- United States

- /

- Semiconductors

- /

- NasdaqGS:OLED

Universal Display (OLED): Assessing Valuation After Years of Growth and Strong Returns

Reviewed by Kshitija Bhandaru

Universal Display (OLED) recently caught attention after outperforming its industry peers with a Return on Equity of 14 percent and delivering steady net income growth over the past five years.

See our latest analysis for Universal Display.

Despite Universal Display’s strong business fundamentals, the past year has been tough for shareholders, with the total shareholder return down 32.8 percent even as some momentum returned in recent weeks. The stock’s multiyear track record, with a 52.8 percent total return over three years, suggests potential is still there if sentiment shifts.

If recent market swings have you reconsidering your portfolio mix, it could be a good time to check out fast growing stocks with high insider ownership.

With Universal Display trading below analyst price targets but facing forecasts of slower earnings growth, investors must ask themselves: Is this an undervalued opportunity, or are markets efficiently pricing in the company’s future prospects?

Most Popular Narrative: 24.5% Undervalued

Compared to the most widely followed narrative, Universal Display’s fair value sits well above the last close, suggesting room for rerating if longer-term expectations play out. The narrative’s estimate relies on sustained revenue expansion and premium margins, setting high hurdles for future performance.

Ongoing investments from major panel makers (Samsung, BOE, LG, TCL, Visionox) in new Gen 8.6 OLED fabs, alongside expansion of OLED capacity for IT and automotive displays, signal an imminent acceleration in OLED penetration across underrepresented markets such as laptops, monitors, and vehicle dashboards. This is poised to drive sustained multi-year revenue growth. The rapid proliferation of connected, intelligent consumer devices (AI, 5G, always-on connectivity) is fueling global demand for high-efficiency, premium displays. This directly benefits Universal Display's energy-saving OLED materials portfolio, which should underpin further licensing and material sales growth.

Curious what bold financial forecasts justify this price target? The narrative is betting on future revenue jumps, expanding margins, and premium multiples rarely seen outside top tech. Want to see exactly what assumptions drive this undervaluation call? Read on to find out what just might shake up Universal Display's trajectory.

Result: Fair Value of $181.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and unpredictable customer demand could disrupt the expected revenue growth that supports this bullish outlook.

Find out about the key risks to this Universal Display narrative.

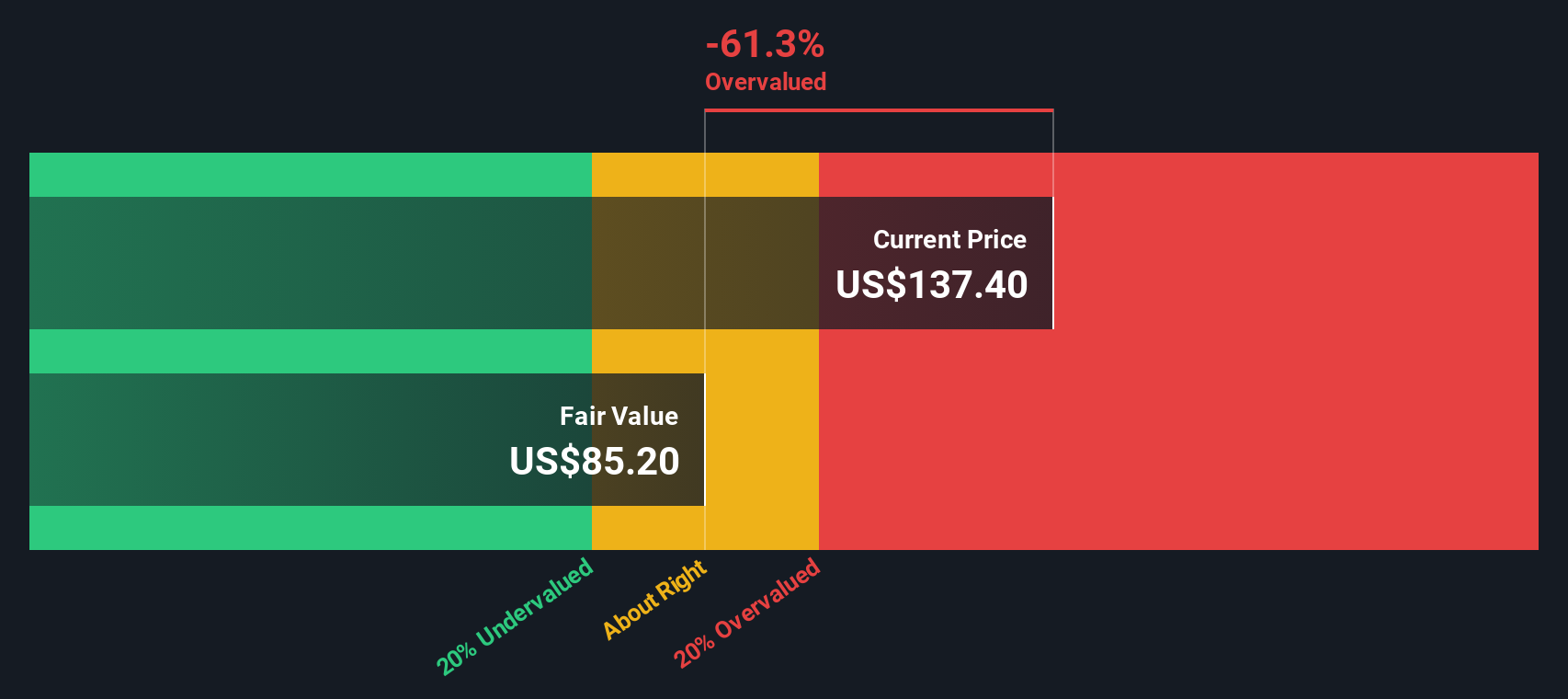

Another View: DCF Model Weighs In

For a different perspective, our SWS DCF model points to Universal Display trading above its estimated fair value, with a notable gap between the current price and the DCF outcome. This suggests that, under more conservative assumptions, the shares might be overvalued based on future cash flows. Could the market be too optimistic compared to what cash flow analysis implies?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Universal Display for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Universal Display Narrative

If you feel differently about Universal Display’s outlook or want to stress-test the data yourself, you can build your own case in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Universal Display.

Looking for More Investment Ideas?

Smart investors look beyond the obvious. Don't let the next big winner slip by. See what you’re missing with these handpicked opportunities for your portfolio:

- Capture growth potential by starting your search with these 24 AI penny stocks, which are shaping tomorrow’s breakthroughs in artificial intelligence applications.

- Secure reliable income streams by evaluating these 19 dividend stocks with yields > 3%, offering yields above 3 percent and solid financials.

- Ride the momentum of financial innovation by reviewing these 79 cryptocurrency and blockchain stocks, leading the blockchain and cryptocurrency evolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OLED

Universal Display

Engages in the research, development, and commercialization of organic light emitting diode (OLED) technologies and materials for use in display and solid-state lighting applications.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives