- United States

- /

- Metals and Mining

- /

- NYSEAM:VGZ

May 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.6%, but it is up 9.1% over the past year, with earnings forecast to grow by 14% annually. Investing in penny stocks—often associated with smaller or newer companies—can still present growth opportunities, especially when these stocks demonstrate strong financial health and potential for long-term gains. In this article, we explore three penny stocks that offer compelling opportunities and balance sheet resilience, highlighting their potential to surprise investors with significant returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.81 | $184.35M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.01 | $169.86M | ✅ 4 ⚠️ 1 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.74 | $364.62M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.78 | $95.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.70 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.8283 | $6.02M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.22 | $72.17M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.922 | $28.94M | ✅ 3 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.06 | $35.83M | ✅ 2 ⚠️ 5 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.877 | $78.88M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 731 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

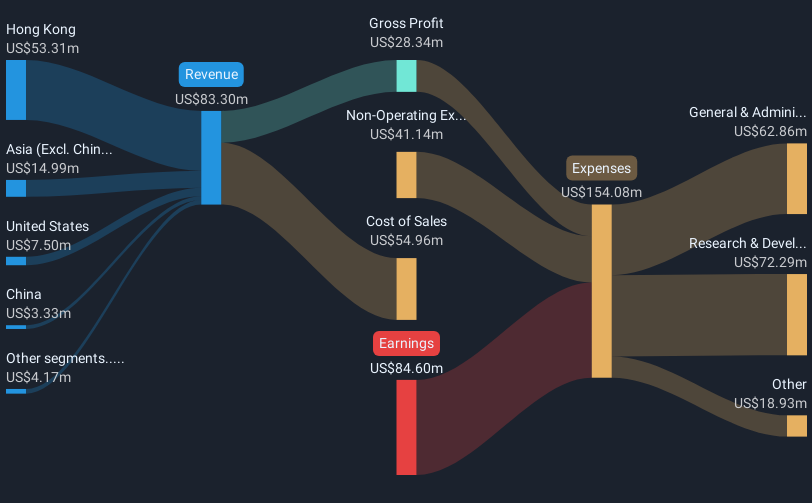

Navitas Semiconductor (NasdaqGM:NVTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Navitas Semiconductor Corporation designs, develops, and markets power semiconductors globally, with a market cap of approximately $845.87 million.

Operations: The company's revenue is primarily derived from its Semiconductors segment, totaling $74.15 million.

Market Cap: $845.87M

Navitas Semiconductor, with a market cap of approximately US$845.87 million, is navigating the volatile landscape of penny stocks with notable developments. Despite its unprofitability and increasing losses over five years, Navitas showcases potential through strategic collaborations, like its recent partnership with NVIDIA for advanced AI data center technologies. The company maintains a solid cash runway and lacks debt while projecting revenue growth of 23.08% annually. Recent product innovations in GaN and SiC technologies highlight their focus on high-efficiency power solutions across sectors such as AI data centers and EVs, positioning Navitas for future opportunities despite current financial challenges.

- Dive into the specifics of Navitas Semiconductor here with our thorough balance sheet health report.

- Gain insights into Navitas Semiconductor's outlook and expected performance with our report on the company's earnings estimates.

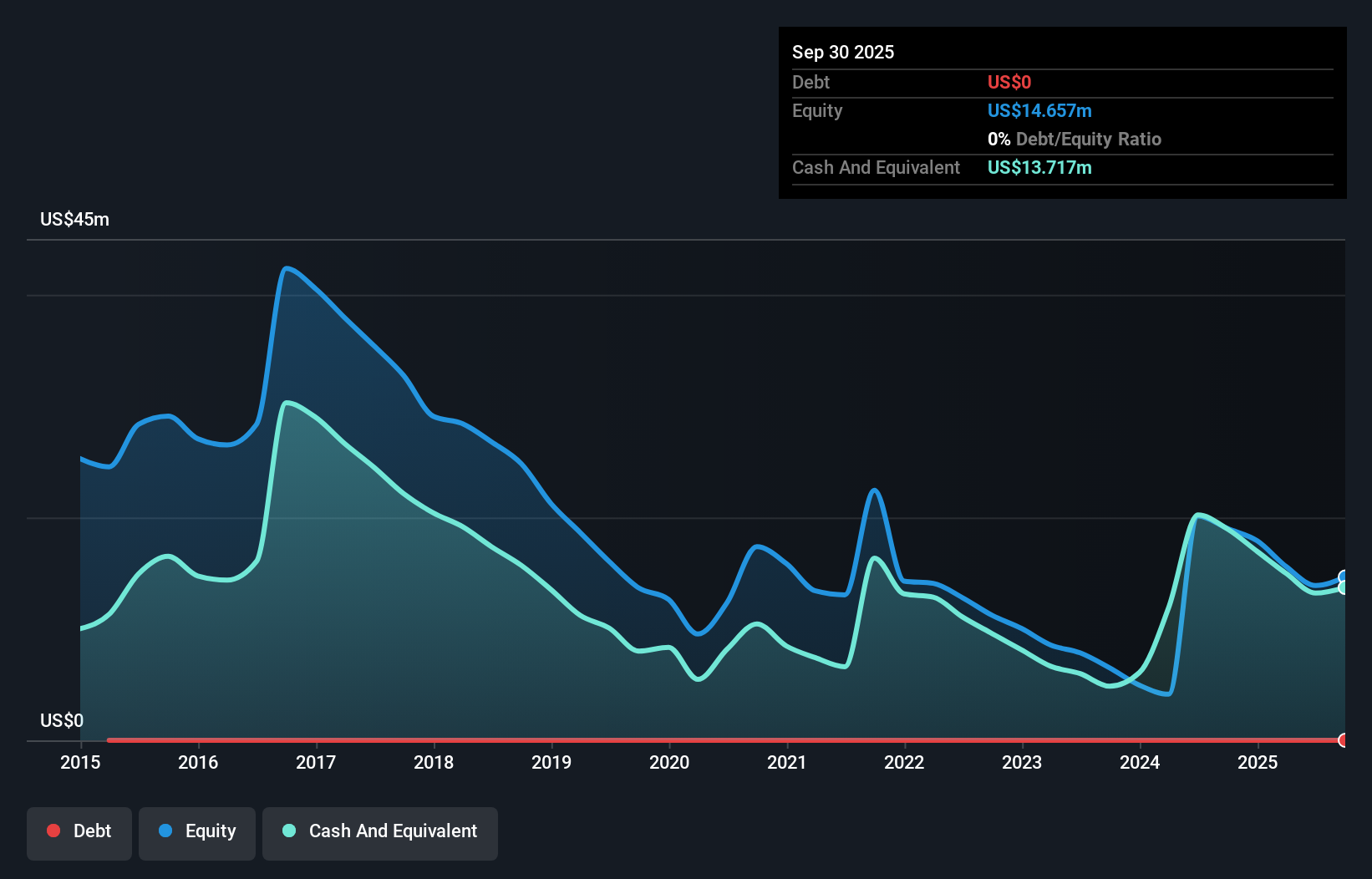

Vista Gold (NYSEAM:VGZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vista Gold Corp., along with its subsidiaries, operates as a development-stage company in the gold mining industry in Australia, with a market cap of approximately $153.54 million.

Operations: Vista Gold Corp. does not report any specific revenue segments as it is a development-stage company in the gold mining industry based in Australia.

Market Cap: $153.54M

Vista Gold Corp., with a market cap of approximately US$153.54 million, is navigating the penny stock realm as a pre-revenue, development-stage company in the gold mining sector. Despite reporting a net loss of US$2.71 million for Q1 2025, Vista has shown resilience by becoming profitable over the past five years and maintaining high-quality earnings without incurring debt. The management team and board are experienced, with average tenures exceeding industry norms. With short-term assets well above liabilities and no significant shareholder dilution recently, Vista Gold demonstrates financial stability amidst its developmental phase challenges.

- Jump into the full analysis health report here for a deeper understanding of Vista Gold.

- Gain insights into Vista Gold's past trends and performance with our report on the company's historical track record.

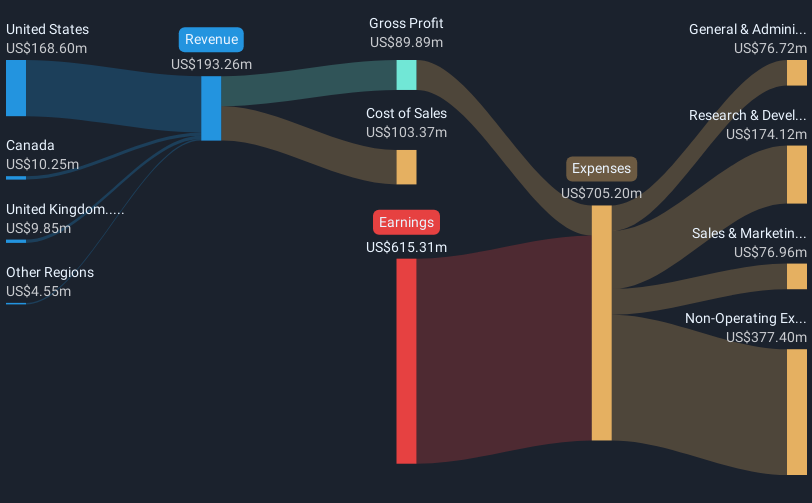

23andMe Holding (OTCPK:MEHC.Q)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 23andMe Holding Co. is a consumer genetics testing company operating in the United States, the United Kingdom, Canada, and internationally, with a market cap of approximately $88.53 million.

Operations: The company's revenue primarily comes from its Consumer & Research Services segment, generating $208.78 million.

Market Cap: $88.53M

23andMe Holding Co., with a market cap of approximately US$88.53 million, is currently navigating significant financial challenges, including Chapter 11 bankruptcy proceedings and delisting from Nasdaq. Despite generating US$208.78 million in revenue from its Consumer & Research Services segment, the company remains unprofitable with increasing losses over the past five years. Recent developments include a proposed acquisition by Regeneron Pharmaceuticals for US$260 million, contingent on bankruptcy court approval and regulatory clearances. The company's short-term assets exceed liabilities, but it faces cash runway constraints and has experienced high share price volatility recently.

- Get an in-depth perspective on 23andMe Holding's performance by reading our balance sheet health report here.

- Explore 23andMe Holding's analyst forecasts in our growth report.

Key Takeaways

- Gain an insight into the universe of 731 US Penny Stocks by clicking here.

- Contemplating Other Strategies? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:VGZ

Vista Gold

Vista Gold Corp., together with its subsidiaries, operate as a development-stage company in the gold mining industry in Australia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives