- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Unveils Cutting-Edge AI Solutions And Expands Global Partnerships In 2025

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) recently announced the launch of several cutting-edge AI products and strategic partnerships aimed at advancing its leadership in AI technology, including the DGX Spark systems, NVLink Fusion, and collaborations with companies like Acer and Foxconn. Over the last month, NVIDIA's stock price increased by 34%, reflecting its aggressive push into AI solutions amid a broader tech rally. This price movement aligns with a general upswing in the tech sector, despite the slight market pullback seen in recent days. NVIDIA's substantial focus on AI innovation may have positively contributed to its share performance.

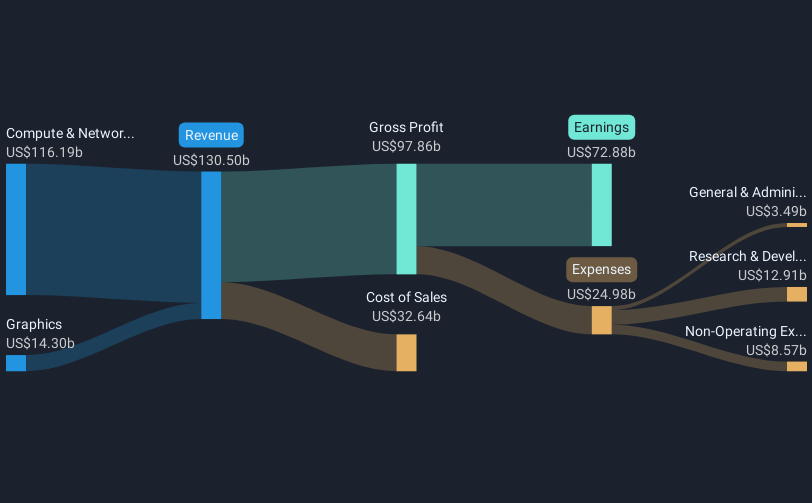

NVIDIA's recent expansion in AI technology through new products and partnerships with companies like Acer and Foxconn could significantly enhance its market position in the AI sector. This aligns well with NVIDIA's broader strategic focus on AI model scaling and data center growth, potentially leading to increased revenue streams from these partnerships. The expansion into sectors like autonomous vehicles with Toyota and Uber is likely to boost future revenues, given the automotive sector’s rapid adoption of AI. Coupled with NVIDIA's launch of innovative GPU products, these moves support forecasts of continued revenue and earnings growth.

Over the past five years, NVIDIA's total shareholder returns have been exceptionally high, reporting a growth of very high percentage, reflecting long-term shareholder value creation. In the past year alone, NVIDIA's performance exceeded the US semiconductor industry, which returned 19.7%, underscoring its strong relative industry positioning.

NVIDIA's current share price of US$113.54 reflects a 34% increase recently, yet it remains approximately 30.4% below the consensus analyst price target of US$163.12. This indicates analysts anticipate further upside, contingent on the company's ability to meet substantial earnings and revenue expectations. Analysts foresee NVIDIA's earnings reaching US$158.20 billion by 2028, with potential expansion in profit margins dependent on the efficacy of scaling operations and overcoming regulatory hurdles. The focus on enhancing Blackwell architecture and AI capabilities suggests robust future growth prospects, contributing to these optimistic forecasts.

Take a closer look at NVIDIA's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives