- United States

- /

- Semiconductors

- /

- NasdaqGS:PLAB

Photronics (PLAB): Assessing Valuation Following Expanded Share Buyback and Recent Earnings Update

Reviewed by Simply Wall St

If you are following Photronics (PLAB), this week’s updates might give you pause or prompt excitement about what comes next. The company just finished a sizable portion of its ongoing share buyback, and management promptly raised the total authorized amount for repurchases. At the same time, the latest earnings numbers showed a dip compared to last year, which adds a little intrigue to the mix. For investors weighing the headlines, these moves suggest Photronics wants to reassure shareholders even as the underlying business faces near-term challenges.

Stepping back, this buyback announcement comes right after Photronics’ quarterly results revealed both sales and net income ticking down from the year before. Yet despite the earnings slowdown, Photronics stock has climbed 22% in the past month and 22% over the past three months, showing strong momentum compared to its more muted 2% one-year return. The company’s consistent reinvestment in itself, combined with the renewed buyback push, stands out against the backdrop of solid long-term earnings growth and no dividend payouts to shareholders.

So after this year’s ride for Photronics, is the market pricing in all the company’s future growth, or could the buyback signal an undervalued stock worth a closer look?

Most Popular Narrative: 31% Undervalued

The most widely followed narrative sees Photronics as significantly undervalued, suggesting current prices do not fully recognize the company’s future earnings potential.

Strategic investments in U.S. capacity and cutting-edge production, multi-beam mask writer and Texas facility expansion position Photronics to benefit as major semiconductor fabrication and reshoring initiatives are realized. This supports future revenue growth and margin expansion.

Want to know the secrets fueling this bullish outlook? The analysts behind this valuation are betting on a string of upgrades and ambitious earnings forecasts to justify that gap between price and fair value. Curious about which growth numbers they're banking on or how margin gains could tilt the equation? With potential upside this big, the underlying calculations might surprise you.

Result: Fair Value of $33.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing trade restrictions and heavy capital spending could challenge Photronics’ growth. This raises questions about how quickly its bullish story plays out.

Find out about the key risks to this Photronics narrative.Another View: SWS DCF Model Suggests a Different Story

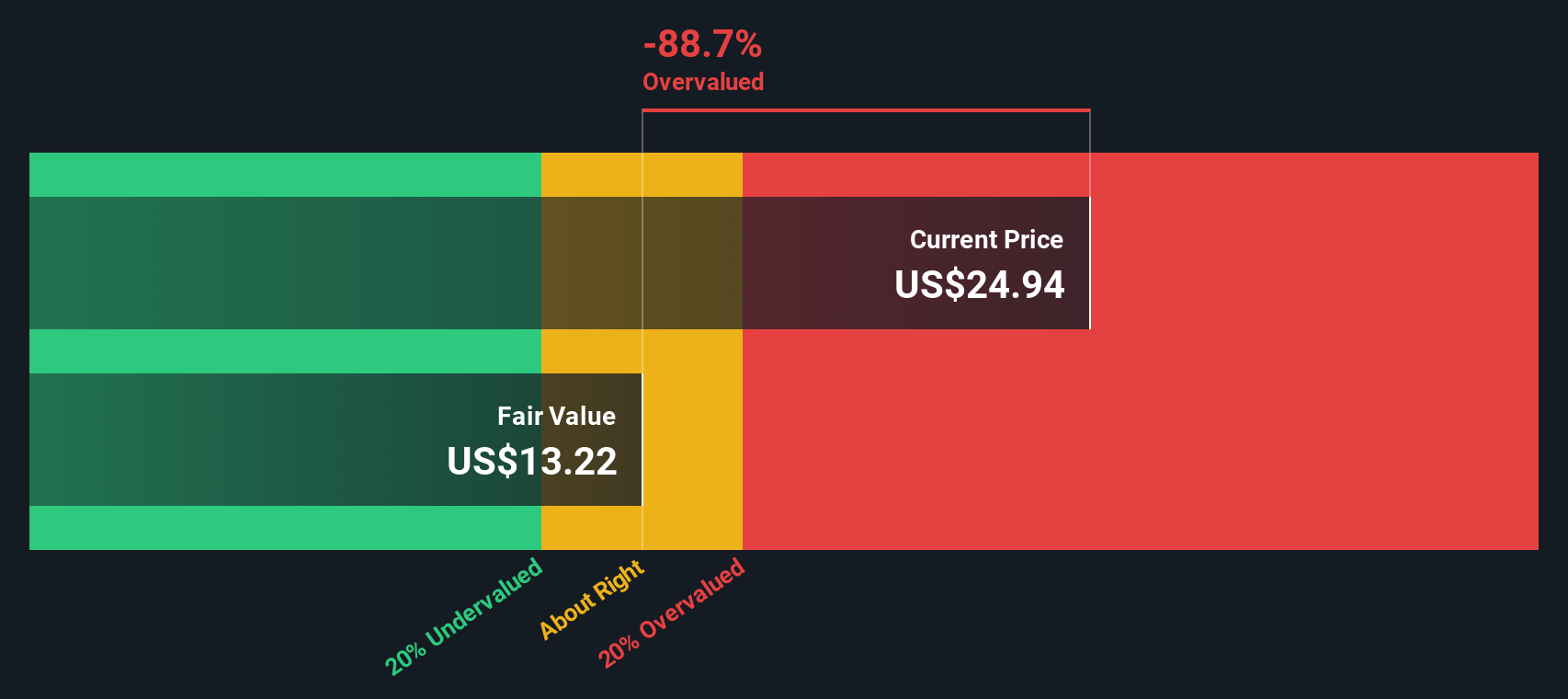

While analysts see Photronics as undervalued based on company forecasts and future potential, our SWS DCF model comes to a different conclusion. The model indicates the stock is actually overvalued according to its cash flow fundamentals. Could the DCF model be missing the big moves ahead, or are forecasts painting too optimistic a picture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Photronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Photronics Narrative

If you think there’s a different angle to the Photronics story or want to dig into the data firsthand, you can quickly craft your own take in just a few minutes. Do it your way

A great starting point for your Photronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait on the sidelines while others uncover smarter stock picks. Let the right screeners open doors to exciting new opportunities for your portfolio.

- Spot rising small-cap companies making waves in their industries by using the penny stocks with strong financials.

- Tap into powerful trends by finding digital assets and businesses pushing the future of finance with the cryptocurrency and blockchain stocks.

- Zero in on high-potential stocks that could be trading below their true worth through the undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:PLAB

Photronics

Engages in the manufacture and sale of photomask products and services in the United States, Taiwan, China, Korea, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)