- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Nvidia (NVDA) Valuation: Fresh Trade Tensions Add Uncertainty to AI Chip Giant’s Growth Outlook

Reviewed by Kshitija Bhandaru

Recent headlines put Nvidia (NVDA) in the spotlight as US-China trade tensions ramped up. The US Senate passed a bill targeting AI chip exports to China, while China responded with increased enforcement against US chipmakers, squeezing Nvidia’s access to a key market.

See our latest analysis for NVIDIA.

Nvidia’s stock has seen a sharp pullback lately, with a 4.9% drop in the past day as the headlines around trade and chip export curbs set a cautious tone. That said, momentum is cooling but not collapsing, given a 32% year-to-date share price return and a remarkable 35.9% total shareholder return over twelve months. Investors are weighing near-term risks from trade tensions against Nvidia’s impressive long-term track record and ongoing AI-driven partnerships.

If you're keeping an eye on sector trends, now is a good moment to discover See the full list for free.

With Nvidia’s rapid ascent facing fresh uncertainty from global trade tensions, investors are left to consider whether recent price declines are an entry point for long-term growth, or if the market is already pricing in every upside scenario. Is there still a true buying opportunity, or has the market fully accounted for Nvidia’s future potential?

Most Popular Narrative: 20% Overvalued

According to Investingwilly, the latest narrative suggests that Nvidia’s fair value stands well below the current market price. At the last close of $183.16, the company is trading at a substantial premium to the narrative’s calculated fair value, raising important questions about the optimism embedded in current expectations.

Nvidia's financial performance in recent years has been nothing short of extraordinary. The company's revenue has surged significantly, largely driven by the rapid growth of its data center segment. Nvidia’s dominance in this sector is reflected in its robust revenue generation. This highlights the increasing global demand for cloud computing, AI, and machine learning solutions. The company’s ability to maintain strong growth despite global economic challenges is a testament to its strategic positioning in key technology markets. Nvidia continues to capitalize on its leadership in high-performance computing and AI-driven innovations.

Curious what bold growth targets fuel this high price? The secret behind this fair value lies in ambitious data center goals and staggering profit margin assumptions. Want to discover the key figures that set this narrative apart? Uncover what makes this fair value calculation stand out from the crowd.

Result: Fair Value of $152.63 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing US-China trade tensions and potential supply chain issues could alter Nvidia’s valuation narrative. These developments may introduce new challenges for growth forecasts.

Find out about the key risks to this NVIDIA narrative.

Another View: How Do Market Multiples Stack Up?

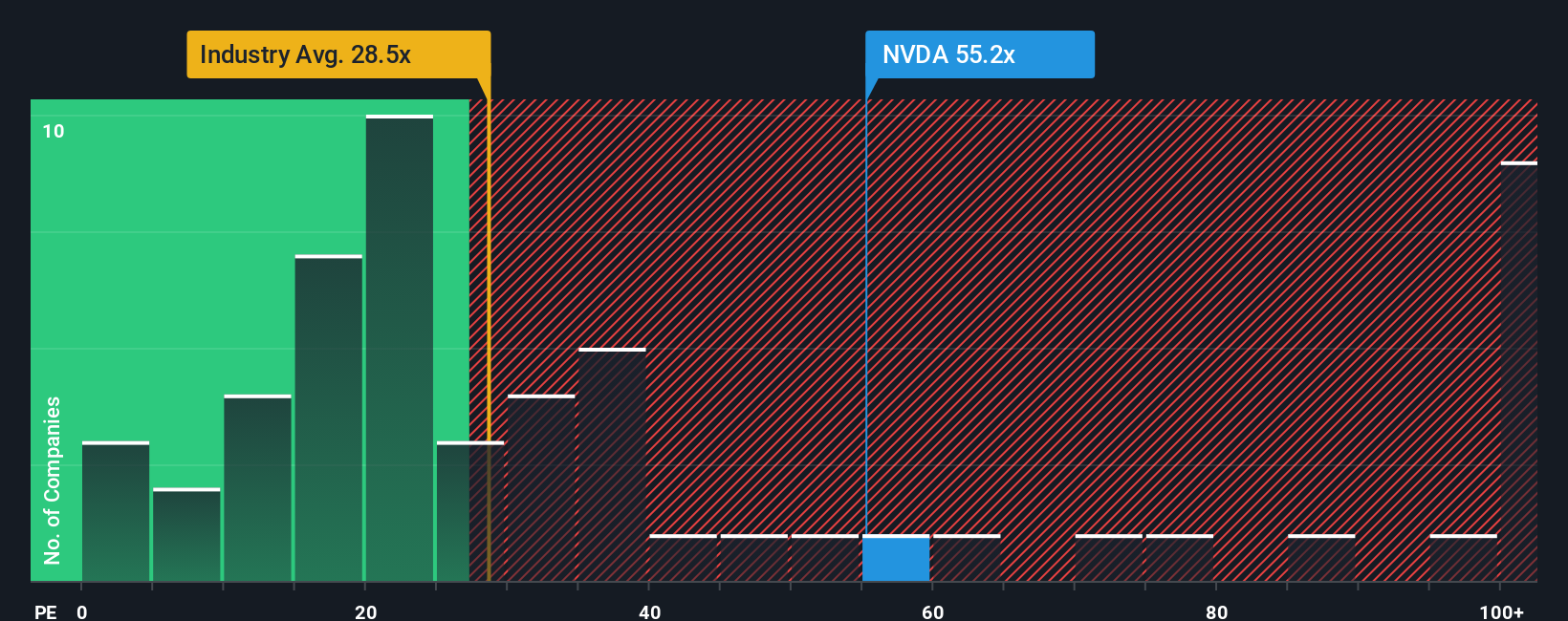

Taking a look at traditional market multiples, Nvidia trades at a price-to-earnings ratio of 51.4x, which is below its peer group average of 61.8x but far above the US Semiconductor industry average of 35.3x. The fair ratio analysis suggests the valuation could eventually move closer to 58.1x. Does this indicate room for upside, or does it highlight a valuation stretch compared to the broader industry?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NVIDIA Narrative

If you want to see a different perspective, crunch the numbers yourself and shape your own interpretation in just a few minutes. Do it your way

A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't stop at just one exciting opportunity. The market is full of unique stocks waiting to be uncovered, and you could seize your next big winner right now.

- Capture growth by scanning for breakthrough innovation and strong financials among these 3585 penny stocks with strong financials. This gives you access to hidden gems before the crowd.

- Boost your portfolio’s stability and future cash flow by tapping into these 19 dividend stocks with yields > 3%, which offers reliable yields above 3% and robust payout histories.

- Amplify your exposure to tomorrow’s breakthroughs by targeting the leaders in these 26 quantum computing stocks. This brings cutting-edge technology investments within your reach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.