- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

The Bull Case For QUALCOMM (QCOM) Could Change Following Board Appointment of AI Security Leader Dr. Kolter

Reviewed by Simply Wall St

- On September 2, 2025, QUALCOMM’s Board of Directors elected Dr. Jeremy (Zico) Kolter, a leading expert in AI safety and cybersecurity from Carnegie Mellon University and current Chair of OpenAI’s Safety and Security Committee, to the Board and its Governance Committee.

- Dr. Kolter’s extensive background in artificial intelligence, cybersecurity, and industry partnerships introduces specialized expertise as QUALCOMM accelerates its investments in next-generation technology initiatives.

- We’ll examine how Dr. Kolter’s AI and security credentials could reshape QUALCOMM’s investment narrative and future innovation path.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

QUALCOMM Investment Narrative Recap

QUALCOMM shareholders are typically focused on the company's ability to expand market share in advanced connectivity and AI-powered devices, while managing competition from major OEMs and global trade risks. The appointment of Dr. Jeremy Kolter to the Board introduces leading-edge AI and cybersecurity experience to the governance team, though it is unlikely to immediately alter the central catalyst of AI-driven product adoption or offset persistent competitive pressures, making the impact of this news more long-term than near-term.

Recent executive changes, like appointing Patricia Grech as Chief Accounting Officer following Neil Martin's transition to Corporate Development, highlight QUALCOMM's ongoing efforts to strengthen oversight as it pursues ambitious diversification into AI, automotive, and industrial IoT, areas that still carry the risk of delayed payoffs or integration hurdles for new ventures.

However, against this, investors should be keenly aware of escalating competition from incumbent OEMs developing in-house chips, which could...

Read the full narrative on QUALCOMM (it's free!)

QUALCOMM's narrative projects $46.9 billion revenue and $12.2 billion earnings by 2028. This requires 2.7% yearly revenue growth and a $0.6 billion earnings increase from $11.6 billion today.

Uncover how QUALCOMM's forecasts yield a $177.71 fair value, a 12% upside to its current price.

Exploring Other Perspectives

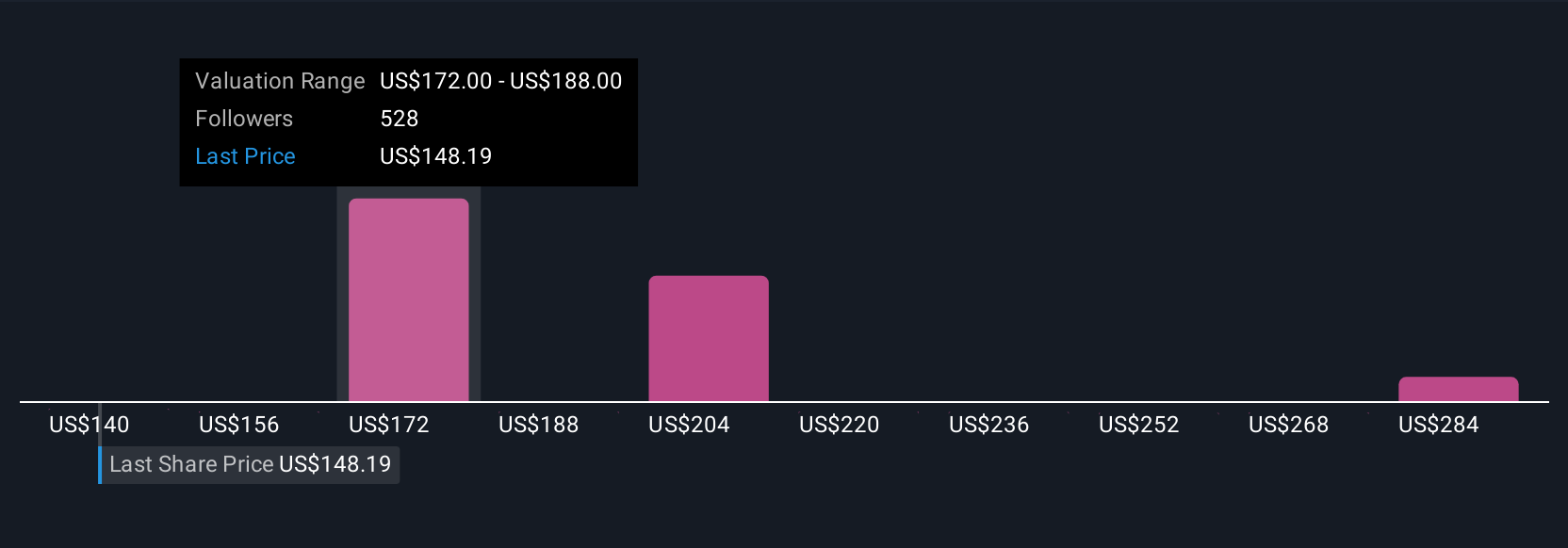

Thirty-seven members of the Simply Wall St Community have shared fair value estimates for QUALCOMM ranging from US$140 to US$300 per share. With AI adoption cited as a key growth catalyst, these wide-ranging perspectives offer a snapshot of how market participants differ in evaluating future upside and potential threats.

Explore 37 other fair value estimates on QUALCOMM - why the stock might be worth as much as 89% more than the current price!

Build Your Own QUALCOMM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QUALCOMM research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free QUALCOMM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QUALCOMM's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives