- United States

- /

- Semiconductors

- /

- NasdaqGS:QRVO

Qorvo (QRVO) Is Down 11.0% After China Imposes New Export Controls on Rare Earth Minerals

Reviewed by Sasha Jovanovic

- Earlier this week, China announced new export controls on critical rare-earth minerals, requiring government approval for exports of products containing these essential materials used in high-tech manufacturing such as chips and electric vehicles.

- This move underscores China's pivotal role in the global rare earth supply chain and introduces new challenges for multinational manufacturers that rely on seamless access to these inputs.

- We'll examine how heightened supply chain pressures from China's export controls could influence Qorvo's long-term growth and operational outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Qorvo Investment Narrative Recap

Qorvo’s investment case centers on capturing multi-year growth opportunities in next-gen wireless, IoT, and defense markets, while managing significant revenue concentration with a single customer. The recent Chinese export controls on rare earths could add incremental cost pressure and supply chain complexity, but they do not appear to materially impact the company’s most immediate catalyst, expanding RF content in 5G and Wi-Fi 7 devices, nor override the key short-term risk of customer concentration.

Among recent developments, Qorvo’s selection by MediaTek as a key Wi-Fi 7 module supplier best illustrates how the company is leveraging major technology rollouts, reinforcing its direct tie to the top-line catalyst. This partnership provides momentum for Qorvo’s presence in connected devices, even as macro risks and shifting supply chains remain important to monitor.

In contrast, the possibility of sudden changes in demand or supplier relationships with its top customer is something investors should pay particular attention to...

Read the full narrative on Qorvo (it's free!)

Qorvo's narrative projects $4.1 billion in revenue and $480.9 million in earnings by 2028. This requires 4.4% yearly revenue growth and a $400.1 million increase in earnings from $80.8 million today.

Uncover how Qorvo's forecasts yield a $97.29 fair value, a 17% upside to its current price.

Exploring Other Perspectives

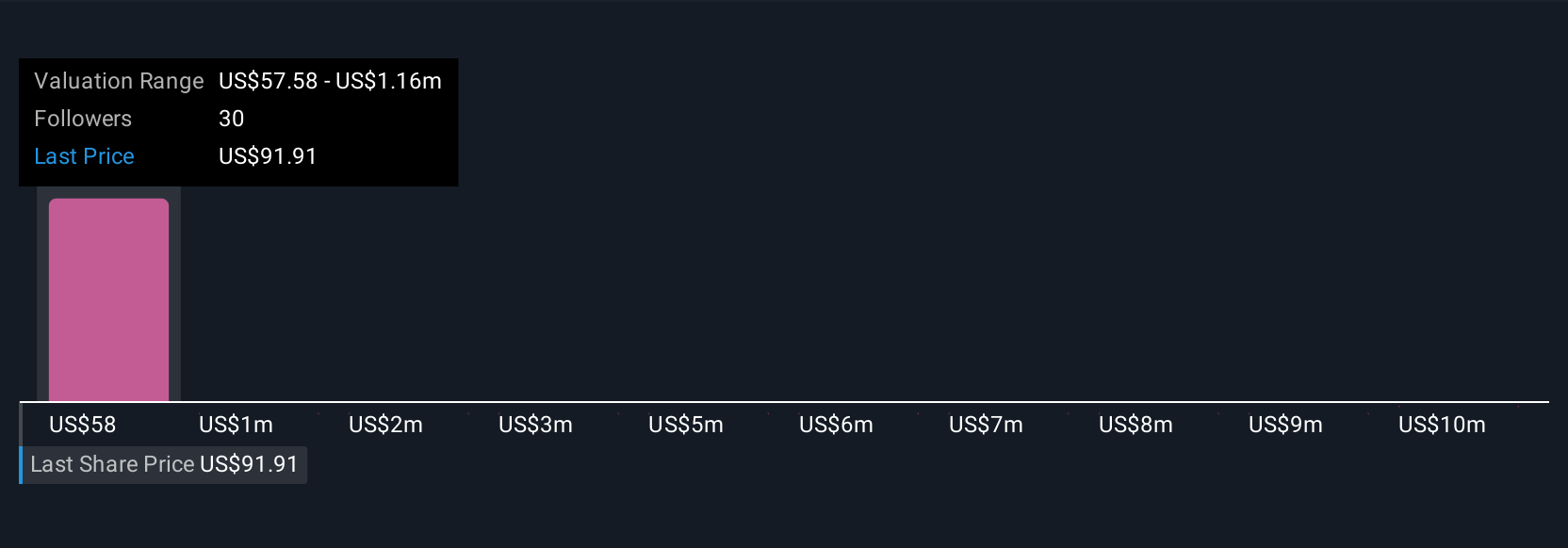

Five fair value estimates from the Simply Wall St Community range from US$57.58 to an outlier of over US$11 million. While earnings growth potential is strong, broad risks from concentrated revenue remain a key factor shaping outcomes. You can review different perspectives and see how your outlook fits in.

Explore 5 other fair value estimates on Qorvo - why the stock might be a potential multi-bagger!

Build Your Own Qorvo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qorvo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qorvo's overall financial health at a glance.

No Opportunity In Qorvo?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qorvo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QRVO

Qorvo

Engages in development and commercialization of technologies and products for wireless, wired, and power markets in the United States, China, rest of Asia, Taiwan, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives