- United States

- /

- Semiconductors

- /

- NasdaqGS:SLAB

Silicon Labs (SLAB): Examining Valuation After Series 3 SoCs Launch and Industry-First Certifications

Reviewed by Kshitija Bhandaru

Silicon Laboratories (SLAB) rolled out its Series 3 platform at the Works With Summit, launching the SiMG301 and SiBG301 SoCs. These chips bring upgrades to compute, integration, and security. The platform is underpinned by industry-first certifications for edge protection and smart home applications.

See our latest analysis for Silicon Laboratories.

Silicon Laboratories’ latest launches have given its momentum a noticeable boost, with a one-day share price return of nearly 5% following the Series 3 announcement. The stock’s year-to-date share price return stands at almost 10%, hinting at renewed optimism among investors. A robust 19% total shareholder return over the past year suggests longer-term holders are seeing meaningful gains as well.

If the recent surge in smart-edge innovation has you curious, you might want to broaden your perspective and discover See the full list for free.

With strong gains over the past year and new products fueling investor enthusiasm, the question now is whether Silicon Laboratories’ shares still offer value, or if the latest growth story is already reflected in the price.

Most Popular Narrative: 8.7% Undervalued

Compared to Silicon Laboratories' last close price, the most cited narrative suggests the stock's fair value sits above current levels. This sets the stage for a deeper dive into the specific growth assumptions fueling the outlook.

Rapid expansion of smart home, healthcare, and industrial IoT deployments, including multiple large-scale customer production ramps and a deep design win pipeline, supports robust, multi-year revenue growth as the number of connected devices in these sectors accelerates.

Curious what’s really propelling this valuation? Behind the scenes, bold growth forecasts and ambitious profit turnaround targets drive the calculations. Want the complete playbook and to see if analyst projections really hold up? Explore the details behind this price call.

Result: Fair Value of $150.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and possible industry commoditization could pressure Silicon Labs’ margins. This could potentially challenge assumptions behind the current undervalued outlook.

Find out about the key risks to this Silicon Laboratories narrative.

Another View: What Does the SWS DCF Model Say?

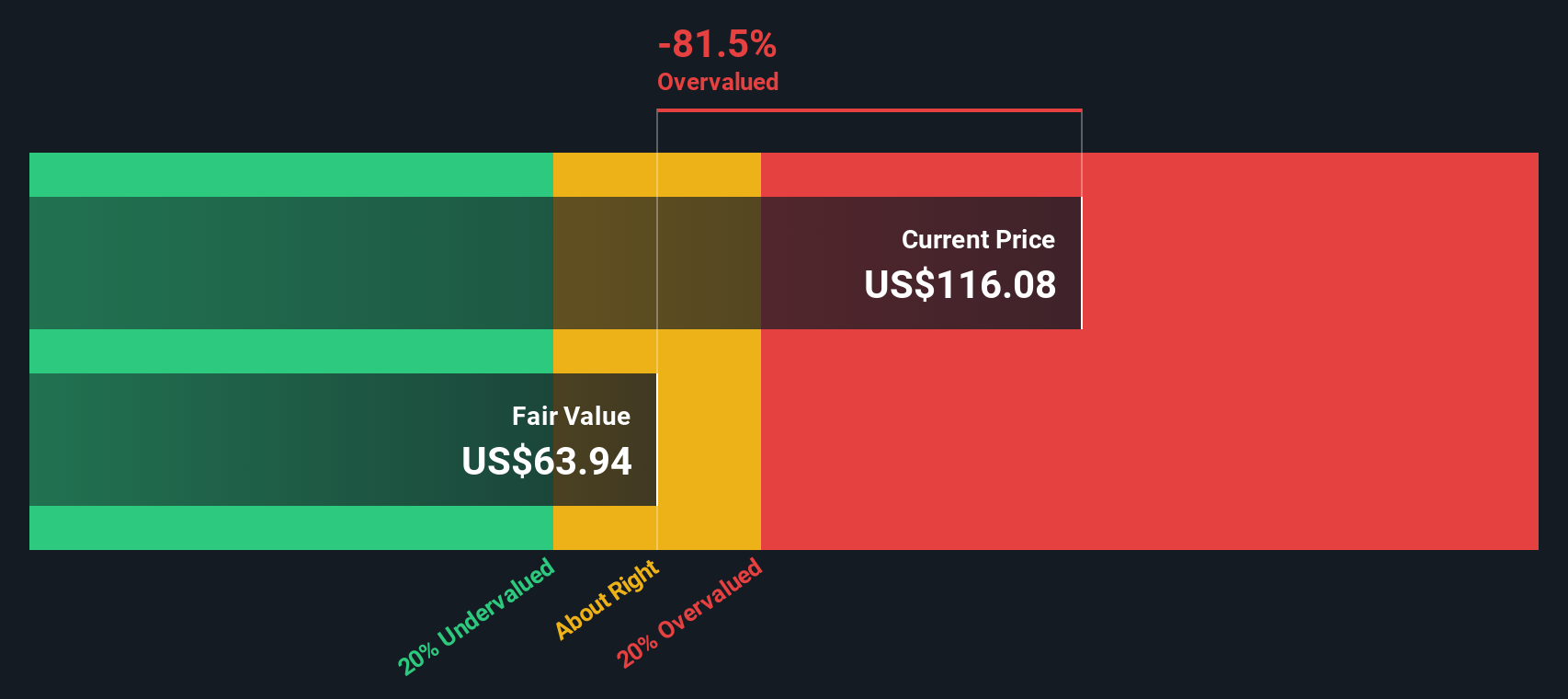

The SWS DCF model presents a contrasting picture and suggests that Silicon Laboratories could be trading above its intrinsic value. The estimated fair value of the company is $79.67, while today’s price stands at $137.29. This difference raises the question of whether the market’s optimism may be outpacing the company’s fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Silicon Laboratories Narrative

If you’d like to review the facts and shape your own story, you can examine the numbers and build a custom narrative yourself in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Silicon Laboratories.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Uncover your next potential winner by checking out these tailored stock lists, handpicked for serious growth and value seekers.

- Unearth hidden gems with solid financials and spot early potential by checking out these 3557 penny stocks with strong financials making waves in dynamic sectors.

- Tap into the future of healthcare by scanning these 33 healthcare AI stocks where AI innovation is transforming patient care and diagnostics.

- Seize standout value opportunities among these 872 undervalued stocks based on cash flows that could offer strong returns based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLAB

Silicon Laboratories

A fabless semiconductor company, provides analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)