- United States

- /

- Hospitality

- /

- NasdaqCM:RAVE

US Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

As the U.S. stock market faces a challenging period, with major indices like the Dow Jones Industrial Average on track for significant weekly declines, investors are increasingly looking for opportunities that might buck broader trends. The term "penny stocks" may seem outdated, but these smaller or newer companies can still offer intriguing possibilities when they exhibit strong financial health. In this article, we'll explore several penny stocks that stand out due to their financial strength and potential for growth in today's volatile market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $132.89M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.78 | $85.54M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.44 | $47.85M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2695 | $9.57M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.20 | $156.67M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.43 | $24.83M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8696 | $79.96M | ★★★★★☆ |

| BAB (OTCPK:BABB) | $0.83 | $6.31M | ★★★★★☆ |

| Lifetime Brands (NasdaqGS:LCUT) | $4.95 | $110.78M | ★★★★★☆ |

Click here to see the full list of 713 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Rave Restaurant Group (NasdaqCM:RAVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rave Restaurant Group, Inc. operates and franchises pizza buffet, delivery/carry-out, express restaurants, and ghost kitchens under the Pizza Inn and Pie Five trademarks in the United States and internationally, with a market cap of $38.40 million.

Operations: Rave Restaurant Group generates revenue primarily through its Pizza Inn Franchising segment with $10.68 million and Pie Five Franchising segment with $1.46 million.

Market Cap: $38.4M

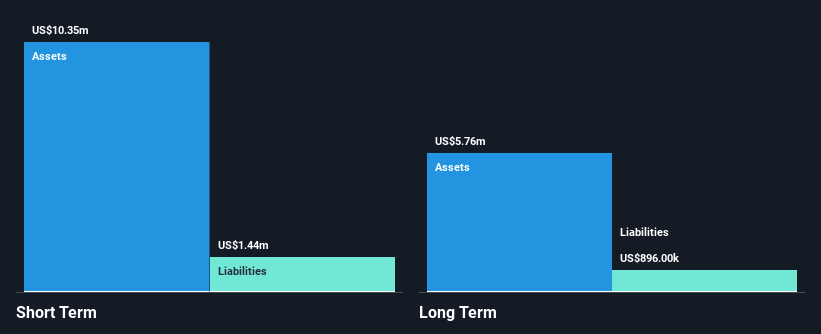

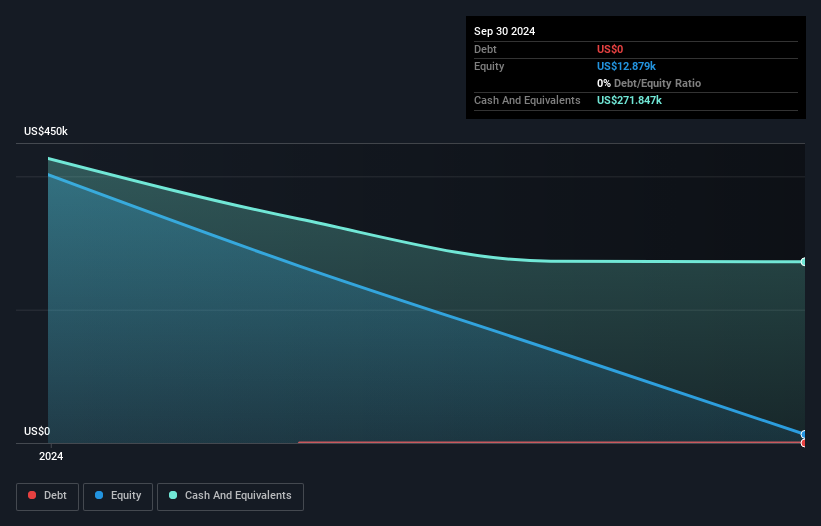

Rave Restaurant Group, with a market cap of US$38.40 million, has shown resilience in the penny stock realm by maintaining profitability and demonstrating revenue growth. Recent earnings for the second quarter ended December 29, 2024, reported sales of US$2.87 million and net income of US$0.607 million. The company benefits from strong short-term asset coverage over liabilities and operates debt-free, enhancing its financial stability. However, while Rave's management team lacks experience with an average tenure under one year, its board is seasoned with an average tenure of 19.3 years, offering governance stability amidst operational changes.

- Navigate through the intricacies of Rave Restaurant Group with our comprehensive balance sheet health report here.

- Gain insights into Rave Restaurant Group's historical outcomes by reviewing our past performance report.

Bowen Acquisition (NasdaqGM:BOWN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bowen Acquisition Corp, with a market cap of $37.86 million, does not have significant operations.

Operations: Bowen Acquisition Corp does not report any revenue segments.

Market Cap: $37.86M

Bowen Acquisition Corp, with a market cap of US$37.86 million, is pre-revenue and operates without significant debt, which can be appealing in the penny stock landscape. The company has recently secured US$5 million through a private placement with Qianzhi Group Holding (Cayman) Limited. Despite its lack of meaningful operations or revenue segments, Bowen's short-term assets exceed its short-term liabilities. However, its long-term liabilities remain uncovered by current assets. The company's stock has experienced high volatility recently and management experience data is insufficient to assess leadership stability fully.

- Unlock comprehensive insights into our analysis of Bowen Acquisition stock in this financial health report.

- Assess Bowen Acquisition's previous results with our detailed historical performance reports.

Pixelworks (NasdaqGM:PXLW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pixelworks, Inc. develops and markets semiconductor and software solutions for mobile, home and enterprise, and cinema markets across the United States, Japan, China, Taiwan, Korea, and Europe with a market cap of approximately $50.43 million.

Operations: The company's revenue primarily comes from the design, development, marketing, and sale of IC solutions, totaling $43.21 million.

Market Cap: $50.43M

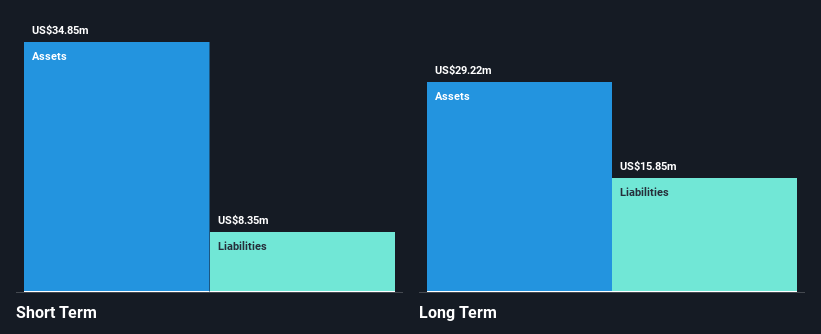

Pixelworks, Inc. operates without debt and maintains a cash runway exceeding one year, but remains unprofitable with increasing losses over the past five years. Recent earnings reports show declining revenue, with Q4 2024 sales at US$9.09 million compared to US$20.07 million the previous year and an annual net loss of US$28.72 million, up from US$26.18 million in 2023. Despite its challenges, Pixelworks' short-term assets cover both short- and long-term liabilities comfortably, while analysts anticipate significant stock price growth potential of 90.4%, suggesting possible investor interest in this volatile penny stock environment.

- Click here and access our complete financial health analysis report to understand the dynamics of Pixelworks.

- Learn about Pixelworks' future growth trajectory here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 713 US Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RAVE

Rave Restaurant Group

Through its subsidiaries, engages in the operation and franchising of pizza buffet, delivery and carry-out, express restaurants, and ghost kitchens under the Pizza Inn and Pie Five trademarks in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives