- United States

- /

- Semiconductors

- /

- NasdaqGS:SYNA

Is Investor Optimism Around SYNA’s Valuation Justified Amid Challenges to Its IoT Transition?

Reviewed by Sasha Jovanovic

- In recent months, Synaptics Incorporated saw a strong recovery in its share price yet remains below its highest point of the year.

- Investor attention has increased due to the stock's perceived undervaluation, even as analysts flag muted profit growth and a strained balance sheet.

- We'll explore how increased investor interest based on undervaluation interacts with Synaptics' longer-term shift toward Core IoT and Edge AI.

Find companies with promising cash flow potential yet trading below their fair value.

Synaptics Investment Narrative Recap

To be a shareholder of Synaptics today, you need to believe in the company’s shift toward Core IoT and Edge AI as a driver of future growth, despite recent financial setbacks and balance sheet strain. The recent share price recovery confirms market interest in the stock’s undervaluation, but this has not fundamentally changed the biggest short-term catalyst (accelerated adoption of new AI-native products) or the main near-term risk, which is ongoing operating losses and a stretched financial position.

Among Synaptics’ recent announcements, the Q4 and full-year earnings report stands out as most relevant; it demonstrated sustained top-line growth, but the company remained unprofitable, highlighting the importance of increasing revenue from new AI and connectivity products to support any turnaround. While sales rose, consistent net losses and cautious guidance reinforce the need for investors to watch cash flow and profitability over flashy product launches.

Yet, before deciding to act, investors should be aware that despite signs of operating improvement, Synaptics’ liabilities still exceed its available cash and short-term receivables...

Read the full narrative on Synaptics (it's free!)

Synaptics' outlook anticipates $1.4 billion in revenue and $199.2 million in earnings by 2028. This is based on an expected annual revenue growth rate of 9.6% and an increase in earnings of $247 million from current earnings of -$47.8 million.

Uncover how Synaptics' forecasts yield a $82.25 fair value, a 33% upside to its current price.

Exploring Other Perspectives

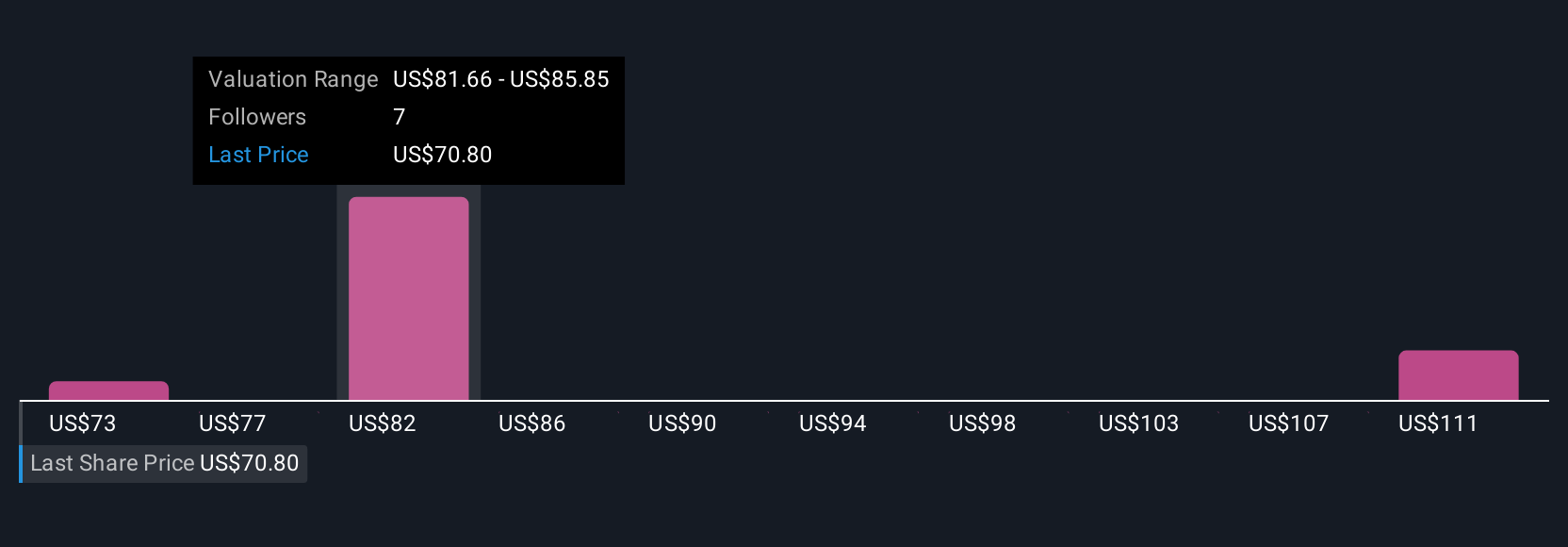

Simply Wall St Community’s three fair value estimates for Synaptics range from US$73.28 to US$113.06 per share, reflecting wide variance in individual outlooks. With persistent operating losses and balance sheet concerns highlighted by analysts, you may want to compare these differing views on potential risks and rewards.

Explore 3 other fair value estimates on Synaptics - why the stock might be worth as much as 82% more than the current price!

Build Your Own Synaptics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Synaptics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Synaptics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Synaptics' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYNA

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives