Last Update 07 May 25

Fair value Decreased 14%Key Takeaways

- Shifts in technology and increased competition threaten Teradyne's core market, putting revenue growth and profitability under pressure.

- Global risks and limited progress in diversification restrict Teradyne's ability to manage volatility and expand beyond mature markets.

- Growth in AI and advanced semiconductor markets, increased value capture from chip complexity, and strategic investments position Teradyne for strong, diversified, and resilient long-term growth.

Catalysts

About Teradyne- Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

- Teradyne's dependence on rapidly growing AI compute and cloud chip investment creates a significant risk that any slowdown or stall in AI infrastructure build-outs or a long-term deceleration in semiconductor innovation will yield sharply lower sales growth, impacting both future revenue and earnings.

- The rapid advancement of integrated testing capabilities within chip manufacturing equipment and semiconductor designs could significantly reduce industry need for standalone automated test equipment, causing long-term erosion of Teradyne's addressable market and undermining both revenue and gross margins.

- Sustained increases in geopolitical tensions, US/China trade restrictions, and expanding environmental and labor compliance requirements threaten to disrupt Teradyne's supply chain, raise operating costs, and limit global market access, compressing net margins and stalling international revenue growth.

- Expansion by low-cost Asian ATE competitors and industry consolidation will drive down pricing power, triggering commoditization and margin compression for Teradyne's core business lines over the coming years, directly eroding gross and operating margins.

- Despite investment in robotics and automation, slow or uneven progress in establishing scale and profitability in these newer segments leaves Teradyne overexposed to mature and cyclical semiconductor markets, amplifying revenue volatility and limiting future growth in both top-line and diversified earnings streams.

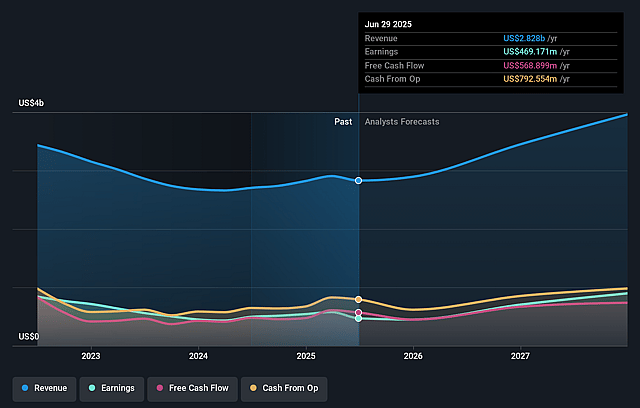

Teradyne Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Teradyne compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Teradyne's revenue will grow by 9.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 16.6% today to 20.7% in 3 years time.

- The bearish analysts expect earnings to reach $761.3 million (and earnings per share of $6.24) by about July 2028, up from $469.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, down from 36.8x today. This future PE is lower than the current PE for the US Semiconductor industry at 27.9x.

- Analysts expect the number of shares outstanding to decline by 1.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.49%, as per the Simply Wall St company report.

Teradyne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating demand for AI compute and the company's success in winning new AI SOC and Memory programs-along with ongoing penetration into the high-growth merchant GPU and hyperscaler market-could drive substantial revenue growth and share gains for Teradyne in the medium to long term, benefiting both topline and earnings.

- Ongoing advances in semiconductor packaging complexity (like 2-nanometer gate-all-around and advanced memory packaging for HBM4) mean longer test times and greater test requirements, which should allow Teradyne to capture more value per unit and sustain high gross margins as chip complexity rises.

- The company's robotics business, currently in a downturn, is set to benefit materially from a transformational large-customer win expected to ramp in 2026, alongside a successful structural reorganization and new US manufacturing, potentially driving a return to profitability and improving overall revenue diversification.

- Teradyne's investment in silicon photonics test (including its recent Quantifi Photonics acquisition) positions it to capitalize on long-term secular growth in optical interconnects and AI hardware infrastructure, providing a new engine for growth and supporting a higher-quality revenue mix in future years.

- Teradyne's supply chain resilience efforts-including geographic diversification and dual-sourcing-along with strong existing share in Chinese memory, position the company to effectively mitigate near-term geopolitical uncertainties and maintain robust international revenue and margins over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Teradyne is $74.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Teradyne's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $133.0, and the most bearish reporting a price target of just $74.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $761.3 million, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 9.5%.

- Given the current share price of $107.65, the bearish analyst price target of $74.0 is 45.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.