- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Some Insiders and Traders Behave as if NVIDIA (NASDAQ:NVDA) is Nearing a Peak

NVIDIA ( NASDAQ:NVDA ), has been stirring up the investment community. With a new government contract in the works, a high upswing since March, and differing market and insider sentiments, it is easy to imagine that investors want to make sense of the happenings in the $565b market capitalization company.

We will go through some key future deals, insider transactions and short term market sentiment for NVIDIA.

Key News

Sometimes too much noise in the news can cover up the important events. For NVIDIA, the key news revolve around:

- United States Innovation and Competition Act of 2021 - Which is meant to provide large capital investments for U.S. chipmakers (among others), in order to lessen the power and dependence on China.

- The pending U.S. senate deal to purchase a supercomputer made with chips from Nvidia Corp and Advanced Micro Devices Inc. ( NASDAQ:AMD ) with a total worth of US$500m.

These news have been moving the market, as traders and investors debate over the utility and fairness of such steps by the U.S.

Another key point that investors should be aware of, is the activity of NVIDIA insiders. This gives some color regarding some of the sentiment within the company.

Although we don't think shareholders should simply follow insider transactions,we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for NVIDIA

NVIDIA Insider Transactions Over The Last Year

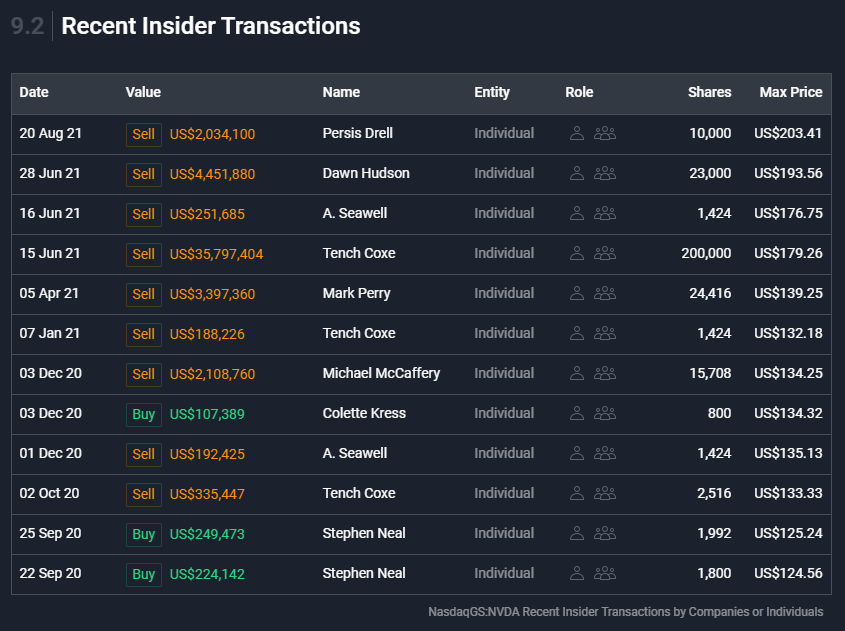

Over the last year, we can see that the biggest insider sale was by the Independent Director, Tench Coxe, for US$36m worth of shares, at about US$179 per share.

That means that even when the share price was below the current price of US$226, an insider wanted to cash in some shares.When an insider sells below the current price, it suggests that they considered that lower price to be fair.

That makes us wonder what they think of the (higher) recent valuation.While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign.

On the other hand, t his single sale was just 4.4% of Tench Coxe's stake, which means that there is a lot more in their portfolio.

The table below shows us a great rundown of the recent insider transactions:

Over the last year, we can see that insiders have bought 4.59k shares worth US$581k.But they sold 279.91k shares for US$49m.

In total, NVIDIA insiders sold more than they bought over the last year.

You can see a visual depiction of insider transactions over the last 12 months, below:

For those who like to find winning investments, this free list of growing companies with recent insider purchasing, could be just the ticket.

It is apparent that at least some insiders are selling chunks of their own company's stock.

We would be unfair to read too much into this, but it gives us a signal as to the current sentiment regarding their own stock. We should also note that insiders may sell for external reasons as well, such as fear of macro market factors, a small regular unwinding of their position, wanting to cash out for their personal needs.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders.It's usually a good sign if insiders own a significant number of shares in the company.

It's great to see that NVIDIA insiders own 4.0% of the US$565 Market Cap company. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

Even though the percent may seem small, it is quite large relative to the market cap and also to what insiders at other large companies tend to own.

Short Term Market Sentiment

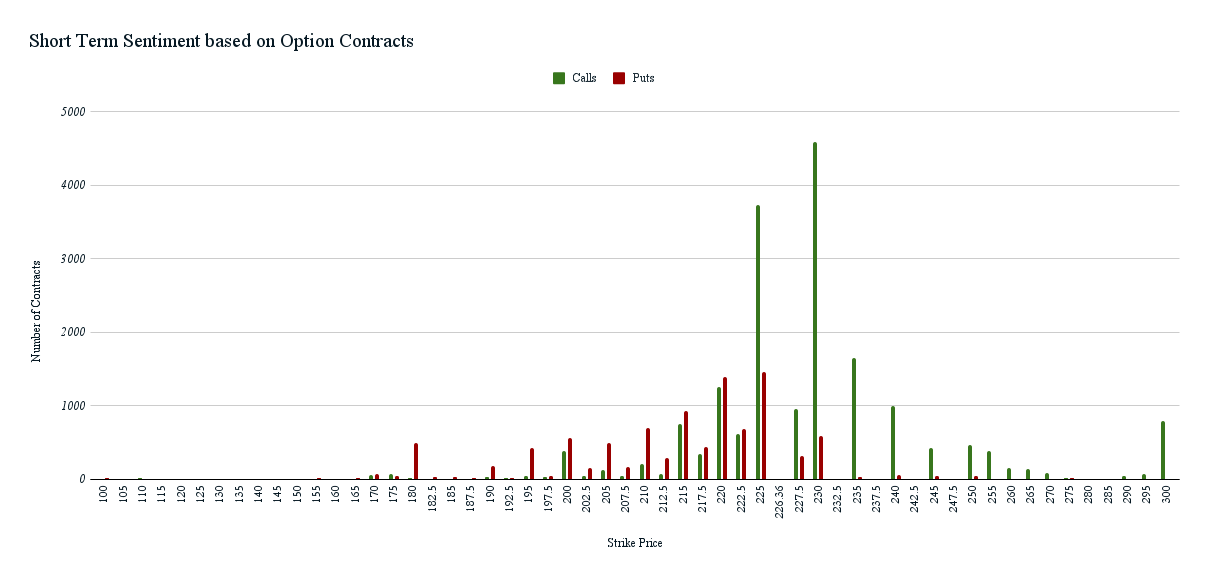

Having looked at the news and insiders, we now turn to derivative data. The short term outstanding option contracts, place the weighted (by number of contracts) average strike price of NVIDIA calls at $231.66 - 2.3% upside, and puts at $213.3, (-5.8%) downside.

This practically means that some investors are betting that the stock will move a bit above $231.7. This suggests that the short term price is near peak, and everything that has been going around the news and financial performance is already priced in.

A clearer picture can be seen at the options distribution chart:

The options expiry date is 10th September 2021.

We can see that a substantial portion of contracts are expecting the price to go beyond $230, but the general upside is small for investors.

That being said, the fundamental performance of the stock is excellent and patient investors may continue seeing price appreciation.

Key Takeaways

While financial performance for NVIDIA has been outstanding, and the company may benefit from government contracts, an analysis into the potential sentiment of both insiders and derivative traders poses the possibility that the stock is nearing a short term ceiling.

Insiders have been mostly selling their stock, but individual insiders own 4% of the stock, of which the CEO owns 3.42%. This suggests that the CEO is still aligned with the interests of shareholders and the success of NVIDIA.

While conducting our analysis, we found that NVIDIA has 3 warning signs and it would be unwise to ignore these.

Of course NVIDIA may not be the best stock to buy . So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives