- United States

- /

- Semiconductors

- /

- NasdaqGS:PLAB

Photronics (PLAB) Margin Compression Tests Bullish Long‑Term Earnings Narrative

Reviewed by Simply Wall St

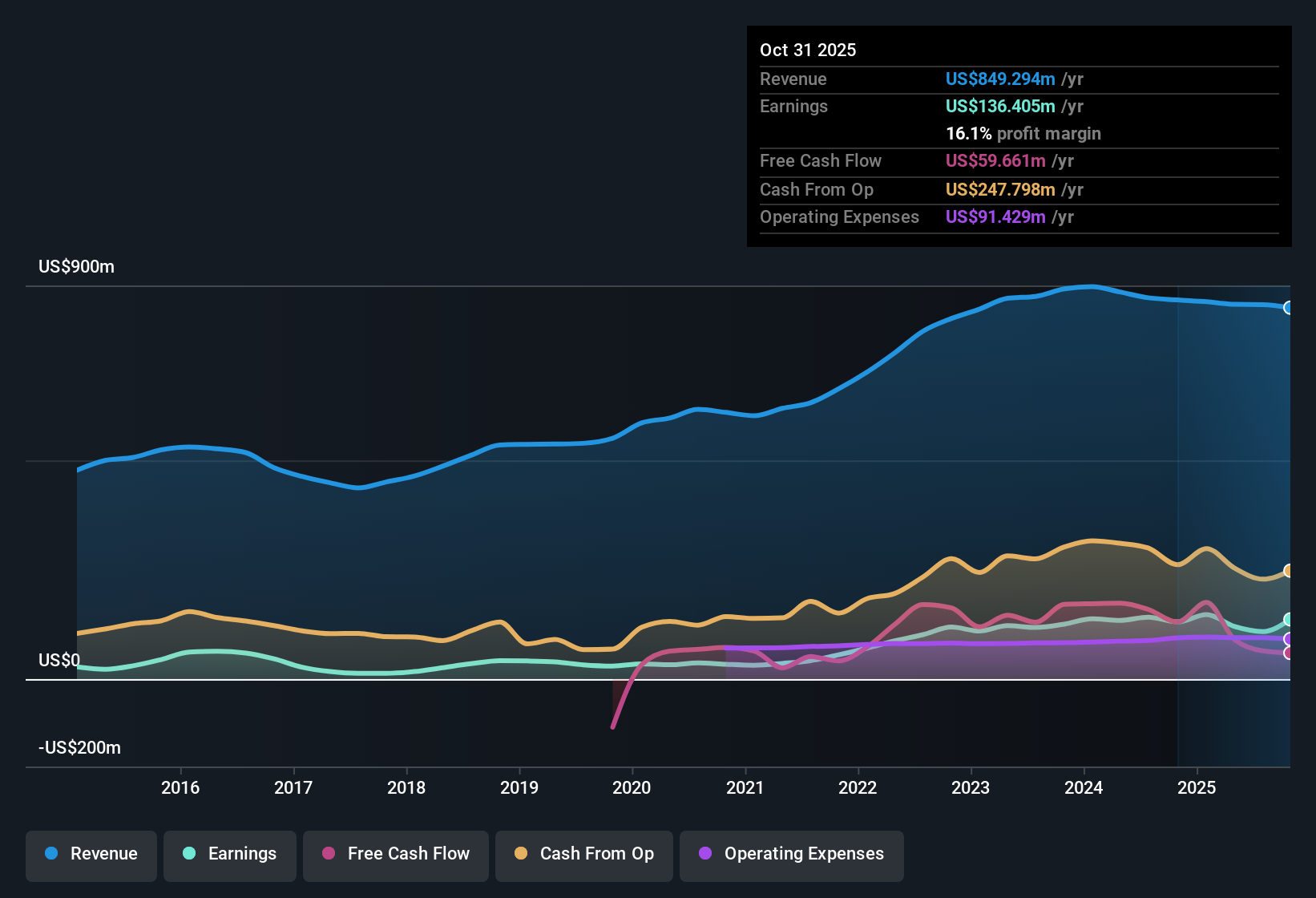

Photronics (PLAB) just turned in a mixed set of FY 2025 third quarter numbers, with revenue of about $210.4 million and EPS of $0.40, while trailing 12 month revenue sits around $856.2 million and EPS at $1.79 as margins have come under pressure from the prior year. The company has seen quarterly revenue hover in a tight band between roughly $211 million and $223 million over the last six reported periods, with EPS ranging from $0.15 to $0.69, which sets the stage for investors to focus squarely on how sustainable current profitability really is.

See our full analysis for Photronics.With the latest print on the table, the next step is to see how these margin trends line up against the prevailing narratives around Photronics's growth, resilience, and risk profile.

See what the community is saying about Photronics

Margins Slip to 12.7 percent Despite Steady Sales

- On a trailing 12 month basis, net profit margin is 12.7 percent, down from 16.2 percent a year earlier, even though revenue over that window has stayed roughly flat at around $856 million to $872 million.

- Consensus narrative talks up future margin expansion from 12.7 percent to 13.8 percent, yet the recent move from 16.2 percent to 12.7 percent highlights that current profitability is running below where the long term investment case expects it to be.

- This gap between recent margin compression and the projected improvement means investors are effectively betting that operational discipline and tech upgrades will eventually reverse the current squeeze.

- Until margins move back closer to the mid teens, the story is more about execution catching up to those margin ambitions than about margins already reflecting that consensus view.

EPS Growth Record Meets Softer Recent Profits

- Over the last five years, earnings have grown 23.6 percent per year, but over the most recent year trailing net income is $108.5 million versus prior trailing numbers as high as about $147.4 million, showing that recent performance is weaker than the long term trend.

- Bulls point to capacity expansion and advanced-node exposure as long term earnings drivers, but the step down from trailing net income of roughly $141.4 million to $108.5 million means the current base the bullish story relies on is lower than it was a year ago.

- Consensus expects earnings to reach $131.6 million by about 2028, which would be an increase from $108.5 million today, so recent softness leaves more ground to make up.

- If that catch up in earnings does not materialize, the strong 23.6 percent historical EPS growth rate would look less like an ongoing trend and more like a high water mark.

Valuation Discount vs DCF and Insider Selling

- The stock trades on a trailing P E of 20.3 times, below the US Semiconductor average of 37.9 times and peer average of 48.6 times, yet still above the DCF fair value of $27.41 with the current share price at $37.35.

- Bears focus on the combination of margin compression, the share price sitting above the $27.41 DCF fair value, and notable recent insider selling, arguing that even this discounted P E leaves limited protection if profitability stays at today’s lower level.

- With net margin at 12.7 percent compared with 16.2 percent a year earlier, skeptics see the lower multiple as compensation for weaker profitability rather than a clear bargain.

- Short term share price volatility and insiders selling into that move add weight to the cautious view that the market is still testing how much these margins and earnings are really worth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Photronics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a moment to test your view against the full dataset, shape it into a concise narrative, then share it with the community: Do it your way

A great starting point for your Photronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Photronics's compressed margins, softer recent earnings, and a share price sitting above DCF fair value raise questions about how much downside protection investors really have.

If paying up for uncertainty on profits and valuation feels risky, use our these 905 undervalued stocks based on cash flows to quickly shift your focus toward candidates where price more clearly compensates for earnings and margin risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLAB

Photronics

Engages in the manufacture and sale of photomask products and services in the United States, Taiwan, China, Korea, Europe, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion