- United States

- /

- Semiconductors

- /

- NasdaqGS:PLAB

Photronics (PLAB) Valuation in Focus After Strong Q3 Earnings and Robust Balance Sheet

Reviewed by Kshitija Bhandaru

Photronics (PLAB) just posted its third-quarter earnings, surprising the market by coming in ahead of forecasts on both profit and sales. Investors are taking note, especially given the company's solid balance sheet and ongoing share buyback program.

See our latest analysis for Photronics.

Photronics' strong quarter comes after a stretch of volatility, with the share price falling 9.05% in a single day but still delivering a 13.88% gain over the past three months. While the 12-month total shareholder return is down 9.61%, the stock’s five-year total return has more than doubled. This reflects long-term value for investors who weathered the ups and downs.

If you’re tracking leadership moves or earnings beats like Photronics', it might be the right moment to broaden your search and discover fast growing stocks with high insider ownership

The real question investors now face, with shares still trading far below analyst price targets, is whether Photronics is currently undervalued or if the market is already pricing in all of its growth prospects.

Most Popular Narrative: 33.9% Undervalued

According to the most popular narrative, Photronics' fair value sits well above the recent share price, putting the spotlight on what is driving analyst conviction. Here is the central catalyst underpinning that narrative:

Ongoing and planned technological upgrades in Asia (extension to 6nm and 8nm nodes) enable Photronics to participate in next-generation chip production for edge AI, automotive, and communications, creating new high-value growth streams and potential revenue share gains as industry complexity increases.

The real factors moving this valuation? A forward-looking growth story that hinges on future-ready manufacturing, ambitious project rollouts, and a bold margin trajectory. Ever wonder what key financial projections are fueling that fair value and why analysts see a big upside? The full narrative reveals what sets Photronics apart from the average chipmaker.

Result: Fair Value of $33.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions in Asia or unexpected slowdowns in advanced node adoption could quickly undermine the bullish outlook that analysts currently project.

Find out about the key risks to this Photronics narrative.

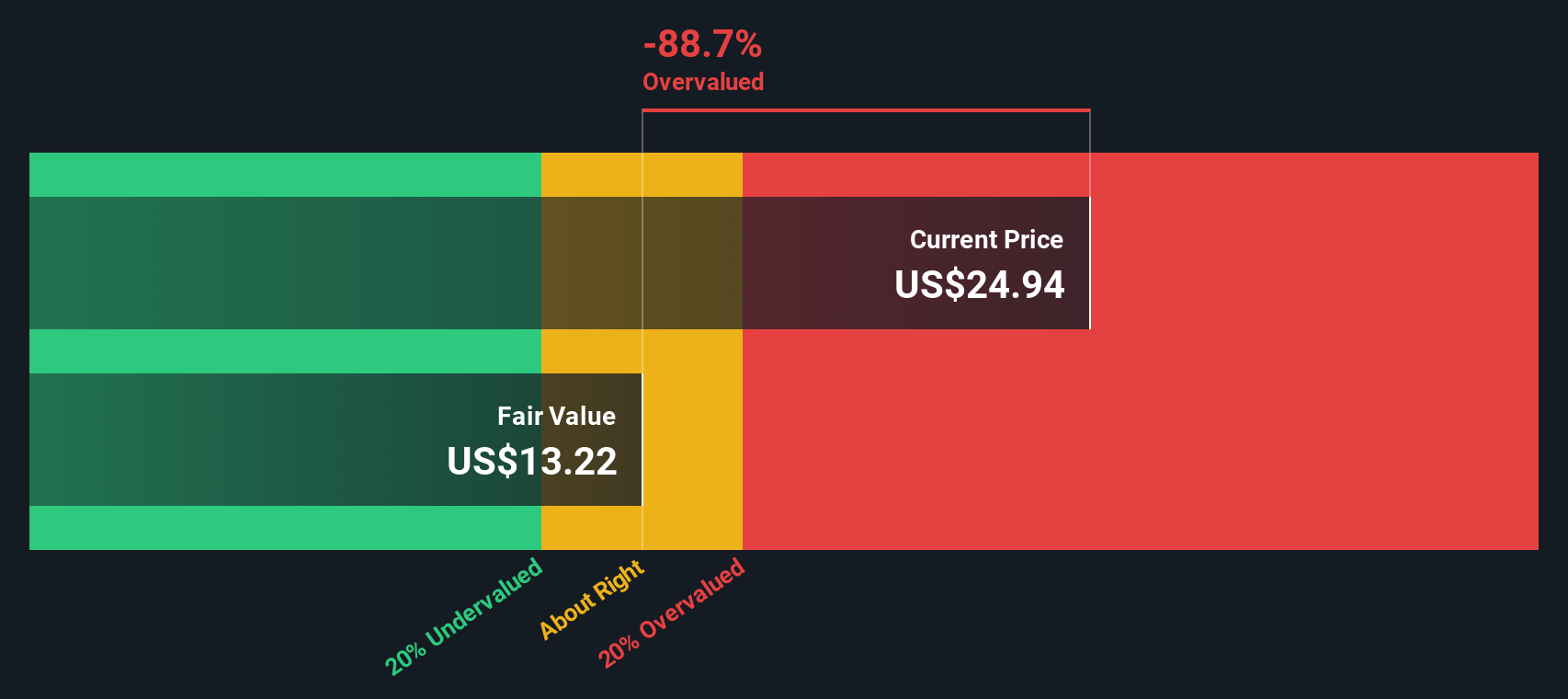

Another Perspective: SWS DCF Model Signals a Different Fair Value

While analysts argue that Photronics is significantly undervalued based on its future earnings power, the SWS DCF model takes a more conservative approach. According to this method, Photronics is currently trading above its estimated fair value, which suggests that the market may be more cautious about long-term cash flow risks. Could this mean the upside is already priced in for now?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Photronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Photronics Narrative

If you think there is more to the story or want to examine the numbers yourself, building your own view takes just a few minutes, so Do it your way.

A great starting point for your Photronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop hunting for tomorrow’s winners. Don’t limit your portfolio to just one story. Seize the edge with these unique strategies only available at your fingertips:

- Boost your search for the next surge by targeting high-yield opportunities through these 19 dividend stocks with yields > 3% with reliable payouts above 3%.

- Capitalize on the artificial intelligence boom by examining these 25 AI penny stocks positioned at the cutting edge of future tech growth.

- Supercharge your gains by tracking undervalued plays using these 897 undervalued stocks based on cash flows based on companies’ actual cash flows, not the hype.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLAB

Photronics

Engages in the manufacture and sale of photomask products and services in the United States, Taiwan, China, Korea, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives