- United States

- /

- Semiconductors

- /

- NasdaqGS:SWKS

Could China’s New Mineral Export Rules Test Skyworks Solutions' (SWKS) Supply Chain Resilience?

Reviewed by Sasha Jovanovic

- Earlier this week, China introduced new export controls on critical minerals essential for high-tech manufacturing, requiring government approval for exports containing certain rare-earth materials.

- This policy change has generated widespread uncertainty about supply chain reliability and potential cost increases for companies in sensitive technology sectors, including semiconductor manufacturers.

- We'll examine how concerns about restricted access to crucial raw materials could influence Skyworks Solutions' outlook and competitive positioning.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Skyworks Solutions Investment Narrative Recap

To be a Skyworks Solutions shareholder, you need to believe in the long-term growth of RF chip content for advanced mobile devices and the company's ability to broaden its reach into new markets like automotive and IoT. However, the recent export controls from China are not a material near-term threat to Skyworks' most important catalysts, such as adoption of new wireless standards, but they add more uncertainty to the supply chain risk, the biggest immediate concern given Skyworks’ customer and segment concentration.

The company's Q3 2025 earnings announcement is particularly relevant, as it highlighted stable revenues and updated Q4 guidance despite industry headwinds. This performance suggests that, at least for now, Skyworks’ immediate growth trajectory and margin improvement opportunities, driven by new wireless technologies, remain intact, even as supply chain questions persist.

On the other hand, investors should not overlook the company’s ongoing reliance on a single major customer, since...

Read the full narrative on Skyworks Solutions (it's free!)

Skyworks Solutions is projected to generate $4.1 billion in revenue and $520.7 million in earnings by 2028. This outlook assumes a 1.0% annual revenue growth rate and a $124.5 million earnings increase from current earnings of $396.2 million.

Uncover how Skyworks Solutions' forecasts yield a $72.47 fair value, a 5% upside to its current price.

Exploring Other Perspectives

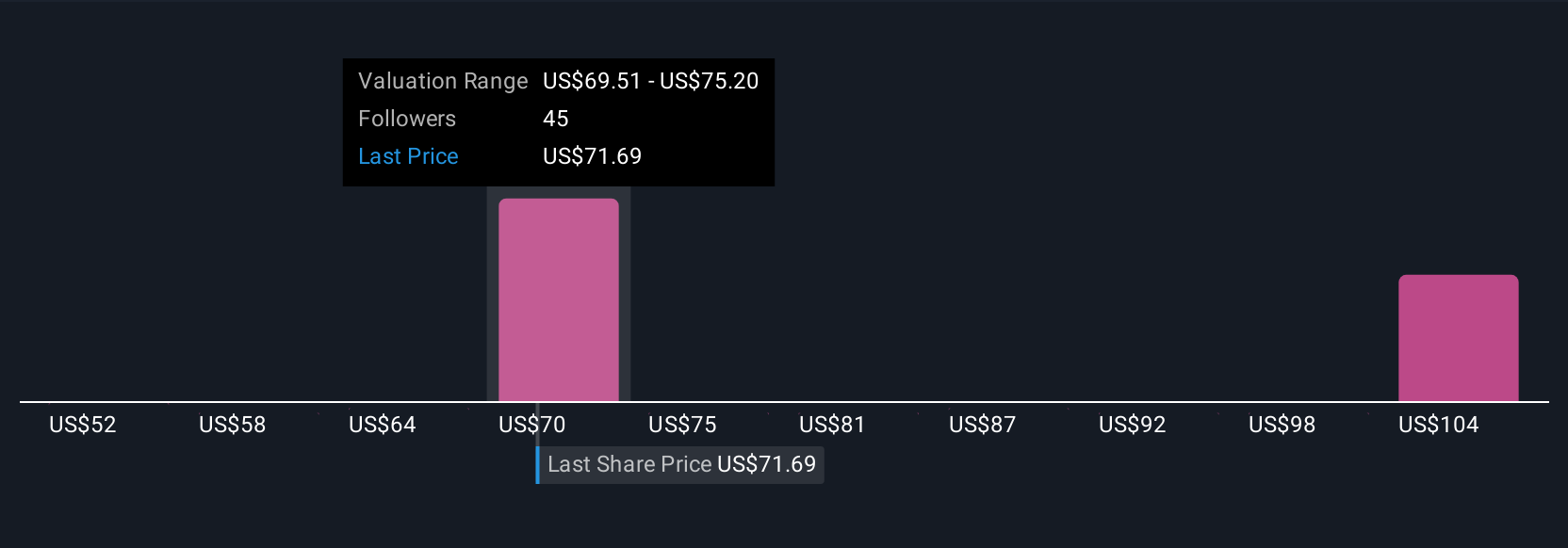

The Simply Wall St Community contributed 5 unique fair value estimates for Skyworks Solutions, ranging from US$58 to US$110.38. While opinions vary widely, many still weigh the company's exposure to a concentrated customer base as a critical risk with real implications for its future financial stability.

Explore 5 other fair value estimates on Skyworks Solutions - why the stock might be worth 16% less than the current price!

Build Your Own Skyworks Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Skyworks Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Skyworks Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Skyworks Solutions' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWKS

Skyworks Solutions

Designs, develops, manufactures, and markets semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives