacting future revenue projections.

- Limited visibility beyond the second quarter due to geopolitical factors might lead to unpredictability in earnings and revenue forecasts.

- Robotics revenue has declined both sequentially and year-over-year, with challenging macro conditions being a persistent headwind, potentially affecting net margins and operational outcomes.

- Fluctuating product mix and volume could lead to variations in gross margins, especially concerning future semiconductor test needs and possible shifts in demand for HBM test capacity.

- The continuity of economic factors such as tariffs and trade policy might impact not only end market demand but also cost structures, thereby affecting net profit margins and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.062 for Teradyne based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $133.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $952.0 million, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 10.0%.

- Given the current share price of $115.07, the analyst price target of $116.06 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.