- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

Does ON Semiconductor (NASDAQ:ON) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like ON Semiconductor (NASDAQ:ON), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for ON Semiconductor

How Fast Is ON Semiconductor Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Recognition must be given to the that ON Semiconductor has grown EPS by 45% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

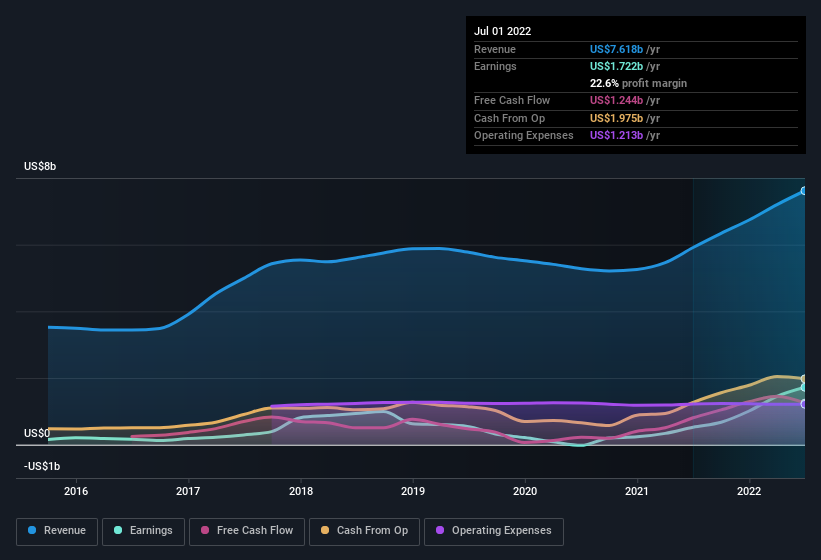

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of ON Semiconductor shareholders is that EBIT margins have grown from 13% to 29% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for ON Semiconductor's future EPS 100% free.

Are ON Semiconductor Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first, there weren't any reports of insiders selling shares in ON Semiconductor in the last 12 months. But the really good news is that Independent Director Gregory Waters spent US$769k buying stock, at an average price of around US$45.26. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

Along with the insider buying, another encouraging sign for ON Semiconductor is that insiders, as a group, have a considerable shareholding. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$348m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Should You Add ON Semiconductor To Your Watchlist?

ON Semiconductor's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest ON Semiconductor belongs near the top of your watchlist. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of ON Semiconductor.

Keen growth investors love to see insider buying. Thankfully, ON Semiconductor isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives