- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Partners With Quantum Machines For AI-Quantum Computing Breakthrough

Reviewed by Simply Wall St

During the recent GTC global AI conference, Quantum Machines announced its partnership with NVIDIA (NasdaqGS:NVDA) to collaborate on advancements in quantum computing, which marked a significant development for the company. Despite this positive news, NVIDIA experienced a 10% price decline over the week. This downturn coincided with broader market challenges, including looming tariff implementations and a selloff in tech stocks, with the Nasdaq and S&P 500 experiencing their largest monthly losses since 2022. Factors such as concerns over inflation and weak consumer sentiment likely exacerbated Nvidia's price movement amid the broader market decline.

The last five years have seen NVIDIA's total returns, including share price and dividends, soar by a very large percentage. Over this period, the company has consistently outperformed the broader market, highlighted by its performance in the past year exceeding the US Semiconductor industry's 2% return. Notably, NVIDIA's collaborations, such as its alliance with Quantum Machines and ongoing partnerships with major automakers like Toyota and Uber, have bolstered its position in the rapidly advancing AI and automotive sectors. These strategic decisions underscore NVIDIA's ability to capitalize on growing AI adoption across various industries.

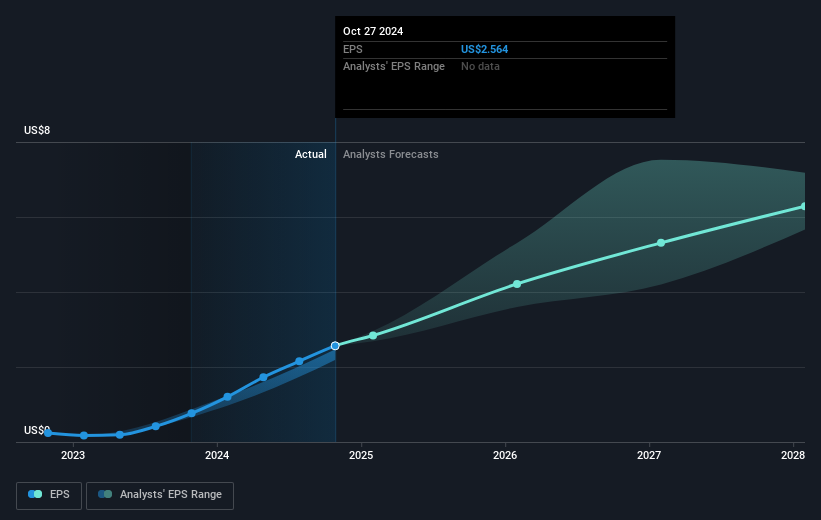

Further enhancing its robust financial performance, NVIDIA reported significant earnings growth for fiscal year 2025, with full-year revenue increasing to US$130.5 billion from the previous year's US$60.9 billion. The rapid development and deployment of advanced products, such as the NVIDIA RTX PRO Blackwell GPUs and the introduction of the NVIDIA GR00T N1 model for robotics, signal ongoing innovation in high-demand areas. Together, these efforts reflect NVIDIA's widespread influence in technology sectors, driving its impressive long-term total returns.

Upon reviewing our latest valuation report, NVIDIA's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NVIDIA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives