- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

What Impinj (PI)'s Analyst Upgrades and Global Grocery Pilots Mean for Shareholders

Reviewed by Sasha Jovanovic

- In recent days, Impinj received strong endorsements from major financial firms as Barclays initiated coverage with a positive rating and Cantor Fitzgerald issued an optimistic update, citing growing demand for the company’s RFID technologies.

- This heightened analyst attention coincided with news of Impinj’s multiple large-scale technology pilots for global grocers, reflecting the company’s rising prominence within the broader AI and RFID sectors.

- We'll look at how increased analyst optimism and focus on enterprise pilots may influence Impinj’s future investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Impinj Investment Narrative Recap

To be a shareholder in Impinj, one must believe in the long-term adoption of RFID technology, particularly in high-growth sectors like food traceability and retail logistics. While the recent analyst endorsements have fueled optimism, the most important near-term catalyst remains the potential conversion of large-scale food pilot programs into full-scale deployments; analyst sentiment alone does not materially shift this fundamental risk, as delays or low adoption could directly impact growth projections and revenue stability.

Of the latest company news, the announcement confirming multiple large-scale RFID pilots with leading global grocers is particularly relevant. These pilots demonstrate Impinj’s ability to secure enterprise interest, but the true investment catalyst will be the pace and scale at which these pilots transition to revenue-generating rollouts, supporting confidence in future growth narratives.

However, despite this momentum, investors should not overlook the potential headwinds posed by supply chain disruptions and customer concentration risk if enterprise pilots stall...

Read the full narrative on Impinj (it's free!)

Impinj's narrative projects $630.4 million revenue and $91.2 million earnings by 2028. This requires 20.6% yearly revenue growth and a $90.6 million earnings increase from $633.0 thousand today.

Uncover how Impinj's forecasts yield a $184.00 fair value, in line with its current price.

Exploring Other Perspectives

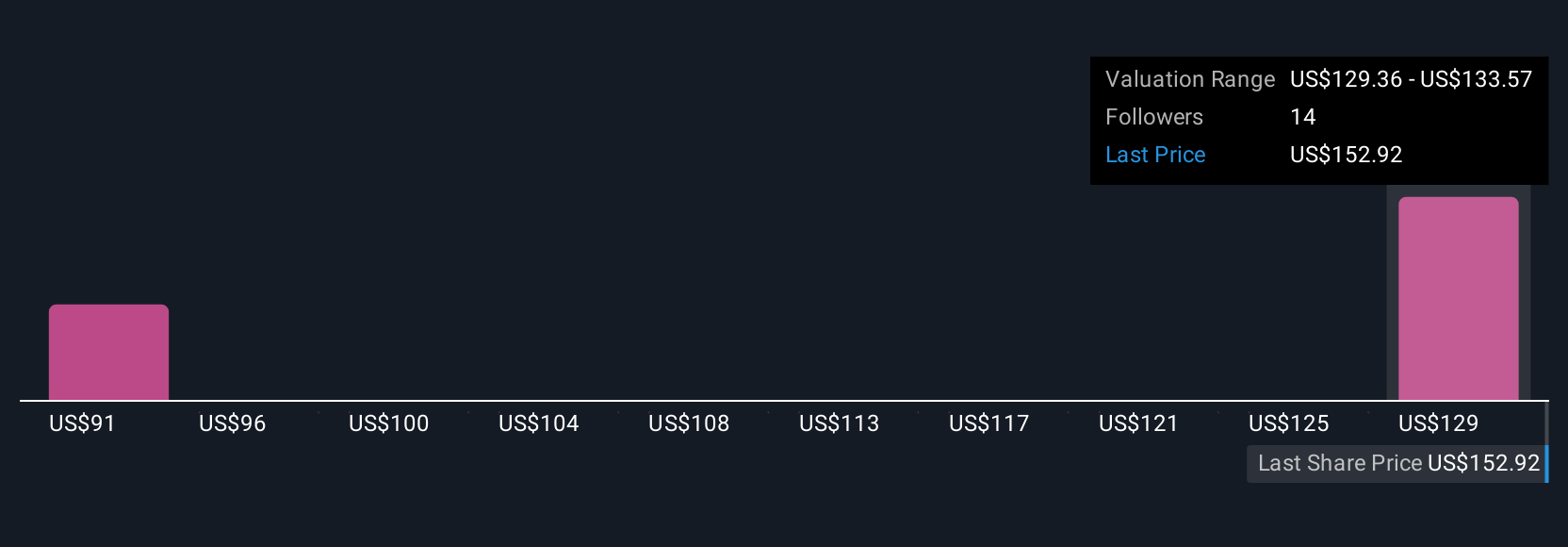

Simply Wall St Community members provided two distinct fair value estimates ranging from US$80.28 to US$184 per share. With growth relying on successful food sector adoption, your view on pilot conversion may sharply influence your outlook.

Explore 2 other fair value estimates on Impinj - why the stock might be worth as much as $184.00!

Build Your Own Impinj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Impinj research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Impinj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Impinj's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives