Key Takeaways

- Leadership in advanced test equipment and robotics positions Teradyne for growth, revenue diversification, and margin expansion as AI adoption and automation accelerate.

- Financial strength and ongoing innovation support strategic investment, enabling increased earnings quality and shareholder returns amid shifting macroeconomic conditions.

- Over-dependence on volatile core markets, persistent geopolitical and regulatory risks, challenged diversification, customer concentration, and rising competition threaten revenue stability and long-term profitability.

Catalysts

About Teradyne- Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

- Demand for advanced test equipment is set to accelerate as the complexity and volume of AI accelerators and high-bandwidth memory devices grows, driven by ongoing investments in AI chips, data centers, and next-generation compute. Teradyne’s recent wins in AI system-level test and HBM4 performance test position it to capture higher average selling prices and market share, supporting top-line growth and margin expansion as volumes ramp in 2026 and beyond.

- The rapid adoption of connected devices across consumer, industrial, and especially automotive end-markets continues to expand the addressable market for Teradyne’s test solutions. Recent record orders in robotics from a global automotive manufacturer, alongside a strategic partnership with ADI to automate semiconductor production, signal increasing cross-divisional opportunities that should drive revenue diversification and support smoother multi-year growth trajectories.

- Teradyne’s focus on innovation in next-generation test platforms—such as system-level test solutions for complex AI and compute products and new image sensor testers for advanced mobile devices—underpins strong pricing power and high gross margins. This technological leadership is expected to sustain gross margin levels near 59 to 60 percent over the long term, driving increased earnings quality even as competitors enter the market.

- Investments in industrial automation and collaborative robotics—particularly through Universal Robots and MiR—are broadening Teradyne’s revenue streams beyond semiconductors. Enhanced organizational alignment and cost structure changes have reduced the Robotics division’s breakeven point, setting up the business to deliver improved operating leverage and significant profit upside as macroeconomic headwinds abate and automation adoption accelerates globally.

- The company’s strong balance sheet, consistent free cash flow generation, and expanded share buyback program (now targeting up to $1 billion through 2026) highlight financial flexibility, enabling ongoing strategic investment during uncertain macro conditions. This positions Teradyne to capture outsized earnings and shareholder returns as end-market demand recovers and long-term industry and secular growth drivers reassert themselves.

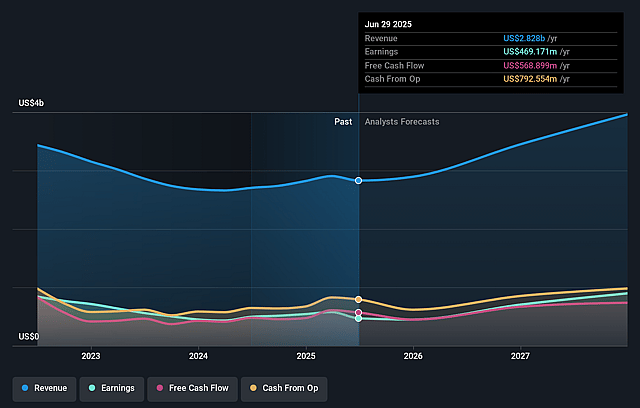

Teradyne Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Teradyne compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Teradyne's revenue will grow by 17.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 19.9% today to 24.2% in 3 years time.

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $7.1) by about July 2028, up from $577.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.3x on those 2028 earnings, down from 26.0x today. This future PE is lower than the current PE for the US Semiconductor industry at 30.9x.

- Analysts expect the number of shares outstanding to decline by 1.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.47%, as per the Simply Wall St company report.

Teradyne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Teradyne’s overreliance on cyclical, capex-driven semiconductor and electronics industries leaves it uniquely exposed to global recessions or prolonged slowdowns, which could lead to significant declines in both revenue and earnings.

- Intensifying geopolitical tensions, de-globalization, and dynamic trade policies—especially tariffs and export restrictions—are creating persistent end-market uncertainty and causing customers to push out orders, threatening near-term demand visibility and stable revenue growth.

- The company’s Robotics division remains structurally challenged, posting sequential and year-over-year revenue declines, operating losses, and requiring restructuring, raising concerns about the success of diversification efforts and the ability to achieve long-term earnings improvement outside of core Semi Test.

- Increasing customer concentration, with one customer responsible for more than 10% of revenue and significant shipments to China, puts Teradyne at risk of outsized revenue fluctuations if relationships or regulatory environments change adversely.

- Growing competition from lower-cost and Asian ATE providers, together with industry trends toward design-for-test and built-in self-test technologies, may reduce the long-term need for external test equipment and risk compressing Teradyne’s gross margins and return on invested capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Teradyne is $126.95, which represents two standard deviations above the consensus price target of $96.69. This valuation is based on what can be assumed as the expectations of Teradyne's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $133.0, and the most bearish reporting a price target of just $74.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.7 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 22.3x, assuming you use a discount rate of 9.5%.

- Given the current share price of $93.7, the bullish analyst price target of $126.95 is 26.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.