- United States

- /

- Semiconductors

- /

- NasdaqGS:OLED

Universal Display (OLED): Revisiting Valuation After a Year of Double‑Digit Growth but Negative Shareholder Returns

Reviewed by Simply Wall St

Recent performance and context

Universal Display (OLED) has quietly slipped this year, with the stock down about 21% year to date and roughly 23% over the past year, even as revenue and net income keep growing at a double digit pace.

See our latest analysis for Universal Display.

The 90 day share price return of negative 13.7 percent and 1 year total shareholder return of about negative 23 percent suggest momentum has cooled as investors reassess how much near term growth they are willing to pay for.

If OLED’s pullback has you rethinking your tech exposure, it could be a good moment to explore other innovative names through high growth tech and AI stocks.

With shares lagging despite solid double digit growth and a sizable gap to analyst targets, the key question now is whether Universal Display is quietly undervalued or whether the market is already pricing in its next chapter of growth.

Most Popular Narrative Narrative: 30.2% Undervalued

With Universal Display last closing at 117.76 dollars against a narrative fair value near 168.78 dollars, the most widely followed view sees meaningful upside if its growth path holds.

The rapid proliferation of connected, intelligent consumer devices (AI, 5G, always-on connectivity) is fueling global demand for high-efficiency, premium displays, which is directly benefiting Universal Display's energy-saving OLED materials portfolio and could underpin further licensing and material sales growth.

Curious how steady margins, disciplined capital returns, and a richer royalty mix could justify such a gap? Want to see the growth, profitability, and valuation levers this narrative is betting on so confidently?

Result: Fair Value of $168.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic view could unravel if OLED IT adoption stays sluggish or if alternative display technologies erode Universal Display’s pricing and royalty power.

Find out about the key risks to this Universal Display narrative.

Another Lens on Valuation

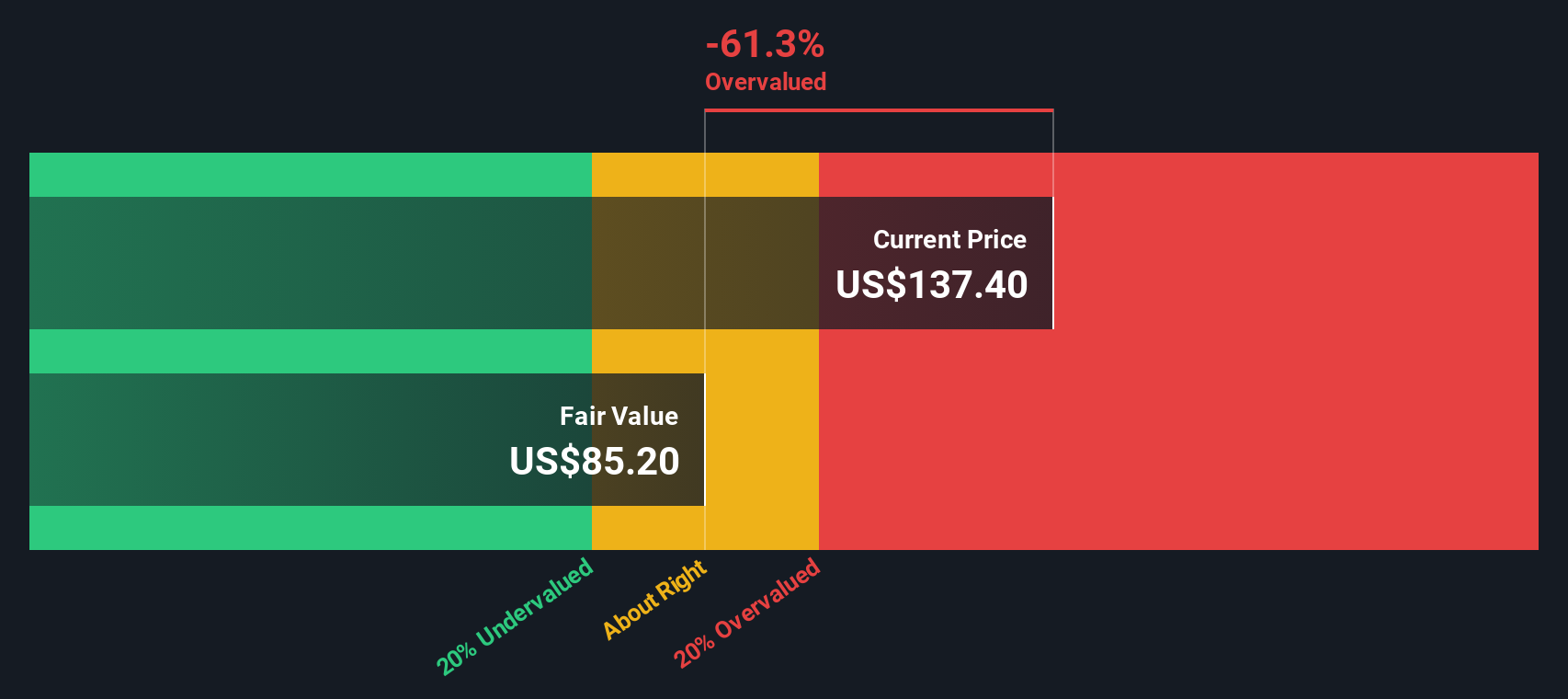

While the narrative fair value suggests upside, our SWS DCF model paints a tougher picture, indicating OLED shares are trading above an estimated fair value of 87.43 dollars. If cash flows do not ramp as quickly as hoped, could this premium limit long term returns?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Universal Display Narrative

If this view does not quite align with your own research instincts, you can quickly build a personalized thesis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Universal Display.

Looking for more investment ideas?

Before you move on, consider scanning hand picked opportunities across different themes that could complement or provide an alternative to your Universal Display thesis.

- Explore high potential rebound candidates by targeting beaten down businesses with improving fundamentals through these 3625 penny stocks with strong financials.

- Position your portfolio for the next wave of intelligent automation by focusing on companies powering breakthrough applications with these 25 AI penny stocks.

- Refine your value strategy by examining quality names trading below their cash flow potential using these 911 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OLED

Universal Display

Engages in the research, development, and commercialization of organic light emitting diode (OLED) technologies and materials for use in display and solid-state lighting applications.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)