- United States

- /

- Semiconductors

- /

- NasdaqGS:OLED

Upgraded Revenue Guidance and Sector Optimism Could Be a Game Changer for Universal Display (OLED)

Reviewed by Simply Wall St

- Universal Display Corporation recently reported past second quarter earnings, with revenue rising to US$171.79 million and net income reaching US$67.26 million, alongside an increase in its revenue guidance for 2025 to a range of US$650 million to US$700 million.

- Macroeconomic optimism, especially expectations of interest rate cuts following a favorable inflation report, boosted sector sentiment and amplified Universal Display's positive outlook, leveraging both its operational performance and broader semiconductor momentum.

- We’ll examine how the combination of upgraded guidance and sector-wide optimism might influence Universal Display’s longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Universal Display Investment Narrative Recap

To be a Universal Display shareholder, you need to believe in the continued expansion of OLED technology adoption, especially in IT and automotive displays, and in the company's ability to translate this trend into stable material sales and licensing growth. The recent earnings beat and raised 2025 revenue guidance provided a welcome boost to confidence, but management’s emphasis on ongoing customer uncertainty (particularly in China) means volatility in ordering remains the most important short-term catalyst and risk; for now, the impact of this latest update does not materially resolve this unpredictability.

Among the latest announcements, the increased full-year revenue guidance to US$650 million to US$700 million stands out as most pertinent, reinforcing longer-term optimism even as short-term demand patterns from panel makers remain unpredictable. While this guidance bump suggests the company is seeing pockets of strength, persistent uncertainty tied to customer order timing and macroeconomic factors leaves the revenue trajectory exposed to external shocks.

On the other hand, investors should pay careful attention to how unpredictable demand from key customers could quickly change Universal Display’s outlook if...

Read the full narrative on Universal Display (it's free!)

Universal Display's narrative projects $909.5 million revenue and $334.7 million earnings by 2028. This requires 11.2% yearly revenue growth and a $90.4 million earnings increase from $244.3 million.

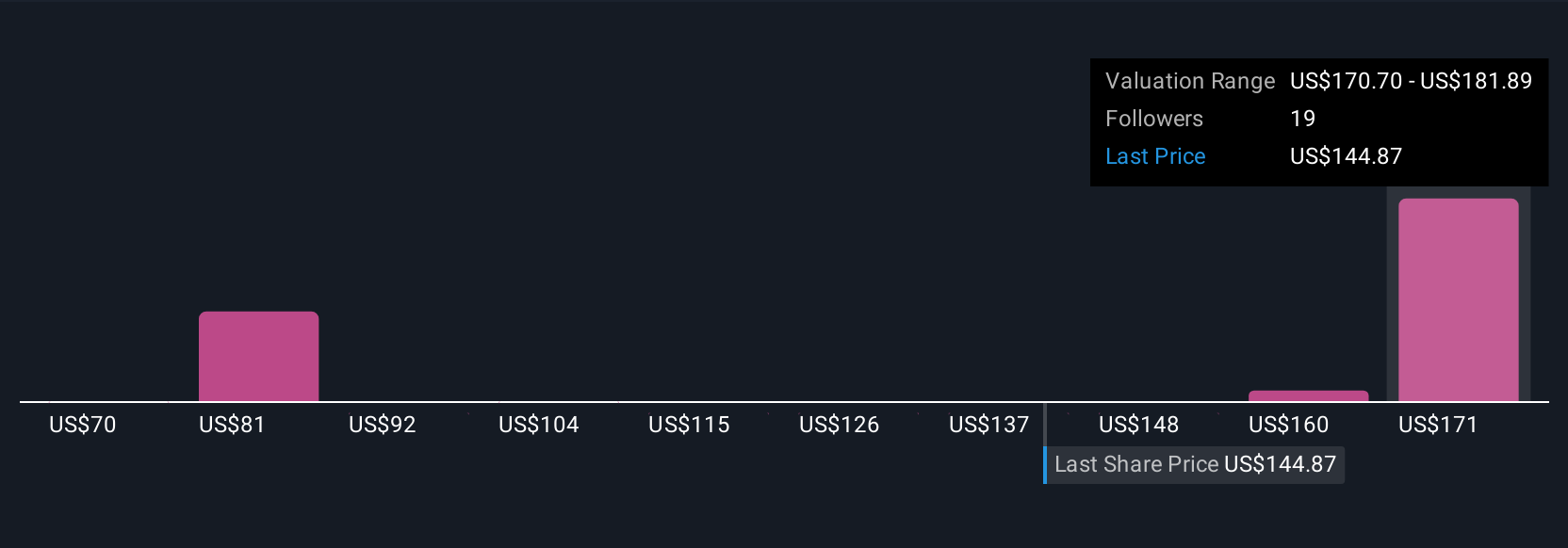

Uncover how Universal Display's forecasts yield a $181.89 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Fair value estimates from six Simply Wall St Community members range widely, from US$70 to US$181.89 per share. Against this backdrop, volatility in customer ordering patterns continues to be a central factor influencing earnings momentum and investor sentiment.

Explore 6 other fair value estimates on Universal Display - why the stock might be worth less than half the current price!

Build Your Own Universal Display Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Display research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Universal Display research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Display's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OLED

Universal Display

Engages in the research, development, and commercialization of organic light emitting diode (OLED) technologies and materials for use in display and solid-state lighting applications.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives