- United States

- /

- Semiconductors

- /

- NasdaqGS:SWKS

Skyworks Solutions (SWKS): Evaluating Valuation After FTSE All-World Index Removal

Reviewed by Kshitija Bhandaru

If you hold Skyworks Solutions (SWKS) or have been considering a move, their recent removal from the FTSE All-World Index has almost certainly caught your eye. When a company drops out of a major benchmark index like this, it can trigger some immediate shake-ups as institutional investors and index funds rebalance their portfolios. This isn’t just about headline risk; it puts real trading volume and price pressure in play as these portfolios adjust.

Looking at the bigger picture, this development comes after a bumpy year for Skyworks Solutions. Share prices are down over the past year, with a slide of around 12%, and the longer-term track record has had its own setbacks, including weaker five-year performance. However, there has been some pulse in the short term, with the stock climbing over 13% during the past three months. All of this adds up to a stock that is very much in flux and could be poised for a shift depending on how investors process this latest change.

With institutional flows now in the mix and recent momentum building, the big question is whether Skyworks Solutions is trading at a discount or if the market is spot-on about its prospects from here.

Most Popular Narrative: 14.5% Overvalued

The consensus among analysts is that Skyworks Solutions is trading above its estimated fair value. The current share price exceeds the fair value calculation by a notable margin.

Accelerated adoption of advanced wireless standards and AI-capable smartphones is increasing the RF content required per device. This positions Skyworks to benefit from higher average selling prices and potential unit volume growth, which could drive revenue and gross margin expansion.

What is fueling this bold valuation? It comes down to expectations for significant increases in future profits and a specific profit multiple that could reset the company’s worth. How do these ambitious projections compare to key financial targets included in the calculations analysts are using? The answers may surprise even seasoned observers.

Result: Fair Value of $72.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant customer concentration and exposure to slowing smartphone demand could quickly challenge the analysts’ upbeat outlook for Skyworks Solutions going forward.

Find out about the key risks to this Skyworks Solutions narrative.Another View: Our DCF Model Tells a Different Story

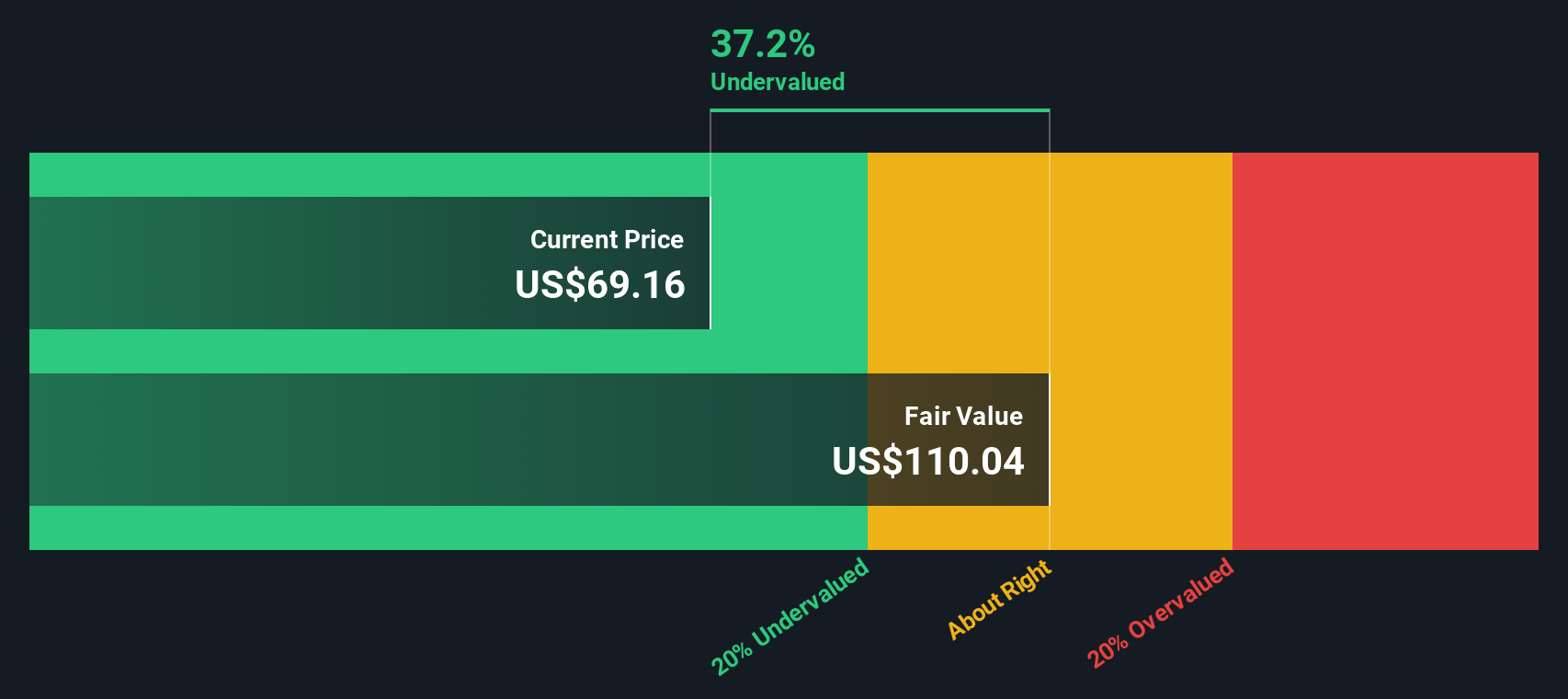

While analysts see Skyworks Solutions as richly priced based on future profit multiples, the SWS DCF model suggests the shares could be trading well below their true worth. Which method really gets it right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Skyworks Solutions Narrative

If you see the story unfolding differently or want to piece together your own take, the data is yours to analyze in just a few minutes. Do it your way

A great starting point for your Skyworks Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Hidden opportunities await in every corner of the market. Don’t stand on the sidelines while others get ahead. Expand your watchlist with these dynamic stock picks:

- Tap into future trends by scouting AI penny stocks for tech innovators capitalizing on breakthroughs in artificial intelligence.

- Lock in reliable income streams and boost your portfolio’s resilience through stocks offering dividend stocks with yields > 3% with generous yields above 3%.

- Seize potential bargains today with companies identified as undervalued stocks based on cash flows based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWKS

Skyworks Solutions

Develops, manufactures, and markets analog and mixed-signal semiconductor products and solutions in the United States, Taiwan, China, South Korea, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion