- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti Computing (NasdaqCM:RGTI) Surges 287% With Ankaa-3 Quantum Computer Launch

Reviewed by Simply Wall St

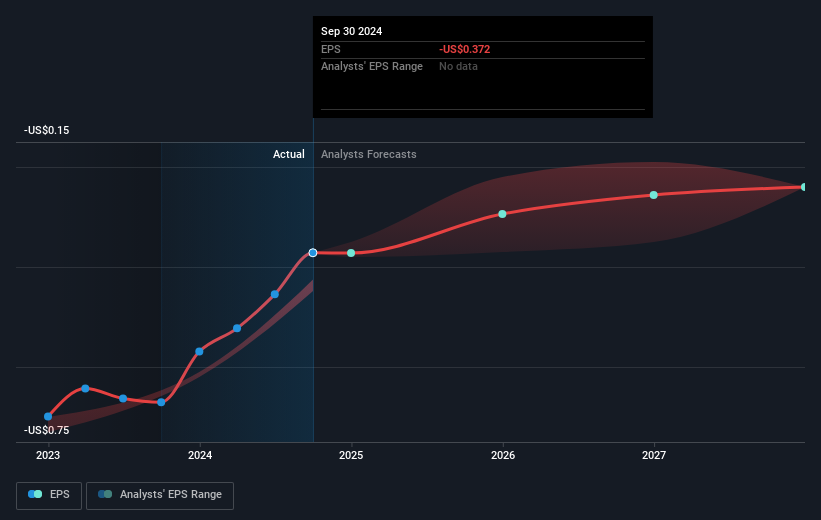

Rigetti Computing (NasdaqCM:RGTI) experienced a remarkable 287% rise in its share price last quarter, likely influenced by several key developments. The public launch of its advanced 84-qubit Ankaa-3 quantum computer demonstrated significant technological advancements and positioned the company prominently within the quantum computing sphere. The termination of a loan agreement, which cleared Rigetti's financial liabilities, improved its balance sheet, supporting investor confidence. Inclusion in the S&P Semiconductors Select Industry Index further bolstered its profile within the wider semiconductor sector. Despite market volatility with major indexes mixed and concerns over economic policies, Rigetti's decisive strides in technology and financial health stand out. This notable share price surge contrasts with the broader market, where tech stocks, including Nvidia and Tesla, faced declines amid broader economic uncertainties, highlighting Rigetti's successful strategic positioning.

Dig deeper into the specifics of Rigetti Computing here with our thorough analysis report.

Over the past year, Rigetti Computing's total return, including share price and dividends, reached 361.69%. This return significantly outpaced the US Semiconductor industry's return of 28.2% and the broader US market's return of 16.7%. Several key developments have likely contributed to the company's impressive performance. In December, the public launch of Rigetti's Ankaa-3 Quantum System marked a significant achievement, showcasing advanced technological capabilities that strengthened its position in the quantum computing sector. Further bolstering investor confidence, Rigetti was added to the S&P Semiconductors Select Industry Index in December, enhancing its visibility within the industry.

Additionally, Rigetti improved its financial flexibility by fully paying off and terminating a US$10.5 million loan agreement in December. Earlier in June, the company gained approval for a 1-for-10 reverse stock split, an effort to maintain compliance with listing requirements and potentially attract institutional investors. These strategic financial moves and technological advancements have likely propelled Rigetti’s standout performance in the market over the past year.

- Learn how Rigetti Computing's intrinsic value compares to its market price with our detailed valuation report.

- Understand the uncertainties surrounding Rigetti Computing's market positioning with our detailed risk analysis report.

- Have a stake in Rigetti Computing? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives