- United States

- /

- Semiconductors

- /

- NasdaqGS:SMTC

Did Semtech's (SMTC) Expanded Skylo Partnership Just Redefine Its Role in Global IoT Connectivity?

Reviewed by Sasha Jovanovic

- In the past week, Semtech Corporation and Skylo unveiled an expanded partnership offering what they describe as the industry's first unified device-to-cloud terrestrial and satellite IoT solution, addressing seamless connectivity for global deployments beyond cellular range and simplifying integration for customers by consolidating vendors and certifications.

- This collaboration aims to capture a rapidly growing market for satellite IoT connectivity by combining certified device modules, multi-network SIMs, and management platforms with global reach and continuous network switching capabilities.

- Next, we'll explore how Semtech's entry into comprehensive satellite IoT solutions could reinforce its position in expanding the connectivity technology landscape.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Semtech Investment Narrative Recap

To invest in Semtech, one must believe in the accelerating adoption of advanced connectivity technologies, especially as IoT and satellite integration reshape global device networks. The expanded partnership with Skylo marks a significant step in this direction, though it does not materially change the most important short-term catalyst: strong design wins in high-margin data center solutions. The biggest current risk remains operational execution in connected services, highlighted recently by a substantial goodwill impairment.

Among recent announcements, the launch of the AirLink XR80 and XR90 Gen2 routers for public safety aligns with Semtech's focus on critical connectivity solutions. This rollout supports the catalyst of portfolio growth into high-value, recurring revenue verticals, potentially complementing ongoing momentum in cloud and telecommunications deployments. But investors should be mindful that...

Read the full narrative on Semtech (it's free!)

Semtech's narrative projects $1.3 billion revenue and $253.1 million earnings by 2028. This requires 8.5% yearly revenue growth and a $229.3 million earnings increase from $23.8 million today.

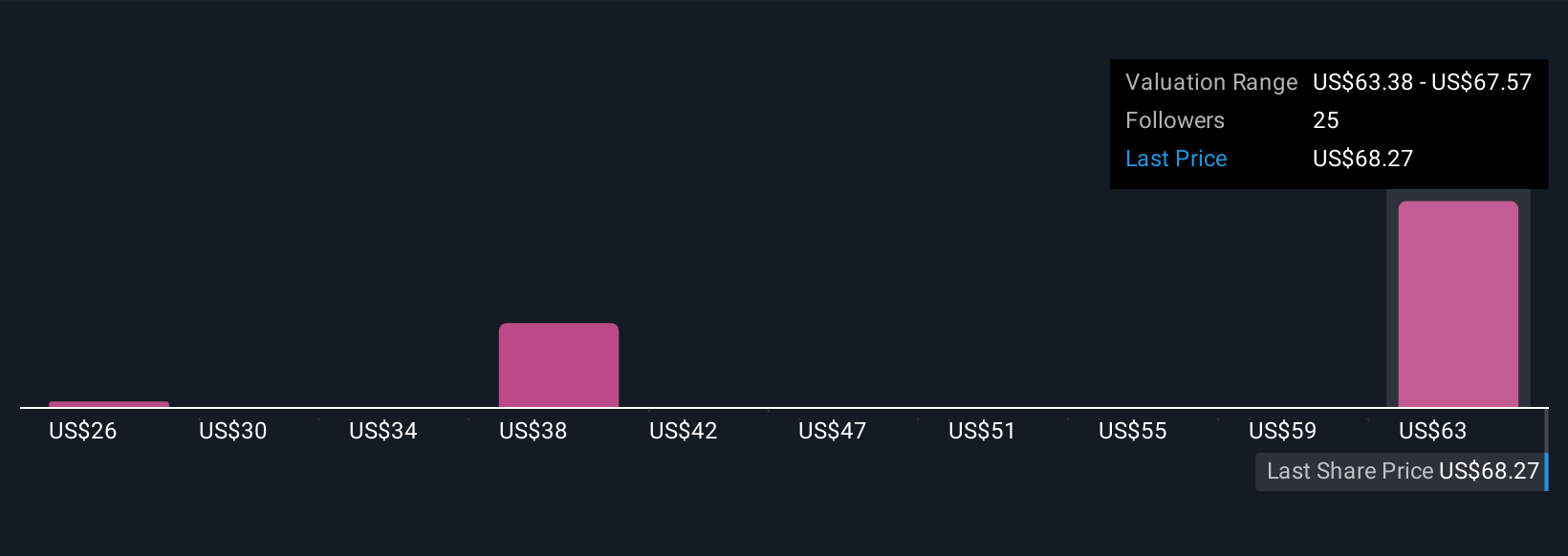

Uncover how Semtech's forecasts yield a $67.57 fair value, in line with its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community assigned fair values to Semtech shares ranging from US$25.69 to US$67.57. While many focus on IoT and data center catalysts, risks around segment profitability and position against peers mean performance outcomes could vary widely.

Explore 5 other fair value estimates on Semtech - why the stock might be worth less than half the current price!

Build Your Own Semtech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Semtech research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Semtech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Semtech's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMTC

Semtech

Provides semiconductor, Internet of Things systems, and cloud connectivity service solutions in the Asia- Pacific, North America, and Europe.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives