- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Nova (NasdaqGS:NVMI): Reassessing Value After Semiconductor Stocks Slide on US-China Trade Escalation

Reviewed by Kshitija Bhandaru

Novo (NasdaqGS:NVMI) traded lower as the semiconductor sector reacted sharply to heightened US-China trade tensions. President Trump's new tariff threats, combined with Chinese export controls on rare earth metals, rattled investor confidence across chipmakers.

See our latest analysis for Nova.

Despite investor nerves over macro turmoil, Nova has demonstrated solid momentum, with the stock climbing nearly 49% on a year-to-date share price basis and posting a remarkable 36% total shareholder return over the past year. That run has been supported by major wins recently, including its ELIPSON platform’s selection by a global foundry leader. This signals growing demand for Nova’s metrology solutions even as volatility returns to the sector.

If recent market shifts have you reassessing your playbook, this is a perfect moment to discover See the full list for free.

Yet after a strong stretch of gains, investors are left to weigh whether Nova’s current share price still holds hidden value, or if the market has already factored in every catalyst and left little room for further upside.

Most Popular Narrative: 1% Undervalued

Nova’s narrative price target stands just above its last closing price, reflecting a consensus that recent gains are near fair value. Investors tracking the story should pay attention to the next catalyst fueling these projections.

The accelerating complexity of semiconductor devices, driven by AI, larger die sizes, advanced nodes, and heterogeneous packaging, continues to fuel demand for Nova's advanced metrology solutions across both logic/foundry and memory segments. This demand is expected to support long-term revenue growth as global digitization trends expand.

Curious about the bold calculations justifying Nova’s current price? This narrative hinges on future growth projections and a rich earnings multiple. Find out what financial leap the consensus expects Nova to make. Read the full narrative to unlock the assumptions driving that price target.

Result: Fair Value of $306.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to a few major customers and rising competition introduce uncertainty. Any unexpected demand shifts or rival advancements are key risks to watch.

Find out about the key risks to this Nova narrative.

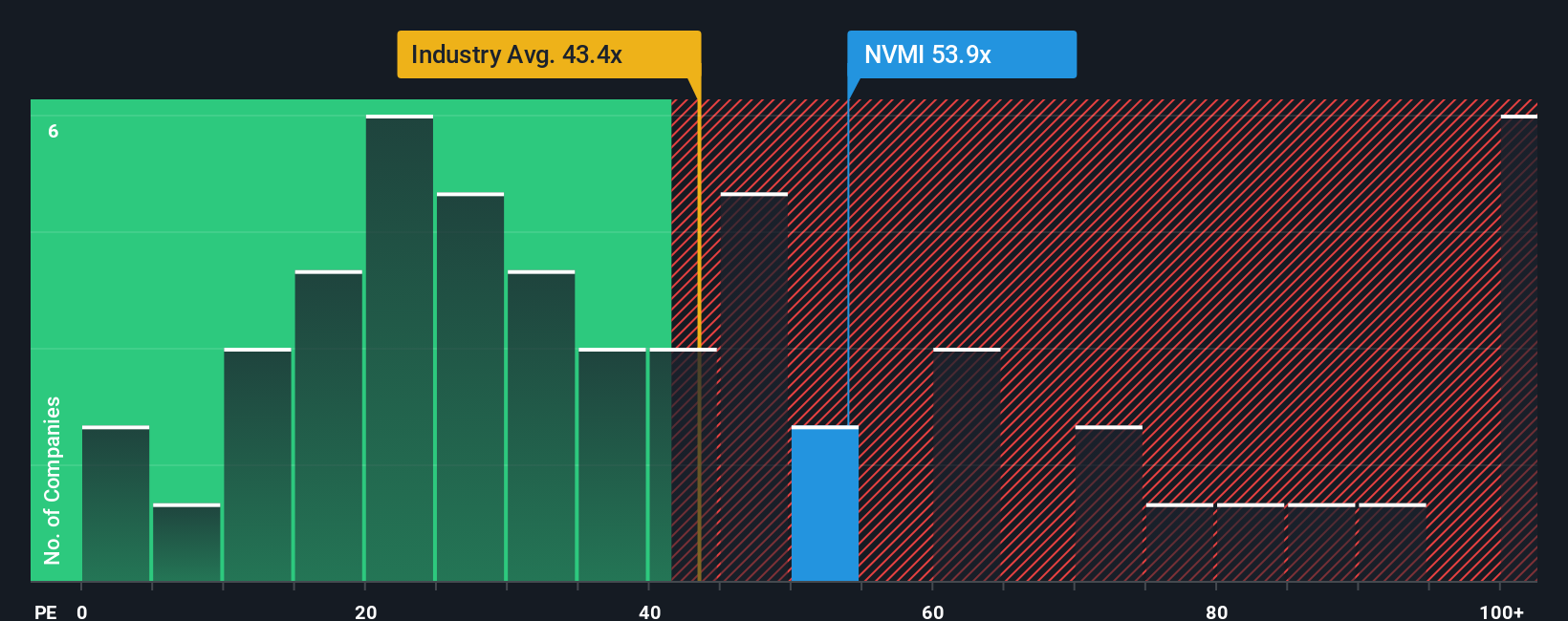

Another View: Market Ratios Signal a Premium

Looking beyond growth projections, Nova’s price-to-earnings ratio of 38.2x stands noticeably higher than the US semiconductor industry average of 35.3x, the peer group at 33.5x, and even the fair ratio of 24.2x. This suggests the market is banking on more upside or rewarding Nova’s consistency. But does this premium leave room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nova Narrative

If you see the story differently or want to test your own thesis against the numbers, you can craft a unique take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nova.

Looking for More Investment Ideas?

Unlock even greater potential by researching stocks that match your strategy. Miss this step, and you may pass up tomorrow’s most talked-about winners.

- Boost your growth portfolio by targeting gains from companies at the forefront of artificial intelligence with these 25 AI penny stocks.

- Secure steady income by tapping into these 19 dividend stocks with yields > 3%, which offers attractive yields above 3% for long-term peace of mind.

- Ride the next wave in computing by exploring these 26 quantum computing stocks, building the future with real-world quantum breakthroughs today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sells of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives